October 2020 NewsletterPresident's MessageBy Sheri Pastor, McCarter & English, LLP

Dear Fellows: Happy Fall. It is hard to believe it is already October. Although the first half of 2020 seemed to pass slowly, the second half is flying by. Our Eighth Annual Meeting was a a great event that we will not soon forget. Many thanks to Angela Elbert, Robert Kole, John Bonnie, and Spence Taylor for developing such outstanding CLE programing. Props to our Executive Director Carol Montoya and Account Director Pearl Ford-Fyffe for making this virtual event so easily accessible to even our most technologically-challenged fellows. Special thanks to our sponsors, KCIC and Jeff Kichaven, for their support, entertaining video messages, and virtual networking events. We look forward to returning to Chicago for our Ninth Annual Meeting on May 12-14, 2021, at the InterContinental Chicago. If you are interested in proposing a panel for that meeting, the due date is October 30, 2020. Even though we cannot be together and in-person for this year’s events, it has been heartening to see how our organization adapted and our Committees have stepped up to offer professional comradery and valuable thought leadership. Heather Sanderson and Robert Allen, co-chairs of the Extracontractual and Bad Faith Claims Litigation Committee, recently hosted a well-attended committee planning call, the upshot of which is that their committee will be holding quarterly pop-up calls starting in October. For those with other pop-up call suggestions, please reach out to Debra Varner and Meghan McGruder who are overseeing pop-up call content and development. Please consider becoming more involved in our Committees, if you have not already done so. With so many Committees, there is sure to be one (if not more) suited to your interests and practice. Even the most seasoned can benefit, for example, from involvement in the Emerging Risk Committee. Co-Chairs Mary Borja, Angela Elbert and Chris Mosley are staying, and keeping their members, abreast of new coverages and new exposures where coverage is sought under traditional policies. You can find details on the website regarding the various committees: Cyber Insurance & Computer Crime Extracontractual & Bad-Faith Claims Professionalism & Ethics Committee Enjoy the change of season and fall foliage. I look forward to seeing you soon. Sheri What a Difference A Century Makes: The Curious Case of the 1918 Global Pandemic Saving Rather Than Undermining Insurance CoverageJohn Bonnie, Weinberg Wheeler Hudgins Gunn & Dial and Neil Posner, Much Shelist, P.C.

On September 24, 1918, 22-year-old Arthur Gorder boarded an Army transport ship in New York City, en route to Liverpool, England to begin his service as a United States Army artilleryman in the concluding months of World War I. Gorder had been drafted just three months earlier, spending the duration of this time at various military training camps before disembarking on the roughly two-week, transatlantic journey to Europe aboard the steamship Saxon. By the time the ship reached England on October 7, 1918, Gorder was so sick he was taken immediately to a base hospital, where he died just one week later as a result of the other “war” that was ravaging the globe: the 1918 influenza pandemic. Gorder’s service in the U.S. Army was just four months to the day, spent entirely in training, his passage on the Saxon, and as a military hospital patient. He did not live long enough to see a battlefield or combat. Just over a year before joining the military and while still a civilian, Gorder had bought a life insurance policy from the Lincoln National Life Insurance Company carrying a $2,000 death benefit and naming his father Jacob Gorder as beneficiary. As issued, the Policy contained a Condition respecting Residence, Travel and Occupation, which read: This policy is free from restrictions as to residence, travel and occupation after one year from the date of issue, except military or naval service in time of war, for which permission must be obtained from the company and an extra premium . . . paid. In case of death of the insured in consequences of such service and without the company’s permit, the liability of the company hereunder shall be for an amount not greater than the legal reserve on this policy. (Emphasis added). The premium Gorder paid was just under $50 while the premium required for coverage to continue while engaged in military service (if “permission” is given by the carrier) was $200. Gorder did not pay the additional premium and did not obtain the required permission from Lincoln National to continue the coverage after being drafted and deployed to active duty in the war. On receiving notice of Gorder’s death, Lincoln National denied coverage based upon the Condition respecting wartime military service, and Jacob Gorder brought suit to recover on the Policy. Lincoln National contended that coverage was unambiguously precluded by the greater hazard Gorder was subjected to due to military service, including “conditions of life” such as contagious diseases present in military camps and transports. Specifically, the carrier contended that diseases like influenza were more prevalent in the Army than among civilians, and that in times of warfare, a greater number of soldiers died from contagious diseases than from actual combat. Lincoln National further contended that death from a contagious disease was as much a death resulting from military service as death from a wound inflicted by an enemy bullet. Since the Policy Condition existed as a stipulation against all increased risk of death due to military service, Lincoln National asserted that coverage was absent. At the conclusion of a bench trial on the matter, the trial court found in favor of Gorder. Lincoln National appealed to the North Dakota Supreme Court. In a fascinating opinion pitting the Policy language against the realities, sensitivities and presumptions of the day, the North Dakota Supreme Court ruled in Gorder v. Lincoln Nat. Life Ins. Co., 46 N.D. 192, 180 N.W. 514 (1920) that Gorder was entitled to coverage for his son’s death. Evidence of the nexus between Gorder’s military service and his contraction of the deadly influenza virus was substantial.1A Dr. Alyen, a physician in the Army Medical Corps throughout the war with “considerable experience in 1918 at ports of embarkation, debarkation, and upon transports” testified that transport ships were crowded; that soldiers slept in quarters with little or no ventilation; that these conditions increased the risk of transmission of disease to the highest point; and that the epidemic spread of influenza-pneumonia was due to close contact, constant and rapid troop movement, climatic conditions, and the short period of organization upon reaching debarkation camps. Statistical evidence was offered that both the presence of the disease and a significantly higher mortality rate existed in the military than in the general civilian population. Like the trial court, the North Dakota Supreme Court was unimpressed with the carrier’s case. The Court summarily noted that none of Dr. Alyen’s experience included passage on theSaxon,the particular transport ship that carried Gorder to England. The Court also noted the lack of any evidence of the sanitary conditions either on board the Saxon;at the camps where Gorder was stationed prior to his death; or among the members of Gorder’s artillery unit. While acknowledging that sanitary conditions varied greatly, the Court stated: If any presumption would arise regarding the sanitary conditions surrounding [Gorder] prior to embarkation, it would be that they were good; for it is not to be presumed that the War Department would designate for overseas duty units that were in poor physical condition, or that were likely to become incapacitated prior to participation at the front.2 More importantly, however, the Court found the statistical evidence of increased rates of disease within the military “unreliable” based upon “a woeful lack of accurate information concerning the ravages among the civil population of the pandemic . . . “, and due to state board of health reports revealing that thousands of civilians never saw physicians, “whereas in the army every man was under constant observation for pathological symptoms, and no case of disease would be likely to be overlooked.” The Court also noted evidence that susceptibility to the disease was greatest among those of military age: The removal of so large a number of vigorous persons of this age from civil life would naturally have a tendency both to lessen the mortality rate for civil life and to accelerate it for military life. These factual determinations informed the Court’s further consideration of the Policy language itself, with the Court rejecting the carrier’s offered construction of the Condition: that coverage was removed for all increased risk of death due to military service without the company’s permission and payment of the extra premium. The Court first noted that the stated limitation would not be construed liberally to reduce liability, and then distinguished between two distinct concepts: death in active military service, on the one hand, and death in consequence of such service, on the other, noting that the limitation should apply only in the case of the latter and not the former. In this respect, the Court noted that normal premiums continued to be payable under the Policy during the period of military service, and further determined that premiums were “presumably” calculated on the basis of average mortality in civil life. The Court continued: To give this war clause the construction for which the appellant contends would be to discriminate . . . against all who entered the military service. It is well known that the ravages of influenza-pneumonia resulted in many thousands of deaths among those in civil life, and to hold that the insurance is not applicable where a solder dies from the same cause would be to exempt for a hazard that would have been insured against had the soldier remained in civil life. With respect to soldiers, therefore, it would place the insurance company upon a better footing than it occupied with respect to civilians generally. The Court did not entirely rule out the possibility that a death from influenza could be in consequence of military service under other circumstances so as to remove coverage based upon the subject Condition, but found that it was not demonstrated in the case of Gorder’s death. Although Gorder irrefutably died while in active military service, it was from a cause that killed many in both civilian and military life. The Court concluded: However the policy in question might be construed in reference to diseases that are more peculiarly prevalent in army camps than in civil life, so that a death from such a disease might be regarded as a death in consequence of such service, we are of the opinion that on the record in this case we cannot say that the death of the insured was in consequence of such service . . . Id. at 516-17. As theCourt saw it then, coverage was afforded because Gorder was killed by a worldwide epidemic that would have presented an even greater risk of death had he remained a civilian. It is not known whether the outcome in Gorder reflected simple deficiencies in the evidence offered by Lincoln National, or whether it was a foregone conclusion based upon the make-up of the North Dakota Court, the prevailing views of the day about insurance coverage, or deference to military service after a bloody war that killed more soldiers due to disease (largely influenza-pneumonia) than to combat. Either way, the Gorder case exemplifies two things: (1) seemingly plain contract language may not be what it appears when a court or jury is the arbiter of its meaning; and (2) thoughtful, creative lawyering—the obligation of all lawyers—can transform what could look like certainty of outcome into a meritorious legal dispute where the underdog wins. ABA Model Rule 3.1 provides that a lawyer “shall not . . . assert or controvert an issue . . . unless there is a basis in law and fact for doing so that is not frivolous . . .” But the boundaries of frivolity are not wide, as revealed by the Comments to the Rule: As advocates, lawyers are guided to “use legal procedure for the fullest benefit of the client’s cause” and “account must be taken of the law’s ambiguities and potential for change.” The Comments acknowledge that “the law is not always clear and never is static.” A different lawyer might easily have declined the father’s case against Lincoln National, believing the carrier’s position to be unassailable, and such a view could hardly be criticized. On the other hand, the further Comments to Model Rule 3.1 instruct that a lawyer informed of the facts and the law believing there are good faith arguments to support the position is not frivolous “even though the lawyer believes that the client’s position ultimately will not prevail.” Just as we do not know whether Lincoln National missed opportunities to develop necessary evidence to prevail in its case, we do not know whether Gorder’s lawyer believed he had a winning case from the start, or whether his argument was just a Hail Mary pass that—inconceivably—he actually completed. The lawyer met his ethical obligations in the attempt, however; the win was just the prize. In 2020, a different “war” rages in the form of a new pandemic that unsurprisingly impacts insurance carriers and policyholders on multiple lines of risk. And just as occurred 100 years ago, lawyers for insurers and insureds alike are plowing new ground with zeal, creativity and careful thought to best represent the interests of their respective clients, as the boundaries of the law are carefully explored and further charted. Notes 1. Notably, October 1918 - the month of Gorder’s death – has been characterized as “America’s Deadliest Month Ever”. See https://www.history.com/news/spanish-flu-deaths-october-1918#:~:text=While%20war%20engulfed%20the%20globe,up%20inside%20a%20makeshift%20morgue.&text=October%201918%20would%20become%20the,Death%20raged%20around%20the%20world. For after-the-fact historical reference, the first officially reported case of the flu virus in the U.S. occurred in early March 1918 at Camp Funston, a U.S. Army training camp in Kansas when in the morning of that day, a mess cook complained of flu-like symptoms. By lunchtime of the same day, 107 more soldiers had the same symptoms. Within three to five weeks (reports vary), as many as 1,100 soldiers (again, reports vary) had been infected and 47 were dead. “The deadly influenza tore through the overcrowded army training camps populated by one million new recruits, and the doughboys sent to Europe in the Spring of 1918 carried with them infinitesimal microbes that proved as lethal as their guns.” See ; https://www.history.com/news/spanish-flu-deaths-october 1918#:~:text=While%20war%20engulfed%20the%20globe,up%20inside%20a%20makeshift%20morgue.&text=October%201918%20 2. The inaccuracy of this conclusion has since been revealed by public health experts within the National Institutes of Health, based upon historical evidence of the spread of the virus among the U.S. military. Ten Tips for Effective Oral Advocacy In The Age of ZoomBy Michael F. Aylward, Morrison Mahoney LLP and Christine Haskett, Covington & Burling LLP

With state and federal courts closed for the foreseeable future, we are increasingly being called on to argue motions and appeals via Zoom or similar remote video platforms. While remote advocacy has its positive aspects (no risk of getting stuck in traffic on the way to court!), many of our Fellows have found it to be an alien and disconcerting experience. Here, then, are 10 suggestions for adapting to this new world of oral advocacy and turning it to your benefit. 1. Dress as if You Were in Court. Whether you are in an office conference room or your kitchen, you are still in court. Dress as you otherwise would if you were in court. (Pants and shoes are optional, of course.) 2. Control Your Setting. You need to create a setting where you feel comfortable and which projects a professional and respectful image for the court. We strongly recommend that you not get cute with virtual backgrounds. Not only are some judges put off by faux courthouse images, but the technology isn’t always great and can create strange auras and distorted images if you move around. A background of books or subdued paintings probably works best and creates a depth of field that a blank screen would not convey. At all costs, do not sit with your back to a sunlit window. 3. Manage Your Environment. Arguing from the living room table has its unexpected surprises, particularly in the form of small inquisitive children and barking dogs. Also, your neighbor may take that opportunity to mow his lawn. Banish the children and house pets or move to an attic or basement space where you are unlikely to be disturbed. 4. Should You Sit or Stand? There is no consensus with respect to whether you should sit or stand during your argument. Some lawyers only feel comfortable standing and even want a lectern in front of them to create a true, virtual courtroom simulation. Ultimately, it may not matter very much because the judge(s) may not be able to tell one way or the other. So, pick the pose that feels comfortable and reassuring to you. What is important is to be looking straight at the camera and that not be looming over the court or peering up at it. Similarly, the camera should not be so far away that you appear to be in the next county. If you use a remote camera (see Tip 5 below), use a tripod to adjust the camera angle and height. Otherwise, you should stack up some boxes, used vodka bottles, or law dictionaries to elevate your laptop camera 5. Be Tech Savvy. To begin with, make sure that you have a reliable WiFi signal, or better yet, use an ethernet connection. Also, consider augmenting your existing laptop camera and microphone. There are excellent remote systems readily available online that are surprisingly inexpensive and easy to use. The Logitech C922 offers high quality video and a microphone for a moderate price (about $99) and requires no technical knowledge to install. It even comes with a small tripod, if your setup would work better that way. Another option is a Logitech ConferenceCam BCC950 (around $250) with a Lapel Clip-on Movo M1 USB Lavalier Omnidirectional Microphone or an Apogee MIC Plus. 6. Practice, Practice. Be sure to speak with the Clerk of Court in advance of your argument to get all necessary technical information and to find out if there are particular procedures that the court prefers. Most courts will invite you to perform a technical dry run. Take advantage of that. It’s also a good idea to watch some archived arguments on court websites to get a sense of what works. You might also consider performing a dry run with a colleague. You can simply do a Zoom or Webex or platform of your choice meeting with your set up and a colleague on the other end who can critique your performance. 7. Try Not to Read Looking up and down or reading from written notes presents worse on video than in person. If you have a set presentation that you really do need to recite, considering using a teleprompter app (e.g., PromptSmart Pro [voice activated] or TelePrompt +3) on an iPad or the like, placed right next to the camera so you are not looking off-screen. 8. Be Aware of How You Look on Camera. Try to adjust your camera so that it appears that you are looking at it when you are looking at the screen. Make sure that your face is well lit and not in the dark. Work on your camera angle so that it looks to the audience on the other end that you are looking at them. Be aware that rocking motions and hand movements can be exaggerated by a camera (this may depend on your camera set up). Consider removing your glasses to the extent that they reflect light. Remember, though, that you are on camera the whole time. High-fiving your partner during the other side’s rebuttal is not going to look good. You can probably take a sip from a water bottle, but beyond that you don’t want to be shuffling papers or otherwise acting in a distracting manner. 9. Pause More. This is new territory for judges too. Some (but not all) are more reticent to interrupt. Make sure that you invite judicial questions by pausing more. And, you can expressly say that everyone is finding their feet with the new normal and you invite the bench to feel free to interrupt you. 10. Take Advantage Of The New World. If you are arguing a dispositive motion in a trial court, you can use “Share Screen” to share exhibits with the judge. You might also be able to this in an appellate context but only with advance notice to and the permission of the court. Don’t overdo it, however. You don’t want to turn oral argument into a PowerPoint presentation. But sometimes a picture (e.g., a property plot, the product mechanism at issue) is worth a thousand words. We hope that these tips are helpful to you in the weeks and months to come and would welcome your own thoughts and accounts of snafus and triumphs. Life In The Time of Pandemic: How Are You Coping?We are now six months into the social isolation and dislocation that have accompanied the COVID-19 pandemic. To find out how our members are coping, we gathered together a baker’s dozen of ACCC Fellows for a most interesting conversation: ACCC: What was the most difficult adjustment for you and your families after it became clear last Spring that this pandemic was going to last for a while? Rob Kole (Choate Hall & Stewart, Boston): Before this all started, my life was very structured. I used to get up at the exact same time every day and I did the same general stuff in the morning and I left my garage within three minutes every day and depending on traffic, I got to the office about the same time every day. This pandemic is the absolute enemy of structure. It’s been a real challenge to figure out what is the new normal for what you do every day.

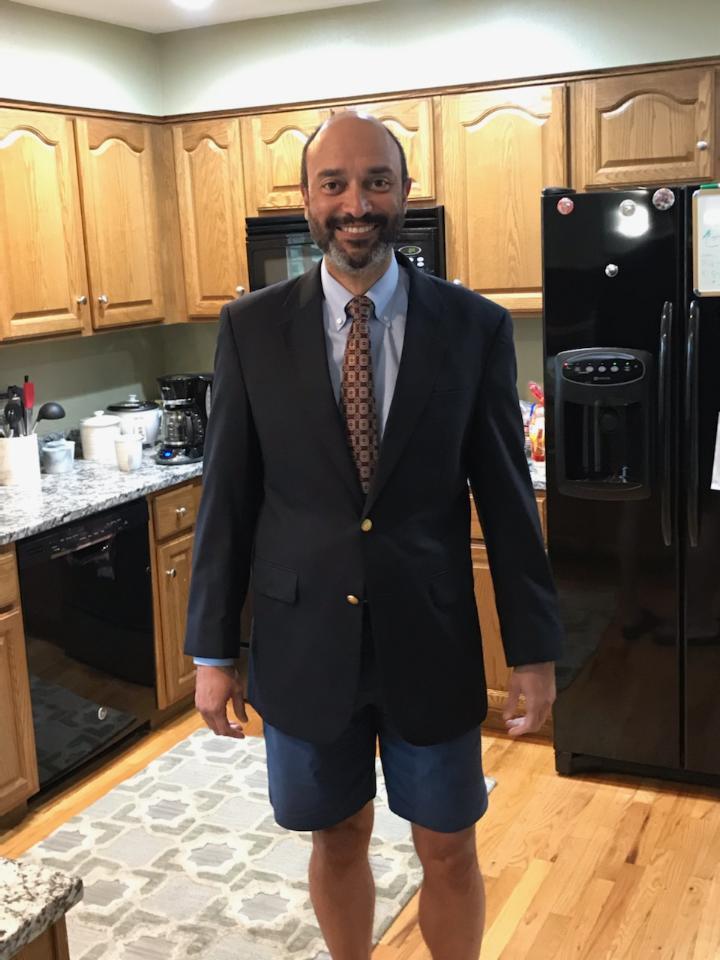

Chris Mosley “dressed up” for ACCC’s Boston College Law webinar Chris Mosley (Sherman & Howard, Denver): My biggest adjustment was figuring out how to coordinate online learning for my three children – then a college sophomore, a high school senior and an 8th grader. Then, it was setting a specific schedule to make sure that work and physical fitness worked into the schedule. I found it too easy to sit in front of my computer all day – which does not foster good fitness habits! Tom Segalla (Goldberg Segalla, Buffalo); I’ve been self-isolated since late February. My wife and I don’t go out unless we can find an isolated table along the Niagara River for a picnic. So that’s been our social life: just the two of us, Zoom calls, talking to my clients, and talking to the people at my law firm remotely.

Mary and Jon Calkins celebrating their 40th anniversary Mary Craig Calkins (Blank Rome, Los Angeles): My husband Jon is a double cancer survivor, so we weren’t able to do the 40th Anniversary vacation that we had planned. Instead, we had dinner somewhere where we hadn’t been in a while: our living room. We hadn’t been there for nearly two years, so it was a new and exciting experience for us.

Christine Haskett & daughters during the Zoom discussion Christine Haskett (Covington & Burling, San Francisco): I was flying 150,000 miles a year for the last 10 or 15 years but haven’t gotten on a plane since March. This is how my life has changed—my two kids are my working companions these days. So far, we have done some weekend trips by car to Mendocino and Carmel, and then the kids and I went to Calistoga. But always driving. I haven’t flown. Calkins: I tried to drive but the battery was dead. We had to jump-start the car. ACCC: What have you been doing this pandemic that’s different? Margo Brownell (Maslon-Minneapolis): As a Minneapolis native, my life during this pandemic has been hugely affected by the George Floyd riots. There has been a huge demand for pro bono services helping minority business owners navigate their insurance claims. Policyholder lawyers have been on the frontline doing clinics and assisting insureds with property and BI claims, many of whom are underinsured (or thought they were insured but weren’t). It’s been crazy and hard and rewarding. The work goes on after the reporters have moved on. But that’s what we are able to do with our insurance expertise! Very lucky! Segalla: I don’t think I had read a novel. I can’t remember when, so my reading basically has picked up—non-legal type reading. Haskett: I’m doing something I’ve been meaning to for years and years and years and I decided it was the perfect pandemic project. I’m reading Doctor Zhivago. Mosley: As a recent divorcee, I discovered someone new in my life. With the pandemic shutting down most everything, we had the opportunity to spend a lot of quiet dinners getting to know each other. So that was a definite plus. I also joined an over-50 baseball team – first time I’ve played competitively in over 30 years! I willingly put my ego aside and took hitting lessons from . . . my 14 year old son. As a result, I’m batting .400 and leading the team in doubles! Karen Dixon (Skarzynski, Chicago): During March and most of April, my family ate really well. I mean, we had so many meals together that by May, it’s like I’m not even hungry anymore. But we have this time and we are going to look back on this time and learn things. Haskett: One of the positive things about this pandemic was the opportunity to spend more quality family time together. I was able to see my kids a lot more than I normally would, and they would have been off at school and I would have been downtown at the office. Now, they’re getting ready to go back to school and we’re a little leery about that. It makes them going away harder than it was in the past. ACCC: Speaking of people whose lives are different, I’m told that Linda Morrison just got back this week from her honeymoon on Bora Bora.

Waiting for Linda when she returned from her honeymoon Linda Morrison (Tressler, Orange County): My husband and I had actually been planning our wedding for a year. We were fortunate that we had picked an outdoor venue because everything is still closed in California and even then we didn’t know until about three weeks prior to our wedding that the venue would be open. So, we had Plan B lined up and figured there would be a pop-up somewhere. Right? My dress was ordered last fall, but apparently it was shipped to the Los Angeles shop sometime in the spring and then sent back to China or wherever they come from, so I didn’t have a dress until, ooh, late June, and you know, by that time, I’m looking on eBay for dresses. And then we had to postpone the honeymoon because my husband hadn’t renewed his passport in time (it arrived the day we were originally supposed to leave). And anyway, French Polynesia wasn’t open for a while. So there was a lot of uncertainty, but you put your trust in God that things will work out the way they were supposed to. There’s no COVID in Bora Bora, which is a great thing, and it was nice to escape the chaos of the world at this time for a little while. ACCC: How far into the pandemic was it before you could get a haircut? Kole: I cut my own. I just buzzed it off like when I was a kid. Tom Alleman (Dykema Gossett, Dallas): About six weeks in, my wife gave me a trim in the back, and so this is Week 24 and it’s still hanging on. But I think this evening we’re going to go for round two. Right now, my hair is longer than it has been since I was in college, and that was in the 1970s! Michael Aylward (Morrison Mahoney, Boston): Mine was starting to look like my high school yearbook picture from 1969. It was not a happy look then either. ACCC: What is your favorite part of the day? Tom Hanekamp (Aronberg Goldberg, Chicago): It’s definitely the morning. I’m sleeping later and have more control over my schedule. Kole: I like the end of the day. My wife and I have started going for walks every evening and sometimes the kids come along. The other night, my 18-year-old daughter and I were the only two who were going for the entire walk and she was asking me questions about what I do, what I did, what I am working on now. To my amazement, she seemed really interested. A lot of it was back in the prosecutor days where the stories were much more fun, but we did talk a little bit of insurance, and she was genuinely interested. It was a moment that I’m going to remember for a while. Morrison: My routine since March has been to get up early and then go for a run mid-day. I look forward to that just as a break from sitting at the computer. I also really miss the interaction with people. It’s tough being an extrovert during a pandemic. Dixon: I find that my kids will often come into my room and watch me work. Kids are curious. They are “Like, wow, Mom is home. What’s, what’s it like?” They’re like “I don’t understand a thing you’re saying, and, you know, did you win?” Or they’ll make these cute observations of like “you were really angry” or, or “that person was really mean.” It was somehow enticing to them, like they’re watching a TV show. ACCC: How have you been coping with your younger lawyers and associates when you can’t have face-to-face meetings sit down in their offices to mentor them? Hanekamp: One of the greatest challenges for me professionally is the lack of face-to-face interaction with my colleagues, particularly the associates that I work with. Conference calls are just not the same as having somebody in your office or being in their office, working with someone on a document and so forth. Angela Elbert (Neal Gerber Eisenberg, Chicago): I think our group is closer now than we were when we could be in the office together. Back then, I was out of the office traveling all the time. Now we do a weekly call that’s a good hour of substance where we talk about matters that we’re working on. It’s interesting because we all have different takes on the issues and different ideas that people haven’t thought of. It’s been really good. Lorie Masters (Hunton Andrews, Washington, DC): At my firm, we’ve assigned partner mentors to each of the associates. It’s really important to try to establish relationships, because many of these associates are people that we didn’t know very well before the lockdown. And we’re having weekly Zoom calls with our group where we talk about all kinds of crazy things like people’s favorite books and movies. Kole: Even if you aren’t always Zooming with your whole group, you should meet regularly with your client teams or particular case teams. It’s particularly important to interact with your younger people. We’ve got long-standing connections to our law firms but the younger associates don’t. So keeping them engaged is important, and, and having the interaction that you talked about, you know, here’s what I would’ve done different on the draft. I think is essential because this pandemic is going to last at least nine months or a year. Who knows? And if you don’t do those sorts of things, then all of sudden your second-year associates are second-year associates again after a year, which doesn’t help anybody. The other issue that arose was how to work with associates of color. Some people really wanted to have a conversation about racial justice issues and others didn’t. It’s not my place to make someone have that conversation but I do feel, as a relatively senior person, that it’s our job to offer the opportunity if people want to talk. ACCC: How has Zoom changed the way that we interact with people? Mike Hamilton (Goldberg Segalla, Philadelphia): I actually prefer Zoom to the conference calls that we had before the pandemic. With Zoom, you at least get to see people during the calls and can interact more with them. Masters: Zoom does allow me to connect with people that I know well and I’ve also gotten to know these new people that we’ve hired. This technology has been adequate for current purposes but longer term, is it enough? It may work for lawyers and maybe paralegals but what about all the other people that make it possible for us to do what we do as litigators? I don’t see how that gets totally replaced by this new normal that we’re in right now. A lot of things are on hold right now or we’re doing work arounds. Maybe that’s the way things will happen in the future, too, but we are social animals. How do you replace all that by having everybody remote? I don’t think you can really. ACCC: Has anybody made a significant home improvement during the last six months? Segalla: We’ve been renovating our kitchen. The difficulty is that I can’t go into shops for health reasons. So my wife, Marylou, will go into the decorator’s shop with her camera and she’ll FaceTime me and ask me what I think. That’s how we picked out our fabric. It’s been kind of fun but strange doing it that way. Calkins: Amazon delivers plants. Who knew? And so I have live plants that are blooming. I have rose bushes. I have geraniums that are very much wishing that Lorie Masters would come back and deadhead them. We have flowers for the first time in probably 30 years, but who’s counting? That’s because this is the first time in 30 years I’ve actually been home long enough to water. Hamilton: My wife and I are in the middle of an unplanned renovation from the storm damage last month. I was in the middle of a mediation when we lost power at our house. Luckily, I was on Zoom on my iPad, but I was worried the whole time that my battery would run down and I’d have to run out to my car. The mediation ended with about 12% left on my battery, so I made it just in time. Segalla: In one of my crazier moments, I decided to make some work t-shirts like the ones that you see guys wearing on construction site. So I had five Goldberg Segalla shirts made up in this color [bright yellow] with the firm logo that I wear when I really want to work. ACCC: Do you have pajamas of the same color, Tom? Segalla: That’s assuming I wear pajamas. ACCC: One of the challenges of the pandemic has been creating a separate space in which to work. Are you all in the basement or an extra bedroom or the kitchen table? Elbert: In the beginning, my husband and I were sharing our home office, but it became quickly clear that it was either divorce or separate offices. Poor Mark got relegated to our guest room with just a card table and a rickety chair, while I got the office that we used to share. Once we realized we were going to be doing this for a long time, we made the investment to get him a full‑on office and a real chair and we continue to sort of upgrade everything in the meantime. So, that’s been our big change here. It makes for a much happier marriage. Haskett: I split my day in half. I tend spend the first half of the day in my kitchen. After lunch, I spend the afternoon in my upstairs office, but honestly, I find it depressing to be there all day—it was never meant to be an 8-hour a day office. It was only meant to be where I could work in the evenings or for a couple of hours on weekends or something. Kole: I’ve tried virtually every room in my house. We have a home office, but I’ve got a wife and a 16- and 18-year-old, so being the house can be a little noisy. I tried the office. I tried the dining room. I tried the break room. I tried the rabbit room (which used to be a sunroom, but now it’s just owned by the rabbit). Lately, I spend all day in the basement because it’s quiet and I can get my work done. Masters: I had already done some renovations to my home office before this happened, but it’s not really set up to have monitors and all kinds of stuff. I have a birdfeeder outside my window that I can watch during Zoom calls and I’ve really enjoyed watching the birds. It’s a nice place to work but it’s not going to be practical if I have to be here for the next year or so. ACCC: Most of our offices have reopened after a fashion. If you had a choice of working in the office or working from home, would you go into the office or do we expect some sort of hybrid arrangement going forward? Kole: Until the office can be more like what the office used to be like, I’m not in a hurry to get back. I’ll probably work from home more than I ever did before, but I’ll come to the office a lot more often than I’ll work from home. But not until things normalize. Dixon: Our firm’s offices are in downtown New York and Chicago and you really can only get to work on public transportation, which is a high source of risk. A firm in Franklin, West Virginia may already be fully operational because they can just drive to the office and walk right in. It’s going to be much harder thing for people who have to rely on public transportation to get to work. Kole: Public transportation is a gigantic problem. We have been very hesitant to say you can’t take public transportation to the office because a lot of our staff don’t drive to work and they might not even have a car. Even if they have a car, the parking in Boston is really expensive. Elbert: We are in Chicago, too, and you really can’t take public transportation at all. The only time that I actually went in, there were only five people in the whole office and no one on my floor. But the week that I was there, someone in the office contracted COVID, so they had to shut the whole office down and do deep cleaning and contact tracing. After that experience, I’m not going back until there’s a real vaccine and, let’s be honest, that may be more than a year away. Whatever normal looks like, I don’t think that I’m ever going to feel really comfortable on a train or being in crowded airports, concerts, the things that we used to do all the time. ACCC: So here is the question: What is the “new normal” going to look like? Or are we in the new “normal”? Elbert: I’m wondering if Zoom mediations and court hearings without having to get on airplanes or travel is going to be the way from here on in. Will clients want to pay for travel once they’ve seen that this works? Kole: I agree. It’s not going to go away. The other new normal, I’m convinced, is that we’re going to start cutting down on our real estate costs. The big costs for our law firms are people and real estate. If you can shrink your footprint because people are working four days a week and it doesn’t really affect your business any, why wouldn’t you? I think there’s going to be a lot of that in the coming years as people’s leases come due. Morrison: There’s also a liberating element in realizing that we don’t need to be in the office 24/7. We are all Type A personalities who feel the need to be in the office. Before this, I never would have dreamt of taking 10 days off. We now know that we can work from different environments, and so if we want to take two weeks to go to the mountains with our families and, you know, do some work while we’re there, we can do that. We will still need the office for litigation support, so I think that we are going to end up with a hybrid approach with folks still working from home somewhat and others in the office. Hanekamp: We’ll have more Zoom hearings going forward, regardless of what happens. From what I understand, a lot of judges really prefer to have in-person hearings and trials, so I think we will get back to some form of that once this gets a little more under control. But going forward, I think there’s no reason you can’t just provide the court with a status report on discovery via Zoom as opposed to trekking over to the Daley Center or wherever it is you have to go to court. Aylward: I think the problem is going to be trials. I mean I’ve done summary judgment arguments and done appellate arguments and they’re all fine by Zoom, but a trial with witnesses and exhibits, is going to be a whole other matter. Also, when the courts finally do open up, there is going to be such a backlog! Alex Henlin (Sulloway Hollis, Concord, NH): The biggest change, which I hope will stick, is that courts will do routine status conferences and other hearings by telephone or WebEx. Otherwise, I expect that discussion about the “new normal” is overblown: people are social creatures and respond best in the company of others, which is how networks form. I think we’ll be back to our old ways sooner rather than later. Mosley: A big change will be how, or more specifically, where we will work – especially the younger set. The pandemic has shown the nation and the world can function very well remotely. This means the demand for sophisticated office space likely will reduce, significantly in my view. As such, I foresee a material reduction in the value of commercial real estate. I also think remote hearings and depositions will become much more the norm given the convenience and cost-efficiencies they bring. I anticipate trials will remain in person, but even that may change – though I don’t see that happening for several years. I don’t how young lawyers will market, but they will find a way to do so – just as we did with webinars, LinkedIn, and the like. The only thing of which I am certain is that things will be different. Segalla: I think that you’ll find that there will be more flexibility about allowing people to work. I also think that there will be a lot more remote communication between various offices. I think that when this is over, firms will assess what impact working remotely has had on billable hours and revenue. That doesn’t mean they’re not going to allow attorneys and paralegals to work remotely. They’ll just set up different types of parameters and assess what it really means to work remotely and how that’s monitored. Hamilton: I agree with Tom. Businesses are going to be a lot more open to allowing employees to work from home, whether it’s full time or on a part-time basis. The days of everyone being in the office all the time are long gone. And because of that, businesses are going to rethink why we need all this expensive office space. Haskett: Covington’s culture has always very much been that we expect people to be in the office. It’s very much sort of impressed on everyone that there is value to being in the office working together in person. So, when it’s safe to go back to work, we’ll probably go back into the office and the rest of San Francisco is going to be completely empty. Aylward: And how will the new normal be outside of the office? I mean it’s one thing to go to an outdoor café and sit 8 feet apart from people, but what about going to the theater or the movies? I don’t know when I’m going to be comfortable sitting in an auditorium right next to somebody who’s sneezing. I remember after 9-11, every time you got on an airplane you looked at the people around you. It took a long time to get over that sense of danger and I wonder if, and when, it’s going to happen with this. Calkins: And yet people are very creative about things. I do think this is going to last for another six months, at least, and then I do think that we will be different when we come out of this. Masters: There will be some great parties when and if that happens. ACCC Tackles the COVID-19 PandemicBy Michael Aylward, Morrison Mahoney LLP and Michael Huddleston, Munsch Hardt Kopf & Harr, PC Our College’s mission statement calls for the ACCC to “advance the creative, ethical and efficient adjudication of insurance coverage and extracontractual disputes…” During this pandemic, we have striven to do so through various means that we hope will encourage discussion and interaction among our members, increase their knowledge and skills, and raise the profile of the ACC in the business community at large. Since March, we have held a series of monthly pop-up calls in which ACCC Fellows who are deeply involved in the COVID-19 insurance litigation have discussed emerging issues and strategies driving this litigation. More recently, we have begun a program of 90-minute webinars in partnership with leading law schools around the country. Unlike our internal pop up calls, these programs are open to the public. They have been very well-attended: our July 16 program with the Boston College Law School had over 400 registrants! We are now in the process of finalizing a program with Baylor Law in Texas that will be followed by program with the University of California at Hastings (San Francisco). We expect to organize two further programs in 2020 with several more to follow during the winter and spring of 2021. In order to sustain audience interest, we will vary both the topics to be discussed and will be constantly updating the content to account for new rulings and case developments as this litigation progresses. If you would like to speak on one of these programs, please contact us. In order to assist the ACCC in developing programming that is attuned and responsive to the emerging scope of the pandemic litigation, we have also formed a COVID-19 Virus Advisory Task Force, comprising six ACCC Fellows who are deeply involved in this litigation: Laura Foggan (Crowell Moring); Seth Lamden (Neil Gerber Eisenberg); Hugh Lumpkin (Reed Smith); Neil Rambin (Faegre Drinker Biddle); Greg Varga (Robinson & Cole) and John Vishneski (Reed Smith). We thank these Fellows for their service. Finally, we have added functionality to the ACCC website so that our members can obtain and share relevant and timely information. In addition to the COVID-19 Community Forum, where members can post information about new legislative and legal developments, we have recently added a new “Cases and Decisions” page where you will be able to readily locate new rulings as they come down. Both of these require Fellows to be logged in for access. As always, we welcome your input and hope that these efforts reinforce the value of your involvement in our College. Allocation, Allocation, Allocation!By Thomas Alleman, Dykema Gossett PLLC

Thomas Alleman Pandemic or no pandemic, coverage disputes – and opinions about coverage -- continue. Montrose Chemical Co. v. Superior Court, 9 Cal. 5th, 460 P.3d 1201, 260 Cal. Rptr. 3d 822 (April 6, 2020), Lubrizol Advanced Materials, Inc. v. National union Fire Ins. Co. of Pittsburgh, Pa.,2020-Ohio-1579 (April 23, 2020), and Rosello v. Zurich American Ins. Co.,468 Md. 92, 226 A.3d 444 (April 3, 2020), all tackle allocation questions with differing results. MONTROSE The California Supreme Court returned to coverage issues arising out of the remediation of environmental contamination from the Montrose Chemical Co. DDT plant. Having already ruled in favor of an “all sums with stacking” approach to allocation, the California Supreme Court turned to the question of horizontal versus vertical exhaustion of coverage as a prerequisite for attachment of coverage under umbrella or excess policies. The setting for this episode of “Return to Montrose” is straightforward. Montrose had towers of insurance for each year from 1961 until 1985, with forty insurers collectively issuing more than 115 excess policies during that period. It was stipulated that Montrose had exhausted its primary coverage under the policy year it previously had selected pursuant to the “all-sums-with-stacking” allocation method, and the question was whether Montrose was obligated to exhaust all other policies in the same layer before coverage under the umbrella or excess policy in any particular year would attach. As the Supreme Court noted, the dispute centered on clauses providing “in a variety of ways, that each policy shall be excess to other insurance available to the insured, whether or not the other insurance is specifically listed in the policy’s schedule of underlying insurance.” At its root, the Supreme Court’s analysis can be captured in the single idea that none of the relevant clauses “clearly or explicitly states that Montrose must exhaust insurance with lower attachment points purchased for different policy periods.” [Emphasis original.] In other words, a requirement to exhaust “all” policies with a lower attachment point could mean “all” but it could also mean scheduled underlying coverage. The Supreme Court found the latter construction of the clauses to be more internally consistent, particularly with schedules of underlying coverage, and with provisos in the attachment clauses relating to other insurance purchased specifically to in excess of this policy. The Court also found that “applying the horizontal exhaustion rule would be far from straightforward.” Policies come in all shapes and sizes with different terms and exclusions. As the Supreme Court noted, the first layer of excess insurance in 1984 appeared to reach as high as the thirteenth layer from 1974. And perhaps in a somewhat ironic, self-referential moment, the Court noted that horizontal exhaustion would create as many layers of additional litigation as there are layers of coverage. Once “all sums” is accepted as the proper approach to allocation, it is difficult not to see this opinion as a logical implementation of the approach. The deeper question, which is discussed in Rosselli, is whether “all sums” is the correct way to address long-tail injuries. LUBRIZOL In Lubrizol Advanced Materials v. National Union Fire Ins. Co. of Pittsburgh, Pa., the Ohio Supreme Court addressed a different situation and different policy language. Lubrizol sold resin to IPEX for use in IPEX’s home plumbing system from 2001 to 2008. The pipes failed in different homes at different times, resulting in many claims for damage against IPEX. IPEX settled the claims and sued Lubrizol for negligence, breach of contract and breach of warranty, all based on the common thread that Lubrizol knew or should have known that the resin was unfit for use in the pipes. (Can you say polybutylene?) Lubrizol settled with IPEX and then sued National Union for insurance coverage under a single umbrella policy in effect from 2001-2002. Lubrizol asserted that because Ohio had previously adopted “all sums” allocation for environmental claims (Goodyear Tire & Rubber Co. v. Aetna Cas. & Sur. Co., 769 N.E.2d 835 (Ohio 2002)) and asbestos bodily injury claims (Pennsylvania Gen. Ins. Co. v. Park-Ohio Indus., 930 N.E.2d 800 (Ohio 2010)), National Union was obligated to bear the entire cost of Lubrizol’s settlement. National Union counterclaimed, alleging that the language in its policy precluded the application of “all sums” allocation. The Ohio Supreme Court agreed with National Union . . . sort of. Noting that the National Union policy obligated the company to pay “thosesums” that Lubrizol was obligated to pay as damages because of bodily injury or property damage during the policy period, the Court agreed that “‘those sums’ may indicate a subset of ‘all sums.’” (Translation: “those sums” is less than “all sums.”) But farther than that the Court refused to go. Declining to engage in a “hyper technical grammar analysis,” the Court stated that whether “those sums” was less than or equal to “all sums” would depend on context. When it looked to the context, the Court found that the “garden-variety product defect” claim presented did not create “the same kind of continuous progressive harm” that was found in prior “all sums” cases. The need for allocation, said the Court, “arises in situations involving long-term injury or damage, such as environmental cleanup claims where it is difficult to determine which insurer must bear the loss.” In this case, however, “the time of damage is known or knowable. For example, it should be ascertainable how much resin was produced on a given date, how much resin was sold to IPEX which lots of Kitec plumbing were produced on certain dates, when the Kitec plumbing was sold and installed, and when it failed.” Three justices concurred in the judgment only, stating that “those sums” is unambiguous and that Lubrizol therefore could not attempt to compress multiple discreet injuries into one policy. The single phrase “‘those sums’ may indicate a subset of ‘all sums’” is oracular at best. What is missing from the opinions is how the pipes failed. Those who remember polybutylene pipes will recall that when those pipes failed, they typically ruptured catastrophically, making it simple to determine when the damage occurred. That supposition (if not actual knowledge) appears to underlie the majority’s opinion. One can speculate what the result would be if the underlying cases had alleged water intrusion due to defective EIFS as in a case such as Don’s Building Supply LLC v. One Beacon Insurance Co. ROSSELLO In Mayor and City Council of Baltimore v. Utica Mut. Ins. Co., 145 Md. App. 256 (2002), Maryland’s intermediate appellate court adopted a pro rata approach to allocation for continuous injuries such as mesothelioma claims. Maryland’s Court of Appeals considered the allocation issue for the first time in Rossello v. Zurich American Ins. Co., decided April 3. Patrick Rossello was exposed to asbestos in 1974 while working at a building in which Lloyd E. Mitchell Inc. was performing construction and renovation. His exposure ripened into mesothelioma in 2013, forty years later. Mitchell was insured by Maryland Casualty Co. with primary and umbrella “all sums” policies from January 1, 1974 through July 31, 1977; each year’s policies had total limits of $3 million per occurrence and in the aggregate. Mitchell ceased all operations in 1976 during its last policy period. After his diagnosis, Mr. Rossello filed suit against multiple defendants, including Mitchell. He obtained a judgment of $8,114,166.79, which was reduced by settlements to a final judgment of $2,682,847.26. Mr. Rossello filed a garnishment action seeking to recover his judgment from Zurich, which previously had acquired Maryland Casualty. Mr. Rossello argued that the entire judgment should be paid by the 1974 policy. Zurich argued for pro rata allocation over the entire forty years of Mr. Rossello’s injury, under which it would be responsible for one fortieth of the judgment for each year of coverage, or, alternatively, that the proper period for allocation was from 1974 to 1985, the last year in which asbestos coverage was available. If this approach was adopted, Zurich would be responsible for one twelfth of the judgment for each year of its coverage. The trial court adopted the twelve year proration argument advanced by Zurich and entered judgment adopting it. The Court of Appeals used the opportunity to address the allocation issue for the first time in Maryland. Much of the Court of Appeals’ opinion is a straightforward explanation of why pro rata allocation is more faithful to policy language and the realities of litigation and insurance. What makes the decision important (other than it is one more case adopting the majority viewpoint on allocation) is the last section relating to the Court’s analysis as to the period over which proration should occur. The Court adopted the trial court’s opinion that proration should occur over the period of time from injury until insurance for asbestos no longer was commercially available in 1985. The first page of the Court’s opinion states succinctly that Lloyd E. Mitchell, Inc. . . was a mechanical contractor that sold, distributed and installed products containing asbestos until 1976, when it ceased all operations. [Emphasis added.] The Court of Appeals did not explain why periods after which Mitchell ceased operations and was not in business to purchase insurance should be included in the proration. It may be speculated that having hitched his wagon to “all sums,” Mr. Rossello did not want to concede any portion of his opponent’s argument. What have we learned from these cases? Obviously there is no sweeping lesson from the three. But each reminds us of enduring issues. First, reconciling language from policies issued at different times remains difficult. Second, picking “all sums” or “time on the risk” allocation does not result in a neat result that is easy to apply or even universally applicable. Finally, facts still matter. Bursting pipes are different from DDT and mesothelioma.

Greg Varga Greg Varga is a partner in the Hartford office of Robinson & Cole, where he chairs the firm’s Insurance & Reinsurance Group. He has worked at R&C since graduating from Boston College Law School in 1995. Greg specializes in first party property insurance disputes and has been in the thick of the COVID-19 business interruption litigation since its on-set last March. ACCC’s immediate past president Michael Aylward caught up with Greg to discuss the evolution of his career in the law and how the pandemic has changed his world, personally and professionally. ACCC: Let's start at the start. I understand that you are a Double Eagle. Did you grow up in Boston or how did you end up at Boston College? Varga: I grew up in Fairfield, Connecticut, and I had a fifth grade teacher who loved the City of Boston and urged me to visit. My parents took me there and we ended up visiting BC. I sort of knew then that I wanted to study there and be on that campus. So years later, I applied and was admitted, and, fortunately, I met the girl who would become my wife on the very first day of class. ACCC: What prompted you to go to law school? Varga: I had actually started off as a business major at BC but quickly realized that my mind was wired for politics, history, language and the humanities, so I became a history major. I had a couple of history courses that deal with the law, including one taught by Professor O’Connell on the Age of Jackson, for which I wrote a thesis on the Roger Taney Supreme Court (that decided Dred Scott). I was pretty certain I wanted to be a lawyer, but I took a year off after college to work and gain some experience. I entered Boston College Law School in 1993 and had a great experience there. I really enjoyed the collegiality of BC Law. During the summer after my second of law school, I clerked at Robinson & Cole, which had just opened a Boston office. I received an offer and joined the firm after I graduated. I knew of the firm, of course, being from Connecticut, and I really liked the idea of being in a smaller office where I could work on a variety of litigation. I started out doing a lot of real estate and title insurance litigation, commercial litigation, and even some traditional insurance defense work. I got a lot of early experience “on my feet” and even got to try a case in District Court in my third year of practice. In that same year, I was recruited by one of the senior partners, John Tener, to work on an insurance coverage matter. Varga: John is a terrific person and was a great mentor who showed an interest in my career and success. I think that anyone who has had any degree of success in any field has a mentor to thank, and John was that person for me early in my career. First party coverage litigation was of great interest to me. Looking back, I think that what appealed to me most is that property insurance lies at the intersection of contract interpretation, case law and statutory law, and the stakes are usually really high in the cases we handle. I enjoyed the intense investigative work you have to undertake to properly defend each case. I also enjoyed handling cases all around the country as it requires you to understand and appreciate differences in the law of various jurisdictions. ACCC: But how did you end up in Hartford? I had been with R&C’s Boston office for seven years, and my wife and I had two toddlers who were growing up with no family close by, and being near family matters to us. So, we eventually decided to move back to Connecticut in 2002. Another benefit for me was that a lot of the insurance clients that I was working with were in Hartford, and I thought it made sense to be a little bit closer to some of the people I was dealing with. ACCC: In my experience, property insurance specialists are a bit of a breed apart. What is it about property insurance sets it apart from casualty work? Varga: What I really enjoy about this work is the variety of claims that you see and how much you have to learn in each case. For instance, I recently had a dispute involving a $25 million claim that arose from a fire at a manufacturing facility. In order for me to be an effective advocate in that case, I had to hire experts to teach me about the process of manufacturing printed circuit boards and about the very complex equipment and myriad chemicals used in that process. By the time that we went to arbitration, I probably knew enough to operate that plant myself. I also had to learn about the financial side of that business, which had experienced a significant interruption due to the fire. And then you have other types of cases where you're dealing with, for example, a claim by a large personal injury law firm. You have to learn everything there is to know about how a plaintiff's personal injury firm keeps its books, when it “earns” and book its income, how different accounting methodologies apply, how the firm markets its services and signs up clients, etc. So you need to become a quasi-expert in a lot of different fields in order to be good at this work. I mean you name it, and I've probably dealt with it. And that’s what I really enjoy, conducting the investigation, finding the right expert, asking the right questions and getting into the nitty gritty of every claim. These days, we’re dealing with a high volume of COVID-19 business interruption cases. We’re serving as national counsel for several carriers, and the pace is incredibly intense. Most days I get into my home office by 5:15 a.m. and I usually don't turn off the lights until after 9:00 at night. But I really enjoy the challenge. The procedural maneuvering of this litigation is fascinating, and I’m very lucky to be working with an incredible team at my firm. ACCC: You were heavily involved in Katrina and Superstorm Sandy and the other large CAT claims. What’s so different about these COVID-19 claims? Varga: As a CAT, COVID-19 is different because it’s everywhere, the losses are ubiquitous. CATs like Sandy, Katrina and Harvey were regional. The losses were localized in at most a few states. But the pandemic is obviously national in scale, as are the government social distancing orders that have given rise to tens of thousands of claims. Nail salons in Minnesota, restaurants in Boston, and souvenir shops in Miami are all impacted. Differences in policy language and in case law make these cases very interesting. When you manage this much litigation in so many states, it is critical to enlist the help of excellent local counsel. When we were working Katrina cases, we were partnering with law firms in only two states - Louisiana and Mississippi. But in the time of COVID-19 litigation, we partner with local counsel all over the country, which I really enjoy. We’re fortunate to have a great team working with us. COVID has been much more challenging because of the number of cases and the diversity of the law in each jurisdiction. Also, now that court decisions are starting to come out, they impact your pending cases, so we find ourselves filing notices of supplemental authority in every case that in which we have fully briefed motions to dismiss, and then the very next day, you have to prepare another one. We’re all waiting on pins and needles waiting for the next decision to come out. As a lawyer, I find it fascinating to be a part of something that is evolving in real time. ACCC: There are now over a thousand DJs pending and more being filed every day. Is there an end to this are or we going to be litigating COVID losses for the next decade? Varga: I don’t see this beginning to wind down for at least several years, until we start getting decisions from the highest courts of the states with the greatest concentration of cases. We are starting to see trial courts issue decisions favorable to the insurance industry, but some of those are going to be appealed and it won’t surprise me to see issues certified to state supreme courts. When we start to see decisions from state supreme courts, it will start to move the needle. Meanwhile, more lawsuits will be filed, and I think we are going to be litigating these cases for at least four or five years, maybe longer than that. ACCC: There are examples of mass insurance litigation that just evaporated after a negative state Supreme Court decision. I’m thinking in particular of what happened in Connecticut last year with the crumbling concrete foundation claims. But then there are examples like asbestos and pollution that have gone on for decades. ACCC: I don’t know if you have much spare time but if you ever do, what do you to relax? Varga: In my spare time, I like to do two things. I play the guitar and I like to do distance cycling. If I have a free couple of hours, I'll go out on a nice long road ride for 30 or 40 miles to clear my head. Or, I will play around on the guitar and learn some new songs. ACCC: You have the distinction of not only chairing the insurance group at Robinson & Cole but also the firm’s the Technology Committee. Where did the interest in technology come from? Varga: I was fortunate to participate in a training program that the FDCC [Federation of Defense and Corporate Counsel] organized in Philadelphia in 2018 called “Fed Tech U.” What I learned was how versatile the iPad Pro is and how trial lawyers can use if effectively. I've always been interested in technology, but that experience really reinforced for me how critical presentation technology is to the work we do. It also helped me understand how to better leverage technology to manage cases, to manage my time, and to be more efficient. Nowadays, I’m completely paperless. My work uses a combination of a laptop and my iPad. Everything is stored digitally, and it is always accessible to me. I can work anywhere, even without an internet connection Our Managing Partner, Steve Goldman, asked me to chair our Technology Committee to help devise solutions that we could bring to other practice groups within the firm. Construction lawyers and IP lawyers use technology in different ways. I was surprised when I interviewed people around the firm how they vary in their use of the tools we have. My charge was to start with small projects and improvements where I could identify a problem and work with our IT experts to develop solutions. ACCC: Robinson & Cole has one of the larger insurance coverage practice groups in the country. How have the technology and ideas that you've implemented helped you and your colleagues work during this pandemic? Varga: It's nothing revolutionary - just using the tools that you have in a different way. To begin with, you needed to be attuned people's workloads and make sure that your associates are getting the right kinds of work so that their skills are developing properly. During this pandemic, you can't sit down with your team or walk door to door, so I put in a very simple system. I created a spreadsheet that is available to everybody in the group, and the associates are required to enter information about their workloads on a weekly basis. That way, I can see the weekly numbers and tell who has got capacity and who doesn't. Beyond that, we are really encouraging our lawyers to use display technology both in court, in mediations, and in depositions. We also want our lawyers to remember that many people are visual learners, and we encourage the use of display tools like PowerPoint in virtual meetings with clients and experts to improve our service and enhance communication. ACCC: At some point, we will hopefully come out of this. How do you see your practice being different when and if it's safe to go back into the office in Hartford or to have practice group meetings in person? Varga: Before the pandemic, my wife used to ask “why don't you work from home more often.” And I’d say that I can't concentrate at home; there are too many distractions. Well, for the last six months, I've been forced to concentrate at home and I've been able to create a space where I can work very effectively - and maybe even more efficiently than when I worked in our office. We have been required to work at a fast pace in managing COVID-19, as well as all the litigation we were handling pre-pandemic. I think we’ve done a good job working entirely remotely. Going forward, I can't speak for how the firm will approach this, but I probably will continue working one or two days per week from home. I do think that we will end up in a situation where the modern law firm looks different from what we’ve been used to. I think that we’ll end up with days when there are fewer people in the office and more people working remotely and as long as we can use tools like Zoom effectively to get together, it works. But I really miss seeing and interacting with my colleagues in person. There are many people I haven't seen since March, except on a laptop screen. As the practice group leader, I work hard to get people together visually, which is why when I hold practice group meetings. I get a little upset when people don’t turn on their cameras. I think it’s important that we see each other. It's important to interact. It's important to see somebody smile. ACCC: Greg, it’s been a real pleasure catching up. Good luck with your firm and your cases. We look forward to visiting again in person soon. Law in a Time of Pandemic: How Texas Courts and Lawyers Responded to the Pandemic of 1918-1920By Stephen Pate, Cozen O’Connor