July 2022 NewsletterPresident's MessageBy Michael Huddleston, Munsch Hardt Kopf & Harr P.C.

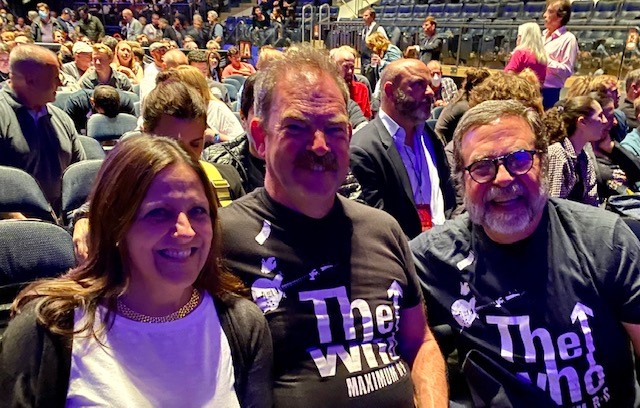

Dear Fellows: We have had a very exciting few months as we have moved beyond the pandemic to have our first face-to-face meetings. Kudos to Wayne Taylor for his creative and persistent leadership as we have moved from the improvisation required by the pandemic to a return to the normal business of the College. We have come through this trying period financially sound, with expanded offerings like Pop-Up Calls for members, and a continued commitment to selecting distinguished and diverse new members. Sheri Pastor will now be cycling out of the formal leadership positions she has held. We extend our heartfelt thanks for her service as an Officer and member of the Board of Regents, and for her continued involvement in the College. Deb Varner has now become the College’s President-Elect and Angela Elbert has been elected Secretary-Treasurer. Our thanks go out to Tracey Saxe and Laura Hanson for the splendid work they did on our recent 2022 Conference. Our Annual Conference will return to Chicago, May 10-12, 2023. The Annual Conference Co-Chairs, KT Talieh and Mary Borja, and Vice-Chairs, Suzan Charlton and Barbara O’Donnell, have already begun the hard work of the planning of the Conference. Warm Regards, Get to Know the New PresidentThe ACCC celebrated its 10th Anniversary in Chicago in May, and Mary Calkins (MCC) sat down with the College’s newest President, Michael Huddleston of Munsch Hardt Kopf & Harr, PC in Dallas, Texas. They met remotely, of course, but while he was en route to a jam at Pinky’s Champagne and Velvet Jazz Lounge in Fort Worth. [MCC: I like Pinky’s style: “We think every day is worth celebrating and what better way than BUBBLES!”] Mary talked to Mike about his journey to becoming President, his practice, and his plans for the 2022-2023 year. MCC: Mike, you have to update your web bio. It says you are a Fellow and Board Member, but you are the College’s 10th President. Let’s step back a moment. What led you to become a lawyer? Mike: Music did not pay enough! I had always aimed at being a lawyer and music was a passion. The first year I had intended to go to the University of Michigan, but I did not get enough of a scholarship, so I went to the University of North Texas. It did not have saxophone even though it had a jazz school, but I was not really into jazz at the time. The idea of going through school with 10 hours a day in a practice room only to be destitute financially just did not make sense. So I went as far away from music, as far as you could go, which was to Texas A&M University, where I majored in Political Science and minored in English. Unfortunately, Poli Sci was a lot of empirical research with a focus on math and statistics vs. philosophy. Polling and math have always been daunting . . . not my subject (unless you are counting zeros on a settlement, and I can figure out 33.3% or higher). MCC: You graduated from Texas A&M, received your JD from Southern Methodist University Dedman School of Law, and started practicing in 1983. How did you become a policyholder-side coverage lawyer? Mike: During law school, I worked on the Journal of Air Law & Commerce, was on the ABA National Moot Court Team, and always loved appellate arguments. After law school, I started at Cowles & Thompson and was hired to work with Brent Cooper, a whiz kid. He was also an A&M grad. We both had 4.0s at A&M, so I was a good candidate to help him in the insurance and appellate group. My job was research intensive, naturally, and I argued in the Supreme Court of Texas some seven or eight times before I was 35. I started on the insurer side, as Cowles and Thompson was on the insurer side and that was my first exposure to this area of practice. I loved working with Brent. He is incredibly bright and has a real taste for this kind of work. Brent was a deep thinker. We would take sides and more often than not, I would play the policyholder side and bring Brent to reason. Brent and I then formed a firm for several years, and then I went to McCauley Macdonald Devin & Huddleston. That is when I started the transition to the policyholder side. I started working a lot with personal injury attorneys in Texas with Stowers Demands to pressure insurers to pay limits or risk liability for a verdict in excess of coverage. From there I went to Shannon Gracey Ratliff & Miller in 2001, which was trying to develop into more of a commercial firm. They asked me to try to build an insurance recovery practice but we did not make the transition to a full policyholder-side practice for six or seven years. All that time, I did a mix of appellate work and tons of insurance coverage work for commercial policyholders as well as plaintiff’s counsel. I do still have some carrier cases. That is the weird thing about Texas. There are more lawyers who really do both sides than in any other state that I have encountered. MCC: You were selected as the “Go to Lawyer in Insurance Law” by Texas Lawyer in 2012, which only publishes that recognition once every five years, with multiple other accolades, so your choice of specialty is working out. Did you ever think about pursuing another area of specialty? Mike: No. I have continued to do appeals but primarily in insurance cases. I did argue a huge covenant not to compete case back in February, but most of my appellate work is on insurance issues. At one point in time, I had some delusions of grandeur of doing securities work but everything else seemed boring. It is a new day every time a new case comes in. One of my first cases was an early trigger case, which provided an introduction to Eagle Picher, Forty-Eight Insulations, and Keene, and I have not been the same since. That’s one of the things that hooked me because those cases were absolutely fascinating. MCC: What are some of the cases that you enjoyed the most over your years as a lawyer? Mike: We won a huge carrier decision killing sweetheart deals in Texas as they existed at that time. State Farm v. Gandy[1] was an incredibly fascinating case where I represented State Farm. At the time, we were not sure what issues the court might seize upon, and it was an appellate lawyer’s nightmare trying to preserve all of the arguments for appeal. The case had a real cast of characters. A stepfather had molested his stepdaughter and I took his deposition. When I deposed the molester, the court reporter did not know anything about the case and was almost flirting with the molester, but as the testimony started coming out, I thought she was going to have a heart attack and she moved to the other end of the table. The original lawyer first appearing as appointed counsel ultimately was appointed by the Governor to be DA in a nearby county in East Texas and then had all kinds of ethical charges brought against him. The underlying parties cut a deal on the morning of trial, after which the molester hanged his testimony but we still got $225,000 verdict, which was considered to be a miracle. We took it up on appeal and got a promising decision out of first level court of appeal in Texarkana. By the time that they went to Supreme Court, everything was teed up for reversal. During oral argument, I used a blow up showing 30 different instances in the underlying trial that clearly established falsehoods. I modeled my argument after Abe Fortis’ argument in Gideon v. Wainwright: When one looks at the record in this case, you can only conclude that this man was not a stupid man, but no man has the ability to represent himself. My argument in Gandy was similar: When you displayed the falsehoods and view the record in this case, you must come to the conclusion that court sanctioning of these kinds of sweetheart deals bring disrepute to the practice of law. Now that I am on the other side, I definitely see the need for some tool or settlement device that is not as porous and problematic for an insured to get out of the ditch when an insurer basically denied a defense and the carrier abandons him. For example, Koblenz agreements in Florida. It is fascinating how other jurisdictions handle this issue. Aside from that, some of my greatest victories have been in litigation management. As an appellate lawyer doing case management, I can help develop defensive parts of the case, recommend replacing counsel, and deal with care and feeding of excess carriers. My mixed experience with appellate experience and more combative trial experience has come in handy. I work both sides: working with insurers to get them to pay more and working with plaintiff’s counsel as appellate lawyer, pointing out why your case is going to go south. MCC: What else has been keeping you busy, like your family, including wife Teresa and children Michael and Tiara? Mike: Michael is a philosophy major at the University of Dallas, age 21. Tiara is almost 19 and finishing high school. She is an incredible musician, playing bass, electric guitar and drums as well as being a talented recording engineer. She is responsible for at least 25 independent projects involving people her age, even though she does not have formal training. My wife Teresa and I worked together at Cowles and Thompson, and she ended up at TIG Insurance Company where she used a Morrison Mahoney lawyer named Mike Aylward. She also worked with Jill Berkeley on ABA matters and was active on ABA. All these unusual points of connection. We talk a lot of shop on coverage issues, and I never have to worry about coming home and knowing whether my wife understands the successes in my life. MCC: Tell us about your band. Mike: I played for years for a big band, Pecos River Brass. Now I have small jazz quartet called Jazz Visions. I have been playing with the drummer since 1994; amazing drummer and an evergreen group of musicians. Tonight, I am doing a jam at Pinkie’s Champagne and Velvet Jazz Lounge, run by a guy I have been playing with for 20 years, Mike Garvey. Every time I am in New York, I am always up at jam sessions from midnight to 3:00 am, seeing the competition and playing. MCC: What are your plans for your year as President, 2022-2023? Mike: Oh, Lord. I don‘t have my list in front of me. Main thing is that I don’t want to screw it up; number one thing is participation, trying to encourage participation and involvement with the committees, CGL has set the standard and is a great example of what can be accomplished by committees; try to get to the end of this presidential year and that we have doubled the number of sections that are contributing; the collegiality and ability to work with people from different states who do what we do. One of the things you don’t know – I came on the Board and was diagnosed with colon cancer and wound up on chemotherapy thru April 2016. When I came to the meeting in 2016, it was three weeks after my last chemo. The first person I met was Walter [Andrews]. He has remained a great encouragement to me. Michael Aylward, who would not have been such a close friend. Michael and I spent a lot of time together talking about COVID issues and pop-up topics. Chris Martin and his date at The Who at the Madison Square Gardens, where we met up with Sheri Pastor and her husband. A lot of my good feelings about the College really go beyond professional issues. It is absolutely tailor made for the kinds of things that I enjoy. Getting to meet people on a national basis doing the things that I do is just a real treat. Always be thankful for the Association because of those friendships. I am an ACCC junkie, and love running into my friends. MCC: And to close, what is your best insurance coverage advice? Mike: Hard work, detailed research would be number one. Thinking outside the box, realizing that there is a significant human element with respect to how the people who make the coverage and settlement decisions on cases. How you work with those people is outcome determinative as to whether you get the claim denied or resolved. It is not just an academic question but carries risk that affects people, the job, and the outcome. Human element touches all of the parties and people, very important to consider. One of the things of which I am proudest is that I represented a gentleman whose son’s liver was failing. He had been an alcoholic and was insured by a state run-program for people who were uninsurable. They had denied coverage, so the young man was not going to get a liver transplant, and if no liver transplant, he was going to die. We did exhaustive research, and the state plan was supposed to mirror what was available in the marketplace. We argued that its broad alcohol exclusion was not a part of standard policies and then turned to the human element. I got in contact with an organization that was running the program and had earnest talks about what their legislative mandate should have had them doing. That human element in the way they approached it – using reason and reference to the importance and emotions involved in the case - that human element was a big part of getting the transplant. That client would have died if we did not get the coverage, and we got the coverage, thank God. [1] 925 S.W.2d 696 Tex. 1996). [MCC: Gandy sued her stepfather for sexually abusing her as a child. State Farm agreed to pay counsel selected by Pearce to defend him but reserved rights. While the case was pending, Pearce pleaded nolo contendere to criminal charges and, without notice to State Farm, settled with Gandy by agreeing to a $6M judgment and assigned all claims he had against State Farm to her.] Get to Know Our New Board MembersTwo new members were elected to the ACCC Board of Regents at the College’s Annual Meeting in Chicago: John Bonnie of Atlanta and Seth Lamden of Chicago. Past president Michael Aylward provides an introduction for each of them.

John is a partner with Weinberg Wheeler Hudgins Gunn & Dial, where he heads up the firm’s Insurance Coverage Practice Group, representing insurers in coverage and bad faith litigation. A 1985 honors graduate of the University of Arizona, John received his legal training at the University of South Carolina, where he was a member of the Order of Wig and Robe. He is an active member of DRI and FDCC, and is Co-Chair (along with Jim Cooper) of the American Bar Association Section of Litigation Insurance Coverage Litigation Committee, Together with Neil Posner, he is Co-Chair of the ACCC’s Professionalism and Ethics Committee. John is ranked Band 1 Insurance - Georgia by Chambers USA; was recognized by Best Lawyers as 2021 “Lawyer of the Year” for Insurance Law in Georgia; and is co-author of New Appleman Georgia Insurance Litigation. John got involved with the ACCC because he “wanted to be a part of the organization that reflects the very best of the lawyers practicing in the insurance coverage space. ,,,I’m gratified (sometimes humbled) by the deep knowledge base of the College’s Fellows, and benefit so much from the programming and material the organization generates - in print, at annual meetings, and in the webinars presented through the year. I am new to the Board of Regents and have a lot to learn about satisfying the demands of this role in the College. However, in addition to supporting the existing initiatives of the ACCC, I would like to help translate the vast expertise of the Fellows into serving the community in some way related to insurance-issues and insurance-related information. Important details are needed to bring the idea to life, but I hope to pursue it as a member of the Board.”

Seth Lamden is a partner in the Chicago office of Blank Rome’s insurance recovery practice. For more than 20 years, Seth has focused his practice exclusively on helping policyholders understand and enforce their rights to insurance coverage. In addition to his dispute resolution practice, Seth offers strategic advice to his clients in connection with policy negotiation, drafting contractual insurance requirements, transactional due diligence, placement of deal-specific insurance policies, and maximizing insurance recovery. Seth received his undergraduate degree from Brandeis University before migrating to the Midwest to attend the University of Illinois Chicago School of Law. He is an avid photographer and likes to spend his spare time traveling, reading and listening to vinyl records. He is also a national level competitive powerlifter. Seth is the chair of the Insurance Coverage and Litigation Committee of the ABA’s Tort Trial & Insurance Practice Section and serves as the executive editor of Insurance Law Essentials, a publication of the International Risk Management Institute. Seth has been an ACCC Fellow since 2017. “I joined the ACCC because I believe strongly in its mission of promoting the creative, civil, and efficient resolution of coverage disputes, and I look forward to furthering this mission through service on the board…The ACCC stands out because its members are consistently at the forefront of cutting edge coverage issues, both in developing the law in the courts and educating the members of the commercial insurance relationship about those issues.”

Sheri Pastor, Mike Aylward, and Mike Huddleston considered “Who” was the best ACCC president at a recent rock concert at Madison Square Garden. Fellow Chris Martin (right) joined in the fun. Three Years Later: How Fares the American Law Institute’s Restatement of Law, Liability InsuranceBy Michael F. Aylward, Morrison Mahoney LLP (Boston)

On May 22, 2018, the membership of the American Law Institute voted to give final approval to the Restatement of Law, Liability Insurance. Eight years in the making, the RLLI is the first Restatement devoted solely to a single industry. Perhaps due to that focus or the difficulty of finding consensus with respect to an area of the law that differs so markedly among the fifty states, the debate over the RLLI was quite contentious and resulted in an unprecedented amount of comments from outside interests in the last few years of the project. Four years following its passage, the controversy surrounding this Restatement is far from settled. Indeed, a large number of state legislatures have taken the unusual steps of enacting statutes that caution courts not to follow this Restatement as a source of state law. At the same time, it is increasingly being cited as authority by state and federal courts, even in states whose legislatures have sought to proscribe its authority. I. The Legislative Response to the ALI Restatement Even before it was approved in 2018, this Restatement received a hostile reception from state legislators. In the weeks leading up to the 2018 Annual Meeting, the ALI received letters from several state insurance commissioners; the National Conference of Insurance Legislators and a joint letter from Governors of Iowa, Maine, Nebraska, South Carolina, Texas and Utah, all expressing the view that this Restatement ignored common law rules, will destabilize insurance markets and may necessitate legislative action. In apparent response to the perceived shortcomings of Section 3, Tennessee adopted HB 1977/SB 1862 in early 2018, requiring that “[a] policy of insurance must be interpreted fairly and reasonably, giving the language of the policy of insurance its ordinary meaning.” Shortly before the Annual Meeting in 2018, the Kentucky House voted 90-0 to approve HR 222, which called upon the ALI to make “material changes” to the RLLI or have it considered as not being a source of authority in Kentucky courts. This resolution did not receive Senate approval, however. A few weeks after the ALI’s vote to approve the RLLI, Ohio Governor John Kasich signed a public works funding bill in July (SB 239) that contained an amendment that seemed to have little to do with infrastructure funding: Sec. 3901.82. The Restatement of the Law, Liability Insurance that was approved at the 2018 annual meeting of the American law Institute does not constitute the public policy of this state and is not an appropriate subject of notice. In early 2019, Michigan enacted Section 500.3023 which declared that as of January 1, 2020: In an action brought in a court in this state, the court shall not apply a principle from the American Law Institute's ‘Restatement of the Law, Liability Insurance’ in ruling on an issue in the case unless the principle is clearly expressed in a statute of this state, the common law, or case law precedent of this state. In April 2019, Arkansas and North Dakota become the latest states to enact legislation declaring that the Restatement was not good legal authority to be cited in their courts. On April 8, Arkansas enacted Act 742, which declared that the Restatement “does not constitute the public policy of Arkansas “if the statement of the law is inconsistent or in conflict with, or otherwise not addressed by (1) a statute of the State of Arkansas; (2) the common law and statute law of England as adopted in Arkansas under Section 1-2-119 or Arkansas case law precedent.” North Dakota House Bill No. 1142 declares that “ p[a]erson may not apply, give weight to, or afford recognition to, the American Law Institute's "Restatement of the Law, Liability Insurance" as an authoritative reference regarding interpretation of North Dakota laws, rules, and principles of insurance law.” In Indiana, the legislature recently approved a concurrent resolution (HCR 568) on April 24, 2019 declaring: That the Indiana General Assembly states that the Restatement of the Law, Liability Insurance that was approved at the 2018 annual meeting of the American Law Institute does not reflect the determination of the State of Indiana's public policy, is not a faithful statement of existing law of the State of Indiana, is not an appropriate subject of notice, and should not be afforded recognition by courts as an authoritative reference regarding established rules and principles of insurance law. Similar proposals also emerged in other states, including Alaska and Texas. In Texas, the co-chair of the House Insurance Committee submitted a resolution on February 8, 2019. HR 568 would make it the policy of Texas that: The ALI ’s most recent Restatement is neither consistent with well-established insurance law nor respectful of the role of state legislators in establishing legal standards and practice for the insurance industry, and it is not worthy of recognition by the courts as an authoritative reference. These efforts are being supported by the National Conference of Insurance Legislators, which was critical of the Reporters’ efforts during the final 2017-2018 debate over the Restatement and has since lobbied their colleagues in state legislatures to limit its effect. On the eve of the originally scheduled ALI vote for final approval, the NCOIL issued a letter to the ALI on May 5, 2017, arguing that “several of the proposed Restatement’s provisions go beyond established insurance law and thus are of immediate concern because they appear to address matters which are properly within the legislative prerogative.” Following the ALI’s agreement to delay final approval for a year, NCOIL sent a further letter on November 28, 2017, following a general session at the annual meeting of NCOIL during which the Restatement reporters spoke, NCOIL leadership wrote the ALI again, arguing that the Restatement remained a misstatement of majority law in several key respects, notably Sections 3, 8, 12, 13(3), 18, 19, 27, 36, 48, 49(3), and 51(1). The letter cautioned that NCOIL was considered whether to take a role “in alerting state Chief Justices, state legislative leaders and members of the committees with jurisdiction over insurance public policy [and] state insurance regulators” that the Restatement was “in numerous places, a misstatement of the law . . . and should not be afforded recognition as an authoritative reference.” Similar legislative proposals were put forward during 2020 in Oklahoma (Senate Bill 1692), West Virginia (SB 772), Nebraska (LB884), Arizona (HB 2644), Oklahoma (SB-1692), and Florida but failed to obtain final approval and are now largely stalled as the attention of legislators shifts to the pandemic. However, on March 24, 2020, Utah Governor Gary Herbert approved House Bill 0037, which directs state judges not to follow this Restatement as it is inconsistent with the common law. By contrast, a similar bill (HB-150) was vetoed by Kentucky Governor Andy Beshear on April 14, 2020. In his veto message, Governor Beshear expressed concern that HB-150 would have violated the separation of powers doctrine by allowing the legislature to dictate to the judiciary how they should interpret treatises. The proposition that state courts are not obliged to follow provisions of Restatements that are inconsistent with their own common law is hardly novel or controversial. See Traventine Corp. v. Lexington-Silverwood, 683 N.W.2d 267, 271-72 (Minn. 2004)( “[w]e will not adopt a provision of a Restatement of the Law if our precedent is to the contrary and we believe that our precedent still reflects the proper rule of law”). The broad-based effort to apply this general principle to an entire Restatement and to do so through the political process is unprecedented, however. On the other hand, it is unclear what impact, if any, these measures may have. Indeed, the Texas Supreme Court ignored a new state statute proscribing reliance on this Restatement in a recent opinion in which it cited Section 27 in support of its holding. See In re Farmers Texas Cty. Mut. Ins. Co., 621 S.W.3d 261, 273, 275 (Tex. 2021). II. The Restatement in the Courts About a dozen decisions have been handed down to date citing this Restatement, although many reflect drafts of the text prior to the final version that was approved on May 22, 2018. --Section 1: Definitions --Section 12: Insurer’s Liability for Conduct of Appointed Defense Counsel A federal judge in South Dakota adopted the “inadequate defense” theory of liability set forth in Section 12 of the ALI Restatement of Law, Liability Insurance, declaring in Sapienza v. Liberty Mut. Fire Ins. Co., 2019 U.S. Dist. LEXIS 84973 (D.S.D. May 17, 2019), that Liberty Mutual might be liable for overriding the advice of the insured’s own chosen counsel and refusing to engage an independent expert architect or contractor to support the insured’s defense. --Section 13: Insurer’s Duty to Defend A federal district court briefly cited Section 13 in Otra, LLC v. Am. Safety Indem. Co., No. 3:20-cv-01063-SB (D. Or. Nov. 20, 2020) for the generic proposition that an insurer’s duty to defend is measured by referenced to the underlying suit. To similar effect is the Oregon Supreme Court’s citation of an early draft of Section 13 as reflecting a “four corners” rule in West Hills Development Co. v. Chartis Claims, 360 Or. 650 (2016). --Section 15: Estoppel Does an insurer’s failure, when undertaking defense of an action, to specifically reserve its right to deny coverage based on an exclusion that it has actual or constructive knowledge of result in loss of such ground for denial, without need for the insured to show prejudice, as provided in Section 15….” --Section 16: Insured’s Right to Independent Counsel --Section 18: Termination of an Insurer’s Duty to Defend A federal district court in Maine relied on Section 18 in Burka v. Garrison Prop. & Cas. Ins. Co., 521 F. Supp. 3d 97 (D. Me. 2021), declaring that an insurer’s duty to defend does not terminate until there is a final adjudication or settlement of the covered claims and that he could not resolve this issue since the docket in the underlying suit was sealed. --Section 19: Consequences of Failing to Defend Section 19’s statement that an insurer that fails to defend forfeits the right to control how an insured should have defended was cited in passing in Nationwide Mutual Fire Insurance Co. v. D.R. Horton, Inc., 2016 WL 6828206, n. 6 (S.D. Ala. Oct. 6, 2016) based on earlier versions of this Restatement. --Section 21: Recoupment Citing Section 21, a federal district court in Georgia predicted in Am. Fam. Ins. Co. v. Almassud, 522 F. Supp. 3d 1263(N.D. Ga. 2021) that Georgia would not recognize a right of recoupment. See also Continental Cas. Co. v. Winder Labs., LLC, No. 2:19-CV-00016-RWS (N.D. Ga. Apr. 20, 2021). A federal district court in Wisconsin observed in Hayes v. Wisconsin & South Railroad, 514 F.Supp.3d 1055 (E.D. Wis. 2021) that not only were courts conflicted on the issue of whether an insurer should be allowed to recoup defense costs if it was later found not to have a duty to defend but the ALI itself had taken contradictory positions, seemingly affirming a right to restitution as involving unjust enrichment in Section 35 of the Restatement of the Law of Restitution and Unjust Enrichment, while abjuring any such right in Section 27 of the RLLI. While the Hayes court adopted to follow the RLLI’s approach, A narrowly divided Nevada Supreme Court took an opposite view in Nautilus Ins. Co.. Access Medical, LLC, 482 P.3d 683 (Nev. 2021) declaring that a general liability insurer is entitled to recoup defense costs that it paid under protest in a case that it had no duty to defend. On a certified question from the Ninth Circuit, the majority declared that “when a court determines that an insurer never owed a duty to defend, the insurer expressly reserved its right to seek reimbursement in writing after defense was tendered, and the policy accepted the defense from the insurer, then the insurer is entitled to that reimbursement. Under generally applicable principals of unjust enrichment and restitution, the insurer has conferred a benefit on the policyholder; the policyholder appreciated the benefit; because it is reasonable for the insurer to accept the policyholder's demand, it is equitable to require the policyholder to pay." The majority concluded that this holding was consistent with Restatement of Restitution and found that, whereas the ALI’s new insurance restatement had reached a different conclusion, it had done so for reasons that the court disagreed with. Three justices dissented, arguing that a court should not rely on equitable principles to imply contractual terms where an express agreement existed between the parties that lacked such terms, nor was it appropriate to permit Nautilus to create a remedy through a unilateral reservation of rights that are not set forth in the agreed terms of the policy itself. A Delaware trial court, applying Tennessee law, ruled in Catlin Specialty Ins. Co. v. CBL & Assocs. Props., 2018 WL 3805868 (Del. Super. Ct. Aug. 9, 2018) that an insurer was entitled to recover defense costs it advanced under a reservation of rights for a non-covered claim. The Superior Court declined to follow Section 19, declaring that “the Restatements are mere persuasive authority until adopted by a court; they never, by mere issuance, override controlling case law. And this Restatement itself acknowledges that ‘[s]ome courts follow the contrary rule.’” --Section 24: The Duty to Make Reasonable Settlement Decisions A federal district court cited a law review discussing the Restatement as a basis for finding a lack of clear case authority concerning whether an insurer might be sued for negligently failing to settle that warranted certifying this issue to the Indiana Supreme Court in Cincinnati Ins. Co. v. Selective Ins. Co. of the Midwest, No. 18-956 (S.D. Ind. Feb. 25, 2021). Cited in In re Farmers Texas County Mut. Ins. Co., No. 19-0701 (Tex. Apr. 23, 2021) for the proposition that the insurer’s liability for damages within policy limits if it fails to settle creates an incentive to make reasonable settlement decisions. In a lengthy footnote in Owners Ins. Co. v. Dockstader, No. 19-4156 (10th Cir. June 29, 2021), the Tenth Circuit rejected an insured’s argument that Sections 24 or 25 impose a duty to insurers to settle non-covered claims and further found that if they did, that contention is contrary to settled Utah law. --Section 27: Duty to Make Reasonable Settlement Decisions --Section 29: Duty to Cooperate --Section 33: Long-Tail Claims --Section35: Notice Conditions Similarly a federal district court in Kentucky cited Section 35 in Darwin Nat. Assur. Co. v. Ky. State Univ., 2021 WL 1045716 (Ct. App. Ky. Mar. 19, 2021)in support of court’s conclusion that “claims made” reporting requirements apply without any requirement by the insurer to prove prejudice from insured’s failure to comply with policy conditions. --Section 38: Number of “Occurrences” --Sections 39 and 41 : Allocation and Exhaustion Section 39 was cited by the Washington Court of Appeals in Gull Indus., Inc. v. Granite State Ins. Co., No. 78277-1-I (Wash. Ct. App. Aug. 23, 2021) for its discussion of the meaning of “attachment points” for excess carriers in an environmental coverage dispute. --Section 48: Damages III. CONCLUSION For now, it appears that the initial surge of legislative efforts to ban courts from relying on this Restatement has slowed, if not stopped. Meanwhile, more and more courts are citing to the Restatement in their insurance coverage opinions. Many of these citations are mere supplemental authority, referencing the RLLI as being consistent with existing law in those states on relatively settled propositions such as the standard for finding a duty to defend. On the other hand, a significant number of these new cases are citing the Restatement on relatively arcane points of law—notably whether reporting provisions in “claims made” policies should be subject to the “notice-prejudice” rules that most courts have adopted for CGL notice terms. In the short term, it seems likely that this Restatement will be most influential on issues where there are not clear state precedents, such as when an insurer may terminate its defense obligations and whether or when excess insurance may be triggered. Over time, this Restatement may also gradually shift how courts addressed areas of the law that may presently seem relatively settled, especially in states where appellate judges are elected, as the principle of stare decisis is undermined by more immediate considerations. In short, while the American Law Institute has closed its book on this Restatement, the debate over its long-term future and implications for the future shape of American insurance law may have only just begun. Michael Aylward is a senior partner in the Boston office of Morrison Mahoney and a past President of the ACCC. During 2013-2018, he was among the ALI-appointed Advisors who worked on the American Law Institute’s Restatement of Law, Liability Insurance. The ESG Police Have Arrived. Is Your Insurance Ready?Authors: ACCC Fellow Robert Chesler and Dennis Artese of Anderson Kill. This article will appear in the Journal of Emerging Issues in Litigation. The authors retain copyright and republication rights.

Robert Chesler I. Government Agencies are Cracking Down on Greenwashing This past May, the Securities and Exchange Commission (“SEC”) fined the investment management arm of a major U.S. bank $1.5 million for ESG violations. Specifically, according to an SEC statement, the SEC order found that the investment advisor “did not always perform the ESG quality review that it disclosed using as part of its investment selection process for certain mutual funds it advised.” This enforcement action follows upon the SEC’s lawsuit against Vale, the Brazilian mining company whose dam collapse killed 270 people and resulted in an estimated $4 billion in damages. Among other things, the SEC alleged that Vale misled the government and investors through its ESG disclosures. Further, the SEC is proposing rules for investment funds that label themselves as green. It is estimated that 800 such funds exist, controlling $3 trillion in investments. The SEC is proposing that such funds be required to explain the basis for their assertion that they are ESG conscious in their investments. Concern over ESG greenwashing claims is not limited to the United States. In Germany, the Frankfurt public prosecutor, the German securities regulator, and the federal criminal police raided the offices of Deutsche Bank and its asset management subsidiary over greenwashing claims. The authorities expressed concern over fraudulent marketing of purportedly sustainable investment funds. ESG – standing for Environmental, Social and Governance – has become a major initiative for corporate America. In particular, the environmental prong of ESG calls for companies to institute sustainability goals and to invest in environmentally friendly companies. This emphasis has both economic and popular support. Environmental sustainability will make companies more able to compete and make their businesses less risky. Indeed, some insurance companies are offering better insurance policies to those companies that demonstrate a commitment to ESG. One leading insurance broker offers an independent ESG review of companies that then receive preferred terms on their D&O policies if they meet certain standards. Insurance companies are beginning to ask questions about ESG compliance as part of the application and procurement process. Moreover, green is popular with investors and shareholders as a good in and of itself. Climate change and its risks have entered popular consciousness. People want the companies in which they invest to be on the right side of the climate crisis. Companies and funds that style themselves as green and ESG compliant believe that they can attract more investors. ESG, though, is not without its risks. Companies can be too apt to label themselves as green or sustainable, and investment advisors may be too quick to accept those labels without scrutiny. This may have been the case with the sanctioned investment advisor, which may have been negligent in not checking out the ESG claims of its investment vehicles. In some cases, companies may engage in such “greenwashing” activities and proclamations with the intent to deceive investors and shareholders – or so may shareholders or regulators allege. It is easy to see how all levels of ESG liability incurred by companies will result in claims against officers and directors. The question then becomes, do companies have insurance coverage for greenwashing liability? The answer in many cases will be “yes.” II. D&O Insurance for Greenwashing and Other ESG-Related Claims A. Notice Issues One coverage trap for companies involved in ESG claims stems from the fact that directors and officers (“D&O”) liability insurance policies are claims-made – the insurance policy in effect when the company receives the claim is responsible, regardless of when the violation occurs. That raises the question: what exactly constitutes a claim? D&O policies define the term “claim” broadly; a claim can be far more than just a complaint filed in civil lawsuit. A typical claim definition will include “any demand for monetary or non-monetary relief.” A company that receives an actual complaint typically knows that it needs to give notice to its insurance companies. However, an SEC proceeding can be long and drawn out, commencing with a letter, without a formal complaint ever being filed. Companies should give notice to their D&O insurance companies upon receipt of the first notice from the SEC, regardless of how informal it may seem. As to general liability policies, in a majority of jurisdictions, late notice of a claim will only result in a forfeiture of coverage if the insurance company can prove that it has incurred prejudice as a result of the delay in providing notice. This measure of legal protection can lull companies into a false sense of security concerning notice. Claims-made policies, such as D&O policies, are completely different from occurrence-based policies as regards notice. Providing notice outside of the policy period will result in the forfeiture of coverage in every jurisdiction. Providing notice of anything that even smells like a claim must have the highest priority. Alpine Home Inspections, LLC v. Underwriters at Lloyds, 2008 WL 4963578 (N.J. App. Div. 2008) is an example of how harsh the effects of late notice can be. There, the policyholder received a claim for $3,300, which it did not report to its insurance company because it was within the deductible. After renewing its insurance policy with the same insurance company, Alpine received an increased demand of $300,000, for which it did provide notice. The insurance company denied coverage contending that notice was late. The appellate court agreed with the insurance company, finding that the policyholder had a duty to provide notice of the demand for $3,300, and its failure to report that claim during the policy period in which it was received foreclosed coverage. If there is any question as to whether an SEC inquiry or other communication concerning ESG compliance rises to the level of a “claim” requiring official reporting under a D&O policy, it is often best practice for policyholders to provide their D&O insurance company with a “notice of circumstance,” explaining in detail the facts of which they are aware that may give rise to a claim in the future. The effect of providing such a notice of circumstance is to anchor a future claim in the policy period in which the notice of circumstance is given. While providing notice of circumstance is discretionary, it could be beneficial in at least two respects. First, by anchoring the future claim in the policy period in which the notice of circumstance is given, it protects the policy limits of future policies. Second, given the increased attention to ESG claims, some insurers may start to limit or even exclude coverage for such claims. Indeed, there is discussion in the insurance industry press about amending the D&O policy to add a climate change exclusion. Thus, providing a notice of circumstance will have the effect of anchoring a future claim concerning ESG liability under a policy that may provide broader coverage than a later-issued policy in effect when the claim is actually asserted. B. Conduct Exclusions D&O policies also typically contain so-called “conduct exclusions,” which bar coverage for fraudulent or intentionally wrongful conduct. In most D&O policies, however, these conduct exclusions apply only if there is a final judgment of wrongful conduct against the insured. Typically, an SEC claim will resolve itself before such a final adjudication comes to pass. Indeed, in order to preserve insurance coverage against a risk of a negative final adjudication, companies and their directors and officers will often purposefully seek to settle a contested claim if they can do so while neither admitting nor denying guilt. C. Pollution Exclusions Companies can also expect their insurance companies to invoke the pollution exclusion as a hurdle to coverage against claims alleging ESG failures. D&O policies typically include broad exclusions for pollution, and many ESG-related actions against companies concern pollutants at their core. Policyholders, however, may well be able to overcome this hurdle. A leading insurance case concerned a shareholder action against directors and officers over allegations that they understated the company’s environmental exposure. The insurance company denied coverage on the basis of a broad pollution exclusion. The court held that the proximate cause of the loss was the misrepresentation and not the pollution, and found coverage. See Sealed Air Corp. v. Royal Indem. Co., 404 N.J. Super. 363 (App. Div. 2008). The holding in Sealed Air has not been tested in other jurisdictions. Rules on causation differ significantly among states. Pollution exclusions remain a major coverage issue for companies confronted with ESG claims. Moreover, as mentioned above, there is discussion in the insurance industry press about amending the D&O policy to add a climate change exclusion. It is not known what such an exclusion might look like, how broad it will be, and whether it can avoid ambiguity. A climate change exclusion in D&O policies will undoubtedly give rise to a tidal wave of coverage litigation challenging its effectiveness. D. Civil Fines and Penalties Finally, depending on your company’s policy language, coverage may or may not be available for civil fines and penalties asserted in a government action. Many D&O policies used to specifically exclude civil fines and penalties within the definition of covered “loss.” While more recent D&O policies typically provide coverage for civil fines or penalties, some policies may place limitations on such coverage. For example, they will cover civil fines and penalties if based on unintentional conduct, or they will cover all fines and penalties if insurable under applicable law. Other more recent D&O policies will at least agree to reimburse defense costs in connection with claims seeking civil fines and penalties, even if they exclude fines and penalties from their definition of “loss.” Issues may also arise over whether a payment to the SEC constitutes a “penalty.” In J.P. Morgan v. Vigilant Insurance Co., the policyholder made a payment of $140,000,000 to the SEC, representing disgorged profits. The insurance company denied coverage for the payment, alleging that it was an excluded penalty, and suit ensued in New York. The trial court ruled in favor of the policyholder, finding that the payment was not an excluded penalty; however, the appellate court reversed. The New York Court of Appeals then reversed the appellate court’s decision, finding that the payment was not a penalty imposed by law. This issue of what constitutes a fine or penalty for coverage purposes is highly fact sensitive, and law on the issue differs among jurisdictions. III. Conclusion With the March 2021 creation of a Climate and ESG Task Force within the SEC's enforcement division and general increase in attention to ESG issues, heightened scrutiny related to ESG investing is expected, along with a corresponding increase in SEC enforcement actions and private litigations. Companies and their directors and officers should look to their D&O insurance for defense and indemnity coverage against such claims, and consult with experienced insurance coverage counsel at the first indication of a claim. Robert D. Chesler is a shareholder in Anderson Kill's New Jersey office and is a member of the firm's Cyber Insurance Recovery Group. Bob represents policyholders in a broad variety of coverage claims against their insurers and advises companies with respect to their insurance programs. Dennis J. Artese is a shareholder in Anderson Kill's New York office and chairs the firm's Climate Change and Disaster Recovery Group. Annual Conference Wrap Up

Almost 150 Fellows and supporting sponsors attended our 10th Annual Meeting at the InterContinental Chicago in May. On the heels of a virtual conference (2020) and delayed conference (2021), it was great to return to our traditional spring gathering.

The conference planning committee was led by co-chairs Laura Hanson, Meagher & Geer, PLLP, and Tracy Saxe, Saxe Doernberger & Vita, P.C. and co-vice chairs, KT Talieh, Hunton Andrews Kurth and Mary Borja, Wiley Rein LLP. Each year, the committee starts planning this event soon after the prior one adjourns. The program content is carefully curated to ensure we present diverse, relevant, and timely sessions.

The conference was kicked off with video remarks from Tom Segalla, a founder of the College and its first President. In addition to education sessions, the conference included a dinner where new Fellows and award recipients were recognized. At the dinner, College President Wayne Taylor presented Steve Pate, with a plaque naming him as the College’s honorary historian, in recognition of his efforts to write The First 10 Years, a history of the College. Ned Currie, one of the Founders, spoke at the dinner, sharing stories of the formation of the College. Steve also prepared a history quiz for attendees; Bill Lewis of Butler Weihmuller Katz Craig LLP was the winner with the most correct questions (including identifying the ACCC member who is Elvis Presley’s fifth cousin!)

Our conference committee, along with members of the Communications committee, have summarized the panel discussions from the conference. Conference attendees can view the papers and presentations behind the members only log in. Still want more content? Mark your calendar to join us for our 11th Annual Conference, May 10-12, 2023. We will be returning to the InterContinental Chicago.

Novel Issues and Emerging Trends in Bad Faith Litigation

Summarized by Mary Borja, Wiley Rein LLP

Rick Hammond, Insurance Claims and Litigation Consultants, LLC; Bryan Weiss, Selman Breitman LLP; Angela Elbert, Neal Gerber & Eisenberg LLP; and Jason Mazer, Cimo Mazer Mark Law Group, discussed the minority of jurisdictions that recognize liability for bad faith, even in the absence of a breach of contract. The panel reported that these jurisdictions include Washington State, New Mexico, Arizona, Ohio, and (in some form) Hawaii. The presentation also discussed the potential for bifurcating bad faith from the coverage determination, both in discovery and trial, or for trial only. While some suggested that the bad faith and coverage issues might be too inextricably intertwined to be bifurcated, an attendee at the presentation suggested that a motion to “phase” the issues might be more successful than a motion to “bifurcate.” Finally, the panel discussed litigation immunity and the potential for liability for alleged bad faith either after denial or during the coverage action.

Second-Level Scrutiny: How Have Appellate Courts Handled COVID-19 Business Interruption Appeals

Summarized by Deb Varner, Varner & Van Volkenburg, PLLC

Michael Levine, Hunton Andrews Kurth, and Chris Mosley, Foley Hoag teamed up on the policyholder side to take on John Mumford, Hancock, Daniel & Johnson, P.C. of the insurer side to address “Second Level Scrutiny: How Have Appellate Courts Handled COVID-19 Business Interruption Appeals.” While reference was repeatedly made to the “scorecard” for the rulings of both federal and state courts on the coverage front, the opening discussion of the presentation centered on identifying the issues in COVID-19 litigation that are being presented to the various courts, including the meaning of “direct physical loss”, as well as the meaning of “damage”. With audience questions and comments, the later part of the presentation focused on the arguments currently being made by both policyholder counsel and insurer counsel in current litigation. In conclusion, the panelists presented tips for arguments on both sides of the v in the continuing COVID-19 litigation arena.

Hot Topics in D&O Insurance

Barry Buchman, Haynes Boone, and James Skarzynski, Skarzynski Marick LLP, discussed “bump-up” coverage disputes; trends in securities class action litigation, explosion of derivative settlements, and related coverage issues. They also devoted some time to reviewing recent developments in SPAC litigation and related coverage issues and coverage for governmental investigations.

The Right to Choose: When Can the Policyholder Pick its Own Lawyer and How Much Does the Insurer Have to Pay?

Summarized by KT Talieh, Hunton Andrews Kurth, LLP

This panel (Suzan Charlton, Covington & Burling LLP, Rina Carmel, Anderson McPharlin & Conner LLP, and Jim Cooper, Reed Smith LLP) discussed issues concerning policyholders’ right to independent counsel and the insurers’ obligation to pay the costs associated with that independent counsel. First, the panel addressed the circumstances under which a policyholder would be entitled to pick its own counsel (i.e., conflicts, reservation of rights letters). Second, the panel addressed how much the insurer had to pay for that independent counsel addressing issues of reasonableness of defense costs as well as insurers’ billing guidelines. The panel next provided several case studies concerning excessive billings and reasonableness of defense costs for independent counsel. The panel concluded its presentation by providing a number of practice pointers for both policyholders and the insurers to address issues that may come up in the context of independent counsel.

Winning and Losing Strategies Litigating the Duty to Defend

Summarized by Laura Hanson, Meagher & Geer, PLLP

This compelling panel had the special privilege of a federal judge to discuss these important strategy issues. The Honorable Manish Shah of the United States District Court for the Northern District of Illinois provided insight from the bench on the strategy of litigating the duty to defend. The carrier side attorney (Alex Potente, Clyde & Co LLP) and the policyholder side attorney (Ray Sheen, Farella Braun + Martel LLP) discussed the issues they consider in deciding whether to sue, and whether to make a motion on the duty to defend. Judge Shah discussed the effective and ineffective tactics he sees on the bench on this type of motion.

The Scope and Limits of Discovery in Arbitration

Summarized by Robert Allen, The Allen Law Group

Cliff Shapiro of Shapiro Dispute Resolution, ACCC Past President Sheri Pastor of McCarter & English, and David Schoenfeld of Shook, Hardy & Bacon discussed many of the discovery issues that arise in the context of insurance coverage arbitrations. Discovery issues arise in a wide variety of contexts because the arbitration rules, for the most part, do not pertain to discovery and the arbitration rules on discovery that do exist, usually focus on efficiency, reduced costs and proportionality.

While Arbitrators possess broad discretion; different arbitration societies have different approaches to discovery. For example, pursuant to the JAMS rules, electronically stored information produced need only be produced in the ordinary course of business. Thus, there is no need to include metadata and parties do not need to search back up servers.

Another arbitration nuance is that Fed Arb Act §7 allows arbitrators to summon witnesses to bring documents to a hearing, however, the arbitrators cannot enforce it—parties have to go to court for relief if a party fails to comply with the summons. Also, the applicable court is where the arbitration is located, as opposed to where the witness is located. Additionally, most courts do not enforce arbitral subpoenas for pre-trial discovery with the 8th Circuit being an outlier.

Common areas of dispute include reserves, reinsurance and discovery for bad faith claims. Third Party discovery can be particularly tricky with cooperation being the key. Accordingly, parties need to look for opportunities to engage third parties to cooperate with them in providing discovery.

Navigating Insurer Insolvency: When an Insurer’s Insolvency Hands You a Lemon, Make Lemonade

Summarized by Michael Aylward, Morrison Mahoney LLP

Day One of the conference concluded with a panel presentation on “Navigating Insurer Insolvencies” featuring Kim Winter (Lathrop GPM LLP), Ned Currie (Currie, Johnson & Myers, P.A.) and Nicholas Sochurek (KCIC). Kim observed at the outset that insolvency proceedings are utterly different from the federal bankruptcy system and are solely governed by state law and regulation. They begin when insurers are placed into receivership at which point a state court may oversee the insurer’s rehabilitation or may ultimately order that it being liquidated if allowing insurer to remain in business would be hazardous to creditors, policyholders or the general public. Liquidation has the effect of terminating all policies issued by the insolvent insurer and limiting an insured’s right to losses that had occurred prior to the date of termination. In the event of liquidation, all creditors must file a proof of claim that will be satisfied in whole or in part depending on the assets of the Estate. Alternatively, an insured may seek relief from State Guarantee Funds, although most state Funds contain caps on recovery, require that all other insurance first be exhausted and may preclude the participation of large corporate insureds. Ned commented that courts have historically precluded insureds from pursuing “cut-through” claims against the reinsurers of insolvent insurers, although some state Guaranty Fund statutes now require that such claims be allowed. Nicholas expressed concern that some states, including New Jersey and South Carolina, are requiring brokers to investigate the financial solvency of insurers before placing coverage, which may give rise to significant E&O claims in the future.

Do You Really Know What Hat You’re Wearing? Identifying & Protecting Against Ethics Faux Pas and (Gasp!) The Loss of Privilege Disputes (2.0)

Summarized by Andrew B. Downs, Bullivant Houser Bailey PC

This year’s ethics program was a continuation of the program from the 2021 Annual Meeting. Neil Posner (Much Shelist, PC), Rikke Dierssen-Morice (Maslon), Deb Varner (Varner & Van Volkenburg, PLLC) and Minnesota Judge Jerome Abrams presented. The focus of the program was on attorney disqualification, with some additional discussion of the attorney as adjuster topic.

The attorney as adjuster segment included discussion of a Colorado decision in which the court treated the insurer’s attorney’s work up to a certain point as being claims adjusting to which no work product doctrine attached, with the work product protection applying only to activities after the point where the attorney’s work became legal representation.

The majority of the program addressed attorney disqualification. The judge commented that motions to disqualify are very disruptive and should not be used as a tactical tool – courts look with disfavor on those which they perceive as tactical tools. He pointed out that lawyers spend insufficient time looking at the preamble to Model Rule 1.9 and in particular paragraph 20 – violation of an ethical rule should not itself give rise to a cause of action against the attorney, nor create a presumption that a legal duty has been breached or that disqualification is appropriate.

There was substantial discussion of what happens when a lawyer switches sides – typically from representing insurers to representing policyholders. The standard is material adverseness – the passage of time does not necessarily cure any conflict, rather the focus is on what the attorney knows and how it relates to the particular case. The more specific and material to the present case(s) the prior representation was, the more likely counsel will be disqualified.

NFTs: What Are They, What Goes Wrong, and Are They Insured?

Summarized by Christine Haskett, Covington & Burling LLP

This panel (featuring Christine Haskett and John Bonnie, Weinberg Wheeler Hudgins Gunn & Dial) began with an explanation of the technology behind and the potential uses of NFTs (Non-Fungible Tokens). The panel explained that NFTs are unique digital proofs of ownership that exist on the blockchain and that can be used to demonstrate ownership of either digital or non-digital (i.e., "real world") assets. Next, there was a discussion of some of the NFTs that have made the news recently (the Bored Ape Yacht Club, Beeple, Jack Dorsey's first tweet, NBA Top Shot, etc.), as a means of explaining the different types of NFTs, as well as their volatility. The panel then turned to the potential for NFT-related losses and whether those losses are likely to be covered by insurance. Although there are currently no cases involving insurance for NFT-related losses, at least some types of traditional policies (both first-party and third-party) could be construed to provide coverage, particularly if they already include coverage for electronic data or systems. However, coverage may be excluded by traditional currency exclusions. Although NFTs should not be considered currency because they are not fungible, it is an open question whether they might fall within the category of excluded securities. Finally, the panel touched on new types of risk-sharing ventures that are cropping up to cover NFTs, such as mutuals.

Floods, Fires, Hurricanes: Emerging Issues in Climate Change Insurance Coverage

Climate change is producing natural disasters that raise new insurance coverage issues under first party property insurance policies. Robert Chesler, Anderson Kill, Laura A. Foggan, Crowell & Moring LLP, and Scott DeVries, Hunton Andrews Kurth, discussed how insurance companies are responding to this trend by adding new restrictions and exclusions to their policies. Laura addressed the physical, transition, and liability risks associated with climate-related losses. Insurers are under significant pressure to lead on this issue. As a result, insurers have substantially divested from coal and pledged to reduce oil and gas underwriting. Robert discussed the impact on D&O insurance, citing recent cases where directors and officers were sued for failing to prepare for net zero emissions pursuant to the Paris Accords and for misrepresenting compliance with environmental laws. Scott noted that actions taken before wildfire strikes can affect the scope of recovery and facilitate the claims process. He also discussed coverage for smoke damage as a result of wildfires.

Segalla Award WinnersThe Thomas F. Segalla Service Award recognizes dedication and service to the College. Award recipients must demonstrate Creativity, Visibility, and Persistence, three characteristics that embody Tom Segalla’s approach to his practice, volunteerism, and leadership in the practice of law. Recipients must be members in good standing at the time of the award. There are two recipients each year: one who represents insurance companies and one who represents policyholders or plaintiffs in insurance coverage and extracontractual matters. The selection committee for this year’s award included Tom Segalla, Deb Varner, Marialuisa Gallozzi, John Bonnie, and KT Talieh.

The policyholder recipient was Chris Mosley of Foley Hoag LLP (Denver, CO) Chris was recognized for his significant contributions to the College. A member since 2014 and a current member of the Board, Mosley is reliability and always willing to assist and contribute when needed. He shares his expertise as a frequent speaker at the ACCC conference and has co-chaired the Law School Symposium Committee and the Blockchain and Virtual Currencies Committee.

The insurer recipient was Robert Allen of The Allen Law Group (Dallas, TX), Bob, an insurer attorney, was recognized for his work as co-chair of the Bad Faith and Extra-contractual Committee. As such, he spearheads that committee’s activities, including quarterly meetings and well-attended pop-up calls on cutting issues. Allen is one of the longest serving members of the College’s Membership Committee. With perfect attendance for committee meetings, he routinely provides a wealth of rich and substantive information on the candidates that he is vetting. He has been instrumental in expanding the College’s membership with qualified candidates -- always with a keen eye towards issues of importance to the College such as diversity and growth in jurisdictions where the College does not have a significant number of Fellows. Allen has been an active Fellow since 2014, is a current Board member, and serves on the Communications Committee. Member News

Chris Mosley joined Foley Hoag in April, opening the firm’s Denver office. Mosley was also named the Policyholder Coverage Lawyer of the Year by Colorado Law Week. The designation comes out annually and was Mosley’s second honor. Mosely specializes in representing corporate policyholders. He also advises companies on various risk management issues, including the development of complex insurance programs and assistance in due diligence and other activities related to M&A and similar activity. Throughout his career, he has helped businesses recover more than $150 million from insurance companies.

Alycen Moss has been promoted to Co-Vice Chair of Cozen O’Connor Global Insurance Department. Moss is also Co-Chair of the firm’s Property Insurance Group. Moss, who serves as managing partner of Cozen O’Connor’s Atlanta office, concentrates her practice in civil litigation, and has extensive experience with matters pertaining to property and casualty insurance, transportation matters, and mass and complex torts. As Co-Chair of the Property Insurance Group at Cozen O’Connor, Moss regularly advises property and casualty carriers on various coverage issues and defends carriers in lawsuits brought by insureds. She also handles life, health, disability, and commercial general liability claims. Moss has litigated numerous coverage issues, including bad faith, extracontractual damages, and deceptive trade practices claims. Moss was also recently named the Claims and Litigation Management Alliance’s Litigation Management Professional of the Year. The award recognizes her demonstrated passion for the profession and the CLM community; collaboration with and education, inclusion, and development of one’s peers and community; contribution to organizational success through strong practices or development of a transformative process; and active involvement with claims or litigation management organizations outside one’s own firm. Do you have news to share? We’ll publish news of achievements, firm changes, awards, wins, etc. If you are quoted or published, send that as well. We are looking for content about our members to include in Member News, Article of the Month, and social media posts. Send your information to [email protected]. Call For VolunteersWant to become more involved in the ACCC? Join a committee! We are actively seeking volunteers to join our committees: ADR CGL/Excess Liability Insurance Communications Cyber Insurance and Computer Crime D&O and Management Liability Emerging Risks Extracontractual and Bad-Faith Claims Litigation First-Party Insurance Outreach Professional Liability Professionalism and Ethics Regional Meetings Click here to volunteer. Nominate a FellowThe Membership Committee routinely vets prospective Fellows of the College. In order to maintain the prestige of membership, the only entry to the College is through a referral from a current member (someone who is NOT at the same firm as the nominee). We are seeking nominations of qualified candidates who practice law in the U.S. and Canada. The Board of Regents recently approved the consideration of candidates from Bermuda as well. Qualified candidates are lawyers engaged in the private practice of law, with a concentration primarily in the fields of insurance coverage, bad faith and/or extracontractual claims, licensed to practice law in the highest court of their respective states, and who have engaged substantially in the practice of insurance law for at least 15 consecutive years. Time spent as a judge or law clerk may be considered in determining whether the 15-year requirement has been satisfied. Nominations can be sent to [email protected]. Please include the nominees name, basic contact information, and link to their firm bio. The Membership Committee will conduct an initial vetting, including contacting other Fellows for references, and will then send an application to the candidate as a next step. If a candidate is nominated and does not progress to the application stage, the nominator will be informed. Welcome New Fellows!William A. Bulfer Lara Degenhart Cassidy John T. Harding Richard Milone Marshall M. Redmon Seth Row David J. Schubert Micah E. Skidmore Michael J. Smith Jodi Spencer Evan Stephenson Donald J. Verfurth |