January 2020 NewsletterPresident's MessageDear Fellows: As I write this report, the snow is falling outside, a stockpot is burbling on the stove with the promise of chicken soup to come, and our basement is a chaotic mess of Christmas ornaments, cards, and wrapping paper that needs to be sorted and put away until next year. As we turn the calendar page to 2020, I am pleased to report that our College is thriving. We now have over 300 Fellows and more continue to added through the hard work of our Membership Committee, led by Lisa Pake and Koorosh Talieh. The public profile of our College also continues to grow through the efforts of our PR consultant, Judy Rakowsky. ACCC Fellows have been quoted in several recent Law360 articles discussing major new insurance law decisions. The 2020 Annual Meeting Committee is also putting the finishing touches on plans for our gathering in Chicago next May. Special thanks to 2020 meeting co-chairs Angela Elbert and Rob Kole and our Secretary-Treasurer Wayne Taylor for their hard work in putting this event together. Boxes of candy and suntan lotion are also now on their way to Doug McIntosh and Hugh Lumpkin for organizing our most outstanding law symposium ever. Dozens of ACCC Fellows from around the country joined with local lawyers, judges, law students, and faculty for a full day of CLE panels and conversation at the Nova Southeastern University in Fort Lauderdale on November 1. In addition to numerous excellent bad faith panels, there was a provocative program on climate change that Troy Froderman, Mike Huddleston, and Neil Rambin organized in conjunction with representatives of the American College of Environmental Lawyers (ACOEL). We look forward to future opportunities to partner with the ACOEL and other sister organizations. Finally, special kudos go out to Marialuisa Gallozzi, whose ADR committee presented a terrific program on mediating bad faith disputes. A bowl of eggnog and a wassail to all the ACCC Fellows who participated in our monthly pop up calls this Fall. In September, Blank Rome’s James Murray and “Tiger” Joyce of the American Tort Reform Association led a discussion of the insurance coverage implications of the trends towards relaxed limitations period for sexual assault claims. In October, Walter Andrews led us through the labyrinthine maze of ransomware claims. November brought us a panel discussion about independent counsel by Mike Huddleston, Mike Marick and “Mike” (Marty) Pentz. We concluded the year with a discussion of the Illinois Supreme Court’s new decision on discovery of privileged defense records with presentations by Karen Dixon, John Vishneski, and Scott Seaman. We have consistently had several dozen Fellows joining these calls for spirited and candid discussions that exemplify our College’s goal to serve as a thought leader in the world of insurance and extracontractual claims. Other aspects of Strategic Planning are moving forward under the leadership of our President-Elect, Sheri Pastor, including training programs for judges and mediators. Our Annual Law School Writing Competition is now underway. As I reported earlier, we completely re-wrote the problem this year and have expanded the list of law schools and professors that received notice of the competition. The premise of this year’s competition is a hypothetical set of law suits that might have been filed in the aftermath of the death of Romeo and Juliet. The problem asks law students to advise insurers or policyholder clients on issues such as whether these were one or more “occurrences,” was Friar Lawrence’s bone-headed scheme to fake Juliet’s death by telling her to take Nightshade was a covered “professional service” or one that was subject to a “controlled substance” exclusion. Written materials were recently mailed to dozens of law schools and professors that teach insurance around the country, inviting their students to participate. We will begin reviewing submissions in March and will announce the three winners at our banquet dinner in Chicago in May. In preparation for our May 2020 meeting, we have also formed a Nominating Committee to review applications to serve on our Board of Regents. If you are interested in taking on a leadership role in the ACCC, please contact our Immediate Past President Mary McCutcheon, who is chairing this year’s Nominating Committee. We are also working with our substantive law committees to add membership and develop projects and content that will encourage our Fellows to get more involved in their work. If you are not already active in a committee, please go to the ACCC website and click on the Committees page, where you’ll find information about each of our committees and contact information for committee chairs. These are excellent opportunities for raising your profile within the ACCC and finding opportunities to create projects in cooperation with other lawyers who share your interests but may or may not agree with your view of the law. Finally, let me express my thanks to the Committee Chairs, ACCC Board members, and my Fellow Officers, without whose dedication and hard work, none of this could be possible. We are also aided immeasurably by the efforts of our Executive Director Carol Montoya and her associate Pearl Ford-Fyffe, who keep the ship of state sailing on a true course. Best wishes to you all for the coming holiday season and a happy 2020. Michael F. Aylward

The Claims Apocalypse That Wasn’t: Y2k RememberedAs the final weeks of the 20th Century ticked by, people throughout the word confronted two existential crises: Were we supposed to “party like it’s 1999” at the end of that year or did the new millennium actually start on January 1, 2001? And, more consequentially, would modern civilization revert to the Dark Ages on New Year’s Eve when computers malfunctioned because of the “Millennium Bug.” Owing to the cost of data memory in the 1960s, computer programmers used a two digit code to designate years. Thus, 1998 became “98.” Although the growing memory capacity of computers soon took care of the cost issue, no effort was made to go back and recode the old mainframe computers and numerous software applications and products that had been developed in the interim. The Y2K problem was complicated by the fact that modern computer networks are often based on a series of overlapping applications and systems that have been integrated one layer on top of another over the years making it difficult to identify the specific origin of the codes and programs. Apart from the issue of computer software, Y2K problems were also presented by embedded computer microchips that provide programming instructions for machinery and appliances. Unlike computer software, which can be recoded, however laboriously, embedded chips had to be manually removed and replaced to render the device “Y2K compliant.” Unless this was done, noncompliant chips would cause the devices in which they are installed to fail or, perhaps more seriously, could have operated erratically in a manner that may not be detected immediately. In the months leading up to 2000, businesses scrambled to fix their systems. At an estimated cost of a dollar per line of computer code, the cost of rewriting software programs for major corporations ran into the hundreds of millions of dollars. Citigroup alone spent nearly a $1 billion. At the same time, insurers circled the wagons, girding for a feared claims catastrophe as the lights went out all over the world. Special claim units were deployed, underwriters puzzled over possible new Y2K exclusions, and coverage lawyers were in demand as never before. January 1, 2000 came and went without major incident. As the New York Times editorialized two days later, “In a welcome anticlimax to two years of dire warnings, the new millennium arrived over the weekend without a computer-driven meltdown of the globe’s electronic infrastructure.” Y2K lived on in the courts for several years, mainly in the form of disputes concerning the applicability of “sue and labor” clauses in commercial property insurance policies. By the end of the decade, however, Y2K was remembered, if at all, as an overhyped problem that probably never existed in the first place. But was it? On the 20th of Y2K, we gathered together some of the ACCC Fellows who played a leading role in the controversy. Here are their recollections of those times: Walter Andrews

The insurance industry was deathly afraid of Y2K and actually thought it could put many carriers out of business if the parade of “horribles” actually occurred. That led the insurance industry to encourage its policyholders to take whatever action was necessary to avoid any exposure and policyholders responded by making the changes necessary to, in fact, avoid any actual exposures. But we didn’t know for sure that would be the case and many of use stayed up late on December 31, 1999, making sure that there were no issues and being ready to “deploy” rapidly if there were. The consequence of spending all of that money on the IT “fix” to avoid any exposure drove dozens of policyholders to file “sue and labor” claims in an attempt to get that money from their insurers. I recall handling 28 such cases for carriers. The only decisions that were issued by courts favored the insurers and the other cases were all dropped. So, there was some litigation, but nothing of the scale that the insurers feared. I would not say it was “much ado about nothing,” but the fear may actually have done a great thing - - it meant that everyone was ready so there were no significant losses. Michael Aylward

My wife and I were in London that New Year’s. Given the forecast of impending disaster, we took a lot of cash and American Express checks (remember those), since credit cards and bank accounts were sure to be frozen. I remember calling friends in the states who were forbidden by clients to leave their offices that evening or have a drink so that they could be on duty if systems started crashing. To our surprise (and relief), the world seemed pretty much unchanged on New Year’s Day. I was scheduled to give a lecture on Y2K claims at a DRI seminar in Florida the following month, however, so all week I went to the British Library in the morning and scoured international newspapers, looking for reports of the digital catastrophe that had been forecast for months. By the end of the week, all that I had was one ATM machine that malfunctioned in New Delhi and an Indiana prisoner who was accidentally released early. There were some recriminations later about how over-hyped Y2K had been but the threat was real and I’m convinced that the effort that corporations put into upgrading their computer systems was a real boon to business in the following years. Jill Berkley

For those of us who practiced before computers and email were introduced into the workplace (roughly before 1983 for me), the reality that the original IT programmers got it wrong when they only used two digits for a date format did not seem that far-fetched. The “fact” that this was supposed to blow up the world on December 31, 1999 was harder to accept. But, believe we did, and the insurance coverage world was no exception to the frenzy that occurred during 1998-1999. What I remember most, however, is the sense that we had to fit a square peg in a round hole in order to anticipate what it would mean for determining coverage for Y2K claims. The skills that this analysis required, beyond just the competence and expertise for interpreting insurance policies, was a certain creativity of view, the “thinking outside the box.” The legal insurance coverage community stepped up to the plate, having no dearth of great thinkers and bold adventurers. What I remember vividly are the articles and conferences that sprang up, putting together advocates from all parts of the insurance world: policyholders, insurers, brokers, underwriters, and claims personnel. For the CGL Reporter, I created a new section “999,” and solicited an article from one of my great mentors and friends, Ben Love. It was published in the Fall 1998, “Year 2000: A Road Map To CGL Coverage Issues.” There was actually one reported case, albeit in Canada, that held the insured was not entitled to recover under an all-risk policy for the costs associated with the prevention of Y2K computer issues. A group of us was engaged by Mealey’s Conferences to travel to several different venues to make presentations on first party, general liability, business interruption, and professional liability. One of the best conference meals I ever had was at the Pasadena Ritz Carlton, waiting for my red-eye flight back to Chicago, when I had the tasting menu with wine pairing. Nevertheless, the world did not end, and the coverage community went back to business as usual, prepared to tackle whatever the next disaster would manifest. John Buchanan

The Y2K issue was a welcome intellectual detour from the asbestos and environmental coverage issues we had already been debating for the better part of two decades by the late 1990’s. In fact, Y2K was probably the impetus for this unscientific liberal arts major to start thinking about how digital technology had started to pervade our lives, and (the fun part) how it could go all wrong. In that sense the Y2K detour launched some of us down the road to working with cyber breaches, Internet of Things disasters, social engineering fraud, ransomware, the risks of Autonomous Vehicles, AI and Smart Cities, and other techy topics of fascination for insurance nerds. The principal arguments for Y2K mitigation coverage rested on our policyholder clients’ “Sue and Labour” clauses (I preferred the original English spelling). There was something charming about a mitigation clause drafted in the Seventeenth Century that could retain its vitality for risks arising on the cusp of the third millennium. Less charming was the reality that not all mitigation clauses were created equal—nor were all policyholders’ Y2K mitigation fact patterns. I particularly recall a dog and pony show we were asked to put on for a prospective Y2K client whose policies and facts appeared less than equal to the task. As is my unfortunate habit, I called it as I saw it. I explained among other things how their Sue and Labor-ish mitigation clause lacked critical words like “imminent loss”, and why their facts might also prove a challenge. Needless to say, we didn’t get the gig. Some months later I saw in Mealey’s that another firm was representing that policyholder in a newly filed coverage case. For months and perhaps years thereafter I read occasional reports of unfortunate developments in the case, culminating in a final ruling that put it out of its misery. For the sake of that would-be client, I hope the other firm took it on a contingency. Not that Y2K is really a thing of the past. With amusing regularity, we still come across proposed renewal policies with Y2K exclusions, some of them consuming nearly a page of boilerplate. Invariably they trigger that annoyingly persistent ear-worm (complete with hokey synthesizer and insistent backbeat)— They say two thousand zero zero party over, oops out of time You just can’t shake those ‘90s. Laura Foggan

In the months leading up to January 1, 2000, I was among many insurance coverage counsel following news reports relating to Y2K issues, albeit with some skepticism on my part. Fortunately, New Year’s Eve of December 31, 1999-January 1, 2000 passed without calamitous worldwide computer snafus. Yet, I actually did litigate a significant Y2K claim. Xerox Corporation sought to recover almost $200 million dollars in Y2K remediation costs from its insurer, American Guarantee and Liability Insurance Company. American Guarantee denied coverage, and we filed a declaratory judgment action for the insurer in New York state court. In our case, which was an important precedent discouraging similar claims, Judge Ramos ruled that there was no coverage. Xerox had undertaken remedial work beginning in 1996 and had incurred over $100 million in remedial costs, before it even notified its insurer of the claim. The facts tended to support our view that these were simply costs of doing business, not emergency measures to avert loss. And Judge Ramos agreed with us that a lack of timely notice, even if Xerox may have had a “sue and labor” clause claim, supported a no-recovery determination. Steve Gilford

Like many of my fellow ACCC Fellows, I remember the hype over Y2K, the absence of the technological Armageddon everyone was so afraid of, the hundreds of millions, indeed billions, of dollars spent to avoid it, and the efforts of policyholders to recover and insurers not to pay. We worked with more than a dozen major companies, particularly financial institutions in an effort to evaluate their insurance and potential claims. Even where we thought there were sound avenues for coverage, there were immense difficulties assembling the claims since, in most cases, coverage lawyers were only involved late and necessary financial data was not captured, organized or reported in a way that made it easy to document and present in an insurance claim, much less to separate recoverable costs from arguably routine computer upgrades and business expenses. These experiences emphasized the importance of involving insurance professionals focused on assembling the data needed for a property claim from the start. The other thing that was remarkable about Y2K coverage claims was the uniformity with which the insurance industry dug in to resist the claims. We had cases where the insurers had mandatory mediation clauses or CPR commitments to mediate. Mediations were held with some of the top mediators in the world, and the insurers refused to budge from their positions that there was no coverage. In a case some of my fellow Fellows will remember, I had a banking client which was so frustrated that it proceeded to litigation. Everyone believed the case had real value, and the bank actually defeated an insurer motion to dismiss on grounds of no coverage – one of the few policyholder successes on a Y2K claim. But the insurer continued to be unwilling to move, issuing massive discovery concerning the claim that would have required numerous depositions and cost millions of dollars to respond to. Ultimately the case was resolved, but the experience reaffirmed the lesson that insurance coverage is not just about coverage. If the insurer will not settle without litigation, the policyholder has to have the documentation and resources to establish the dollar value of its claim. Mary McCutcheon

I was involved in several cases where we advised clients on whether we could recover the costs of dealing with Y2K prevention expenses under the “sue and labor” clause. In one instance we did in fact mediate a claim and recover some costs. But these claims were largely under standard property policies- there were many hoops to jump through to argue that the efforts were necessary to prevent a covered claim. A client “in the know” in the financial sector confided that the Russian financial markets would “collapse” as the result of Y2K. While I don’t recall being too concerned about Y2K in general, it was somewhat of a relief to watch the clock strike midnight across multiple times zones, with no dire outcomes. It’s hard to say what the ultimate effect of Y2K was but it certainly raised the profile of and opened up new uses for, the “sue and labor” clause. John Mathias

January 1, 2000 seems like both yesterday and forever ago. Like everyone else in the nationwide/worldwide coverage practice, we here were very attentive to the whole risk issue as it had been played up in the media for the previous several years. You may also remember that all underwriters everywhere were insisting upon Y2K exclusions, so when the time came, pretty much all first and third party covers had such an exclusion in them. For myself, I never really believed that Armageddon was coming via Y2K in any way, shape, or form. Still, everyone had to be fully prepared for it, as no CEO anywhere could possibly afford to overlook or discount the risk should the worst happen. All in all, it wound up being the classic much ado about nothing situation. All of us, however, became deeply involved in the “much ado.” I don’t think the business and insurance landscape has changed all that much as the result of the Y2K scare. We still have the Armageddon type fears influencing both business and insurance in such areas as (a) massive worldwide cyber-attacks by super threat actors, and (b) catastrophic climate change. Both of these risks are highly speculative, but no one can afford to ignore or discount them. But where there is risk, there are underwriters. That’s the name of the game. And where there are huge losses, there are emerging and even growing markets. In a way, the risk or even the fact of huge losses is what creates the market for insurance products in the first place. So be it. Major Insurance Developments of 2019By Robert Chesler and Nicholas Insua

Robert Chesler In the early 1980s, when insurance coverage litigation was in its infancy, most practitioners expected that courts would quickly resolve the key issues. No one expected that they would still be debating basic coverage issues in 2019. This past year did not see any decisions addressing truly novel issues. Rather, with the exception of cyber insurance, the year’s decisions shed clarity on existing issues with which coverage litigators long have grappled. Cyber Insurance The Eleventh Circuit, applying Georgia law, held that a phishing loss constituted a direct loss resulting from a fraudulent transfer. Principle Solutions Group LLC v. Ironshore Indemnity Inc., 944 F.3d 886 (11th Cir. 2019). The meaning of ‘direct’ has long been a source of contention. Principle Solutions concerned a classic phishing case. The company’s controller received a message supposedly from the company’s managing director, advising her to wire $1,700,000 pursuant to instructions that the controller would receive from an attorney. The purported attorney then contacted the controller and gave her instructions to wire the money to a bank in China. The transferring bank, Wells Fargo, asked for verification that the wire transfer was legitimate, which the controller confirmed. Wells Fargo then released the funds. The next day, the managing director told the controller that he never gave the instruction. Ironshore first argued that the phishing loss did not constitute a covered fraudulent transfer pursuant to the insurance policy, an argument that the court found was unpersuasive. Ironshore next asserted that the loss was not ‘direct’ as required by the fraudulent transfer coverage because there was no “immediate link between the instruction and the loss.” Id. Again the court disagreed. It found that the Georgia standard was proximate cause, which included “all of the natural and probable consequences” of the act “unless there is a sufficient and independent intervening cause.” (Cite omitted) (Emphasis in original.) Id. The court held that the intervening acts between the initial message and the wiring of the money were not sufficient to break the causal chain. Principle Solutions is the third circuit court decision to find coverage for phishing losses under a business crime policy. Illusory Coverage Policyholders often assert to a court that if it adopts the policy interpretation proffered by the insurance company, it would render coverage illusory, but the case law shows that this assertion has met with only limited success. However, cases from 2019 may breathe new life into this argument. Crum & Forster Specialty Ins. Co. v. DVO, Inc., 939 F.3d 852 (7th Cir. 2019) concerned a professional liability policy issued to a company that had contracted to design and build an ‘aerobic digester,’ designed to convert cow manure to electricity. After an accident, the insurance company denied coverage on the basis of a breach of contract exclusion. Since the underlying claim arose from DVO’s breach of contract, the insurance company asserted the application of the exclusion. The trial court agreed, but the Seventh Circuit reversed. The court found that all of DVO’s work was performed pursuant to a contract, and to enforce the breach of contract exclusion would render the coverage illusory. In Starr Surplus Lines Ins. Co. v. Star Roofing, No. CA-CV18-0642, 2019 WL 5617575 (Ariz. Ct. App. Oct. 31, 2019), Starr issued a policy to a roofing company. An employee of the building’s tenant passed out from roofing fumes and broke her arm. The insurance company denied coverage on the basis of the pollution exclusion, and the court’s decision centered on its holding that the absolute pollution exclusion only applied to traditional environmental pollution. However, the court also addressed illusory coverage: “The scope of interpretation requested by Starr Surplus would result in illusory coverage for the ordinary commercial business activities of the insured….” Id. at *35. See also, McGraw-Hill Education v. Illinois National Insurance Co., Case No. 655708/16, 2019 WL 6869010 (Ill App. Div. 1st Dept., Dec. 17, 2019) (applying fortuity defense to copyright infringement coverage “would render that portion of the policy illusory.”) Id. at *1. Bad Faith Bad faith is another cause of action often pressed by policyholders with only mixed success. However, two decisions from 2019 may provide a roadmap to policyholders on such claims. In Yahoo! Inc. v. National Union Fire Ins. Co. of Pittsburgh, PA, No. 5:17-cv-00489 (N.D. Cal. May 17, 2019), National Union moved for judgment as a matter of law on Yahoo’s bad faith claim. To oppose, Yahoo relied on such evidence as (1) National Union’s denial letter cited to an exclusion not found in the policy, (2) National Union used an incomplete copy of the policy to determine coverage, (3) National Union did not construe “the allegations of the underlying suits in a manner that would favor a finding of coverage,” (4) National Union did not reconsider its coverage position, and (5) National Union did not conduct a thorough investigation, among others. Id. at *3. The court found that the jury could rule for National Union and find that its “coverage decisions were not unreasonable.” However, it also found that “there is a legally sufficient evidentiary basis for a jury to find that National Union acted or failed to act without proper cause.” As a result, the court denied National Union’s motion. Prucker v. American Economy Ins. Co., No. CV186013630S, 2019 WL 2880369 (Conn. Sup. Ct. May 31, 2019) involved a homeowners’ claim of deteriorating conditions in its basement walls caused by a contaminant in the concrete, apparently a common complaint. The insured brought causes of action in bad faith, and pursuant to the Connecticut Unfair Trade Practices Act (“CUTPA”) and the Connecticut Unfair Insurance Practices Act (“CUIPA”). The insurance company moved to strike these counts. The court allowed the bad faith claim to remain because the insured alleged that the insurance company “knew of and chose to ignore the rulings by state and federal courts in Connecticut that similar damage should be covered under similar policy language.” Id. at *4. The court stated that this essentially alleged that the insurance company had no reasonable basis to deny coverage. The court found that if these decisions were confirmed by the Connecticut Supreme Court and Harleysville knew that its coverage position was incorrect, a bad faith claim was plausible. The CUTPA and CUIPA counts required by statute a general business practice of unfair trade practices by the insurance company. The plaintiff alleged the insurance company’s “systematic and uniform denial” of similar claims, and pointed to a putative class action on the same issue. The court found that the plaintiff had alleged a sufficient general business practice, and denied the insurance company’s motion to strike. Id. at *7. Yahoo and Prucker indicate that courts will look to evidence of claims handling practices in determining bad faith. This could be a fertile field for policyholders. War Risk Exclusion The war risk exclusion has received much attention with respect to cyber-attacks of late. Universal Cable Productions, LLC v Atlantic Specialty Ins. Co., 929 F.3d 1143 (9th Cir. 2019) concerned a more traditional conflict – that between Israel and Hamas in Gaza. Universal was filming near Gaza and had to move and cease production because of the outbreak of fighting between the parties. This resulted in a business interruption loss. The insurance policy had two war risk exclusions upon which the insurance company relied to deny coverage. The district court held that the conflict was a war within the ordinary understanding of that term and denied coverage, and the Ninth Circuit reversed. First, the court rejected the application of contra proferentem, because of Universal’s broker’s role in drafting the insurance policy. The court next rejected the district court’s reliance on the ‘ordinary understanding’ rule. It cited to the California Civil Code, which stated that the ordinary meaning applied to policy terms “unless a special meaning is given to them by usage, in which case the latter must be followed.” (Emphasis in court’s decision.) Id. at 1153. The court then found that in the insurance context, ‘war’ was understood only to be a conflict between two sovereign states. It therefore held that since neither Hamas nor Gaza were sovereign states, the exclusions did not apply. War and terrorism exclusions have become much broader in many policies. Policyholders and their brokers or consultants should review them carefully and see if they need to be scaled back. Late Notice Late notice is a crucial issue on which jurisdictions differ dispositively. A majority of states hold that late notice of a claim will only foreclose coverage under a general liability policy if the late notice has prejudiced the insurance company – although states differ on what constitutes prejudice. A minority of states hold that late notice of a claim will foreclose coverage as a matter of law. Pitzer College v. Indian Harbor Ins. Co., 447 P.3d 669 (Cal. 2019) concerned a California insured suing in California on an insurance policy that contained a New York choice of law provision. Pitzer gave late notice of an environmental claim to Indian Harbor, which denied coverage on the basis of late notice. Under California law, late notice will only foreclose coverage if the insurance company can demonstrate substantial prejudice, while under New York law, with respect to the insurance policies at issue, late notice is fatal to coverage. Pitzer argued that the court should not enforce the choice of law provision because the prejudice rule constituted California fundamental public policy. The Ninth Circuit certified the case to the California Supreme Court. The California Supreme Court held that even in the absence of a legislative pronouncement, the prejudice rule was a fundamental public policy of California that overrode the contractual choice of law provision. The court relied on several factors. Id. at 99. Asbestos Insurance Coverage Apocryphally, someone once asked a Lloyd’s representative what would be the next asbestos, and he replied – asbestos. The Connecticut Supreme Court’s decision in R.T. Vanderbilt v. Hartford Acc. & Indem. Co., 216 A.3d 629 (Conn. 2019) reflects the persistence of asbestos in the insurance (and other) contexts. The court addressed four important issues. Most importantly, the court confirmed that Connecticut was a continuous trigger state. Under that rule, the insurance company on the risk when the first exposure to asbestos exposed, and insurance companies continued on the risk until manifestation of an asbestos illness. The court affirmed the lower court’s refusal to permit expert testimony by an insurance company to establish that in fact, an asbestos injury does not take place until the final cellular mutation that caused the disease to develop. The court also adopted the ‘unavailability rule,’ holding that the insurance company and not the insured was responsible for those years on the risk when insurance coverage was not available in the marketplace. The court ruled that indoor exposure to asbestos was not pollution, adopting, as in Starr Surplus, the rule that the pollution exclusion only applied to traditional environmental pollution. The court then granted a significant victory to insurance companies, holding that an ‘occupational disease’ exclusion applied not only to the insured’s only employees but to any employee. Since almost all asbestos claimants suffered exposure in the course of their employment, this holding practically vitiates coverage under any policy containing such an exclusion. Assignment Ever since the decision by the California Supreme Court in Henkel Corp. v. Hartford Acc. & Ind. Co., 62 P.3d 69 (Cal. 2003), insurance companies have carefully reviewed claims by successor companies under their predecessors’ policies to see if the parties had properly assigned the policies. In The Premcor Refining Group, Inc. v. ACE Ins. Co. of Illinois, No. 5-18-0210, 2019 Ill. App. (5th) 180210-u (Ill. App. Ct. 5th Dist., Aug. 12, 2019), the successor corporation failed to do so. Premcor purchased assets from Apex. As a result, Premcor found itself subject to environmental litigation stemming from those assets. Premcor sought coverage under the Apex policies in place when the contamination occurred. The insurance companies denied coverage, asserting that the asset purchase agreement (“APA”) had not assigned those policies to Premcor. Moreover, Apex intervened, joining the insurance companies and denying that it had assigned the policies to Premcor. The court ruled that the APA did not include an assignment of those policies in dispute. It found that while the APA did specifically assign certain policies, it did not assign the earlier policies. The court stated, “a valid assignment must describe the subject of the assignment with sufficient particularity.” Id. at *4. In some similar disputes, successor companies have argued that a general assignment of contractual rights includes rights under insurance policies. Query whether such an argument would survive the Premcor test of ‘sufficient particularity.’ See also, PCS Nitrogen, Inc. v. Continental Casualty Co., N. 5699 (S.Car. App. 2019) (court held that company was not a successor and did not receive an assignment). Loss of Use The definition of property damage in a general liability policy includes ‘loss of use of tangible property that is not physically injured.’ Many policyholders do not realize how broad this coverage is. In Thee Sombrero, Inc. v. Scottsdale Ins. Co., 28 Cal. App. 5th 729 (Cal. App. Ct. 2019), the court stretched this coverage probably as far as it can go. After a shooting, the city canceled Thee Sombrero’s nightclub license, although the club could still be used as a banquet hall. The Sombrero sued the security company at the night club. That company defaulted, and Thee Sombrero sued the company’s insurance company directly. The trial court dismissed the claim, finding that the loss was not for property damage but for economic loss. The appellate court reversed. It held that Thee Sombrero suffered the loss of use of the property as a nightclub, which was an element of the definition of property damage. The court then found that the proper measure of damages was the loss in value of the property. Relationship Back Under claims-made policies, and particularly D&O policies, a later claim can relate back to a prior claim and be covered under the policy in place at the time of the earlier claim. This ‘relationship back’ doctrine has produced a large and bewildering morass of case law. Emmis Communications Corp. v. Illinois National Ins. Co., 323 F. Supp. 3d 1012. (S.D. Ind. 2018) may help both policyholders and insurance companies navigate their way on this issue. Emmis has both an unusual fact pattern and procedural history. The relationship back doctrine can aid either the policyholder or the insurance company depending on the circumstances. However, it is more frequently used by insurance companies to argue that a latter claim relates back to an earlier claim that the policyholder did not report, thereby foreclosing coverage for the latter claim because of late notice. In Emmis, the insurance company sought to relate the later action back to the prior one. The district court disagreed and ruled in favor of the policyholder. At first, the Seventh Circuit reversed. However, it then granted a petition for rehearing, withdrew its prior opinion, and adopted the decision of the district court. The district court had adopted a relation back standard of “operative facts…that is, facts that form the basis of the causes of action asserted in the lawsuits.” Id. at 1027. The court found that the related facts relied upon by the insurance company were just “window dressing,” and held that the actions were not related. D&O Issues Delaware courts were active in addressing D&O issues in 2019, issuing five important decisions. The Delaware Supreme Court handed a victory to insurance companies in In re Verizon Insurance Coverage Appeals, No. 558, 560, 561, 2018, 2019 WL 5616263 (Del. Sup. Ct. Oct. 31, 2019). Verizon had spun off a company, which quickly entered bankruptcy. The bankruptcy trustee sued Verizon, alleging violation of fraudulent transfer statutes, payment of unlawful dividends in violation of Delaware corporate statutes, and common law counts of breach of fiduciary duty, promoter liability, and unjust enrichment. While Verizon successfully defended the suit, it incurred $48 million in attorneys’ fees. Verizon sought coverage under its D&O policy, which defined a security claim in relevant part as a claim “alleging a violation of any federal, state, local or foreign regulation, rule or statute regulating securities.” Id. at *1. The trial court held that the definition of ‘security claim’ was ambiguous and that contra proferentem applied, and found coverage. The Delaware Supreme Court reversed, holding that the definition was unambiguous. It found that the broad definition of “regulations, rules or statutes” enunciated by the lower court “would encompass a variety of non-security related claims.” Id. at *3. In Conduent State Healthcare, LLC v. AIG Specialty Ins. Co., No. N18C-12-074, 2019 WL 3337216 (Del. Super. Ct. June 24, 2019), the insured received a civil investigation demand (“CID”) from the Texas attorney general demanding documents. The insurance company sought partial summary judgment, arguing that the CID was only a request for information and not a ‘claim’ under the insurance policy. The court denied the motion, holding that the demand for documents was a claim because it was a demand for non-monetary relief. In IDT Corp. v. U.S. Specialty Ins. Co. No. N18C-03-032, 2019 WL 413692 (Del. Super. Ct. Jan. 31, 2019), the court held that the insurance company had to defend the chairman of the board of the corporation. The insurance company asserted that the underlying complaint did not allege a ‘wrongful act’ necessary to trigger coverage against the chairman. The court found that the definition of ‘wrongful act’ was unambiguous It held that ‘wrongful act’ had a broad meaning not limited to the breach of fiduciary duty, and found coverage. However, the court also held that the corporate spin-off that was the basis of the claim was not a securities claim, so that the corporation itself did not have coverage. It found that a security claim had to be brought by a subsidiary, and that, following a spin-off, the former subsidiary that sued IDT was no longer a subsidiary, despite its central role. In Arch Ins. Co. v. Murdock, No. N16C-01-104, 2019 WL 2005750 (Del. Super. Ct. May 7, 2019), the court held that settlement payments by the company to its shareholders were not an excluded ‘increase in the consideration paid’ but a covered loss. In Solera Holdings v. XL Specialty Ins. Co., No. N18C-08-315, 2019 WL 4733431 (Del. Super. Ct. Sept. 26, 2019, the court faced the novel issue of whether an appraisal action constituted a covered securities claim, and held that it did. Conclusion Insurance law is state law, which means that the parties can litigate each issue fifty times. Hopefully, this year’s decisions will be normative and help to reduce future litigation on these issues. However, if the past is any indicator, we can expect that we have not heard the last word. Bob Chesler and Nick Insua are shareholders in the Newark office of Anderson Kill, where they represent policyholders.

Other 2019 Recaps

Click here to read Randy Maniloff’s 19th annual “Ten Most Significant Coverage Decisions of the Year.” Click here to read Morrison Mahoney LLP’s “Insurance Law Update, 2019: The Year in Review.” Click here to read Saxe Doernberger & Vita, P.C.’s Top 10 Cases of 2019. Click here to read Hunton Andrews Kurth LLP's Year in Review. Insurance Law Symposium Wrap UpOn November 1, 2019, the ACCC hosted its sixth annual insurance law symposium at the alma mater of co-chair Doug McIntosh, the Nova Southeastern University Shepard Broad College of Law in Fort Lauderdale, Florida. With the expert assistance of Carol Montoya and the cooperation of the Law School dean, faculty, and administrative staff, the event was a great success. The ACCC hosted a speaker’s dinner on Halloween (Hugh Lumpkin supplemented the wine choices), followed the next day by the symposium that was attended by a hundred registrants, including students, faculty, mediators, consultants, attorneys and, of course ACCC Fellows. Registrants literally travelled from around the country to attend, including California, Texas, Virginia, Mississippi, Arizona, Illinois, Georgia, Delaware, Washington, DC, and New York.

The seminar content was particularly wide-ranging, with ACCC fellows addressing the anatomy of a bad faith claim, providing pertinent case law updates, guidance on mediating insurance claims and bad faith cases, cutting edge issues on privileges and immunities and the scope and nature of expert testimony in extra-contractual claims under Daubert principles. The presentation bookended a hard-hitting segment on global warming including the harbinger cases that have addressed issues of standing and causation. Our keynote speaker was the former Chief Judge of Florida’s Fourth District Court of Appeals, Robert M. Gross.

The symposium was a great success judging from the comments of those who attended and a financial success as well for the ACCC. Co-chairs, Dough McIntosh and Hugh Lumpkin thank all of those who made this event possible.

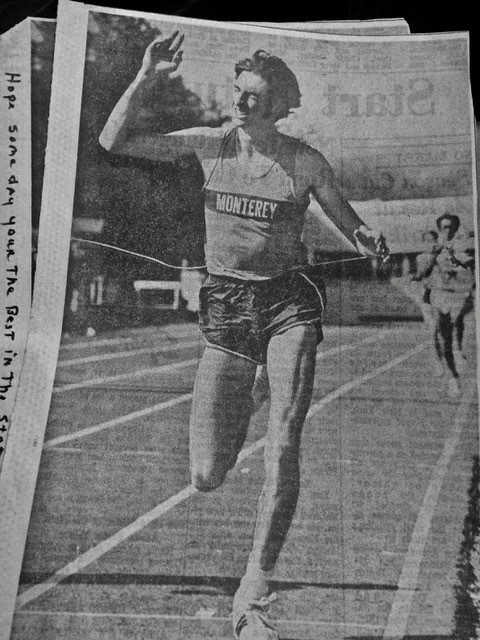

Materials from the Symposium are available on our website. Click here for presentations, papers, and speaker bios. Forty years after graduating from the Baylor Law School, Austin’s Mark Lawless is hanging up his old track spikes at the ripe young age of 66 and moving to Walla Walla, Washington to start a new chapter in his life with his new wife and twin daughters (who will be graduating this May from the University of Oregon Law School). As he transitions from being one of our College’s most active members to emeritus status, we reminisced with Mark about his life and career in the law.

ACCC: You took a circuitous route to your true calling: five years working for the State of Texas on energy and environmental policy work and then another five defending businesses facing environmental liability and enforcement issues. How did you finally get into coverage work?

ML: I was working in Texas for a DC-based firm defending businesses with environmental problems. I’d been following the environmental coverage world and, as a young associate, I was, trying to figure out how to make a niche for myself. We were representing all of these hazardous waste clients and nobody was helping them with insurance.

As an environmental lawyer, I was a pretty pro-environmental person and here I was working for polluters in the environmental field, negotiating penalties, and trying to get permits from the state. When I got into insurance, I was still working for the same clients, but I felt better about it because I was recovering money that went to help clean up the environment or pay the victims of asbestos or silica.

So that was how I got into the insurance side, and it overlapped with my environmental work for about 3 or 4 years. When that firm went bankrupt in 1990, I went out on my own. My mentors back then were people like Jerry Oshinsky, Gene Anderson and Bill Greaney, who came down to Texas in the early 1990s. Back then, the only people in Texas bringing insurance claims were plaintiffs’ lawyers. But there was nobody just representing corporate clients.

We did a major pre-packaged bankruptcy involving silica and asbestos exposures and put over $200 million into a trust. That makes you feel pretty good.

ACCC: Do you regret having spent the last three decades in such a niche practice?

ML: I knew more law the day I graduated from law school than I know today. But I had a passion to do the insurance work. I loved it. Part of the reason that I had such a passion was that I had created the market for myself down here. I took a lot of pride in having carved out a niche practice where we were the goto people for insurance problems.

The other thing I liked about insurance work was how collegial the lawyers were that I worked with. I have as many friends who were opposing me over the years, as I do people on my side of the docket. Most of the people that I do business with, I did on a handshake and never felt that they were going to stab me in the back. The ABA insurance group in Tucson helped build those relationships and the ACCC is the national culmination of that idea.

ACCC: You were one of the founders of the Insurance Law Section of the Texas Bar, which is today probably the most successful organization of its kind in the country.

ML: When we started the Texas Insurance Law Section, we only had a few hundred members. Now, 20 years later, we have 2,200 members and it’s a very collegial Bar. I’m very proud of what we did. We educated an unsophisticated bar and judges who didn’t know much about insurance. It cut into our business, but overall it’s a much healthier bar because of what we did.

ACCC: You’ve had some amazing cases over the years. Is there one that stands out in your memory?

ML: One of my very first insurance cases involved a client who had a paper making business down in Houston. They had a spill of some kind and the vacuum truck that came to suck up the wood shavings had an earlier load of plastic pellets that they’d forgotten to get rid of so it got mixed in together and completely gunked up the works. So they made a claim to their insurance company but the plaintiff’s lawyer made the mistake of saying that this vacuum truck had “polluted” their feed stock so the insurer denied coverage based on the pollution exclusion from these plastic pellets. A lawyer from the insurer came down from Washington, DC to meet with me and I took a bunch of the plastic pellets and put them in a little china bowl and set them on the table. And the lawyer said, “What is that?” I said,“That’s your pollution.” Within 2 hours, I had a check and they asked me how much my attorney’s fees were.

ACCC: What’s the biggest change that you’ve seen in the practice of insurance law in Texas over the last few decades? ML: Clearly, the biggest change, is technology. Younger lawyers have grown up on computers and learned to read documents electronically. I still have to print out documents so that I can highlight and make margin notes. The second change, and important to me, is that it is no longer easy to practice law by handshake. It is all about ambushing your opponents and writing CYA memos to the file. I still believe that you can be a good lawyer without being a jerk.

The other big change is the number of young coverage lawyers. I’ve gone from being the only game in town for long tail claims to a market where there’s a lot more competition from people that will do the work a lot cheaper than I can. Also, a lot of us on the policyholder side have ventured into larger firms like Pillsbury, Reed Smith, and McGuire Woods.

ACCC: Walla Walla is going to be quite a change after 40 years in Austin.

ML: Actually, I’m looking forward to it. Austin is a great town but it’s also grown from 700,000 people to over 3 million and the traffic sucks. Walla Walla only has 35,000 people and you can get across town in 7 minutes. But because of the tourism from the wine industry and all of the colleges in the area, it has the culture of a much larger town. It’s also a little bit like Austin in being a progressive community in the middle of a more conservative part of the state.

I got married there a year ago in one of the vineyards, and my daughters’ college tennis coach hosted our wedding party. I have a friend that owns a winery, so we already have a lot of connections, but we want to get involved in the community.

ACCC: You were one of the earliest members of the College and played an active role on our Board of Regents for years. What drew you to the ACCC?

ML: The American College was very important to me because it was a culmination of a lot of things we talked about earlier that had to do with the collegiality part of what we were doing. All I can say is just keep doing the work, that there’s so much that can be done. I hope that I may be able to come back to one of the ACCC annual meetings just to see people.

ACCC: Don’t worry-we’ll save a place at the table for you. Committees – Working Hard for Our MembersOne of the great strengths of this College are its substantive committees, of which there are nine. In an effort to give greater visibility to their efforts and encourage Fellows to join a committee or two, we are inaugurating a new feature article highlighting the efforts and programming of several committees. ADR, CGL/Excess and Cyber will be featured in the April 2020 Newsletter. D&O and Emerging Risk will be featured in the July 2020 Newsletter, followed by Extracontractual and First Party. Professional Liability and Professionalism and Ethics will be featured in the final Newsletter of the year. As a part of the reporting process, Committee Chairs will be asked to provide a report to the Executive Committee, through Debra Varner, regarding the Committee’s activities. The activities of a designated committee will be discussed during the monthly Executive Committee calls. The monthly schedule for this reporting will begin in February 2020 with ADR, followed by CGL/Excess in March and Cyber in April. D&O will provide its report in May, followed by Emerging Risk. Extracontractual will provide its report in July, followed by First Party in August, Professional Liability in September and Professionalism and Ethics in October. The Executive Committee meets monthly by telephone on the fourth Thursday of the month. Thus, Committee Chairs should provide their reports to Debra Varner by the 15th day of their assigned month. From this information, the Newsletter features will be created. The intent of this project is to keep everyone engaged in the business and developments of the ACCC. Let us know all that you are doing for the ACCC. We look forward to making this project a success. The Ethicists Look at the Issue of Issue ConflictsBy John Bonnie and Neil Posner

John Bonnie

Neil Posner Question: An insurer client has asked me to file a declaratory judgment action advocating a coverage position I know is contrary to the position one of my partners argued in a case that has since settled. Does my firm have a duty to check with that client and/or do I have to check with my partners to see if there are other inconsistent positions being argued in other pending cases? Answer: Bar regulators disagree as to whether this type of “issue” or “positional” conflict presents a true ethical conflict, and the guidance contained in the ABA Model Rules of Professional Responsibility is circumspect. The details matter, and the analysis in a given situation is ultimately very fact specific. The starting point is ABA Model Rule 1.7 or the corollary bar rule in the relevant jurisdiction. Under the Model Rule, representation of a client raises an ethical concern if the representation of one client will be “directly adverse” to another client (Rule 1.7(a)(1)), or there is a “significant risk” that representation of a client or clients will be “materially limited” by the responsibilities to another client (present or former), or to a third person, or by a personal interest of the lawyer (Rule 1.7(a)(2)). The rule goes on to state exceptions, however, if the lawyer “reasonably believes” he or she will be able to provide competent and diligent representation to each client; the representation is not prohibited by law; it does not involve the assertion of a claim by one client against another client represented by the same lawyer in the same litigation or other proceeding before a tribunal; and the affected clients give informed, written consent. Rule 1.7(b). Rule 1.7 is not implicated in the first instance then without “directly adverse” interests among clients or a “significant risk” the lawyer’s responsibilities in the representation will be “materially limited” by responsibilities to others. In the scenario described, the representation likely does not present an ethical conflict and the client’s informed consent would therefore not be required. The pathways to this conclusion are many. First, since the matter handled by the other partner has settled, there is arguably no issue of the representation being “directly adverse” to the other client. Furthermore, since different lawyers represent the two clients, there is arguably no “significant risk” the representation of either clients’ interest will be “materially limited” by two different lawyers’ advocacy. Even assuming otherwise and considering the Rule’s exceptions, it is likely both lawyers would reasonably conclude that they can competently and diligently represent the two clients, and in any event, the matters are different and not before the same tribunal (since one has settled). Comment 24 to Rule 1.7 provides further, important guidance in answering the question: Ordinarily, a lawyer may take inconsistent legal positions in different tribunals at different times on behalf of different clients. The mere fact that advocating a legal position on behalf of one client might create precedent adverse to the interests of a client represented by the lawyer in an unrelated matter does not create a conflict of interest. A conflict of interest exists, however, if there is a significant risk that a lawyer’s action on behalf of one client will materially limit the lawyer’s effectiveness in representing another client in a different case; for example, when a decision favoring one client will create precedent likely to seriously weaken the position taken on behalf of the other client. Factors relevant to determining whether the clients need to be advised of the risk include: where the cases are pending, whether the issue is substantive or procedural; the temporal relationship between the matters, the significance of the issue to the immediate and long-terms interests of the clients involved and the clients’ reasonable expectations in retaining the lawyer. If there is significant risk of material limitation, then absent informed consent of the affected clients, the layer must refuse one of the representations or withdraw from one or both matters. Distilling this guidance, a lawyer may take inconsistent legal positions in different tribunals at different times for different clients even where adverse precedent might thereby be created respecting one client. It’s just a question of degree: a conflict only exists if the resulting precedent is “likely to seriously weaken” the position of the other client. Still other considerations may be elusive: is the issue significant to the “immediate and long-terms interests” of the clients, and what are the clients’ reasonable expectations in hiring the respective lawyers? The considerations arising under the Rule have been appropriately described as “subtle and difficult”. Ethics Opinion 265, District of Columbia Bar. Indeed, in Opinion No. 155, the majority of the Board of Overseers of the Bar, State of Maine, expressly declined to follow older, now replaced guidance in prior notes to Model Rule 1.7, where a lawyer advocated opposing results on the same issue for two different clients in unrelated litigation. In the Opinion the Board majority found the outcome under Model Rule 1.7 would be inconsistent with the corresponding Maine Bar Rule, concluding that “an ‘issue conflict,’ without more, is not a conflict of interest.” The Board majority added that there was no obligation on the part of a law firm to implement screening procedures for a positional or issue conflict. Nevertheless, the Board did acknowledge that “an attorney must be mindful of the possibility that contemporaneously arguing opposite sides of the same issue before the same judge or panel of judges could impair her effectiveness on behalf of both clients . . . .“ And in an often-mentioned opinion of the California Standing Committee on Professional Responsibility and Conduct, the Committee determined that no ethical issue existed in an attorney representing two clients not directly adverse to one another arguing opposite sides of the same legal question before the same judge – even where one or both clients would be prejudiced by the representation. Among the many bases for the opinion were the Committee’s belief that even the most unsophisticated client would not assume that [his] attorney represents no other clients who may have divergent interests in their legal matters. While certainly a close question, we do not believe that there can be any reasonable expectation on the part of the client that the duty of undivided loyalty prohibits the attorney from taking an inconsistent legal position on behalf of another client. The Committee nonetheless cautioned: “[t]he prudent attorney, however, will advise both clients of the other representation (if to do so will not violate the attorney/client relationship) and allow both an opportunity to seek new counsel.” Whether a potential conflict exists in the scenario presented depends upon: (a) the rule and ethics opinions that prevail in the controlling jurisdiction and (b) in jurisdictions adopting the Model Rule, upon the application of the subjective considerations of whether the interests of the clients are “directly adverse” and (c) whether there is a “significant risk” that the clients’ representation will be “materially limited”. In any event, business interests may guide the law firm toward disclosure and informed consent, if for no other reason than to avoid souring the business relationships with both clients. The Opinion of our ACCC Ethicists is not intended to provide formal legal advice, nor does it necessarily reflect the opinions of their firms or clients. Help Expand our Reach: LinkedIn

Given the extraordinary array of talent in our College, we would like both the College and its Fellows to be better known. LinkedIn is the best platform for raising the profile and awareness of the ACCC among members, influencers, and potential clients. This is a team effort. We need every single member's help. On our newly created public LinkedIn page, we will be reposting web content including press releases, article of the month, member news, relevant events hosted by members, and news articles in which you are quoted, and other content. The ACCC LinkedIn page currently has 89 followers, and with their help we have had over 1,400 impressions in just a few weeks. We want every member to follow the page so that the network of people who see the posts increases. With each additional follower to the page, the number of people who will see the ACCC posts grows exponentially. 1. Follow the LinkedIn page by going to this link and clicking “Follow” 2. When you see posts from the ACCC page, please “Like” the post. This indicates interest in the post and elevates it so that others in your network. Thank you for your help! Call for ContentWe are always looking for interesting content from the membership, for the membership, to be used on our website, in the newsletter, and on social media. If you have compiled any “Top of 2019” lists, please share. In particular, we are looking for the following: Articles. Please forward any articles that you have authored/co-authored on insurance-related topics that can be reprinted and/or linked to from the College website or in the newsletter. Blogs. If you or your firm author a blog on insurance-related issues, please provide the link. We are curating a repository of links to relevant blogs. Member Spotlights. Do you have an unusual or unique talent, hobby, or recent experience that would be interesting to other Fellows? Let us know. It should *not* be work-related. Anything Else. The goal is to be interesting, informative and fun. If it checks one or more of those boxes, let us know! Any materials, information, or links can be sent to [email protected].

Member News

Christine Haskett Named an Insurance MVP

Christine Haskett Christine Haskett, Covington & Burling, has been named to Law360's 2019 Insurance MVP list. In a Law360 article, Christina discusses her near-total trial victory for defunct aluminum company Noranda, where she secured $35.5 million in business interruption coverage for a pair of accidents at an aluminum smelter in Missouri that happened amid a trough in the metals market.

John Bonnie Weighs in on 11th Circuit Decision

John Bonnie Law360 featured a piece by John Bonnie on the Eleventh Circuit's new opinion in Principle Solutions Group LLP v. lronshore Indemnity lnc. Click here to read more.

DBusiness names Charles Browning among Top Lawyers

Charles Browning DBusiness magazine recently named 20 metro Detroit attorneys from Plunkett Cooney, one of the Midwest’s oldest and largest law firms, to its 2020 list of “Top Lawyers.” The DBusiness Top Lawyers list was compiled based on a peer-review survey open to all metro Detroit lawyers. The publication polled 19,000 attorneys in Wayne, Oakland, Macomb, Washtenaw and Livingston counties to nominate lawyers among 50 practice areas. The list was published in the November/December edition and included ACCC Fellow Charles Browning.

ACCC Fellows Quoted in Law360 After Key Insurance Rulings

Michael Hamilton

John Vishneski

Michael Manire

Seth Lamden

Bryan Weiss

Franklin Cordell College Fellows Michael A. Hamilton, Seth Lamden, Michael Manire, John Vishneski, Bryan Weiss, and Franklin Cordell, were quoted in “3 Key Insurance Rulings Attorneys Should Know This Fall.” Click here to read the piece.

Michael Aylward

Sheri Pastor ACCC president Michael Aylward and President-Elect Sheri Pastor were quoted in “4 Ways Conn. Justices Set Precedent On Asbestos.” Click here to read the piece.

Zale Files Appellant’s Brief in Dallas D&O Coverage Action Involving Delaware Securities Appraisal Action Between the Zale action in Dallas (which the insurers won on summary judgment) and the Solera Holdings action in Delaware (which the policyholder won the first ruling), a number of Fellows are involved in this high-stakes litigation involving significant money. Click here to read more. Membership Renewals & Demographic InfoThe College’s membership year is January 1 through December 31. If you haven’t renewed your membership already, please do so now. The grace period ends January 31.

In conjunction with renewing your membership, we ask that you also take a moment to answer a few demographic questions we have developed to collect information for our diversity initiatives. Log in to americancollegecoverage.org, click on “My Profile”, then choose “Edit” within your profile to see the questions. Fill in your responses and click “Save”. All responses are optional and your answers are confidential. They will not appear in the public view of your profile. Thank you in advance for participating!

Welcome New Fellows!Linda M. Dedman Laurie Dugoniths Busbee Larry Fields Daniel J. Healy Scott Hofer Orin H. Lewis Anthony W. Merrill Samuel H. Ruby

|