December 2021 NewsletterPresident's MessageBy Wayne Taylor, Mozley, Finlayson & Loggins, LLP

Dear Fellows: I am so proud of the College as we emerge from the pandemic. Our recent Annual Conference in September was an absolute success! Kudos to John Bonnie and Spence Taylor for planning and executing a fantastic program. We now get back to our regular schedule. Our next Annual Conference will take place from May 11 to 13, 2022, at the Intercontinental Hotel in Chicago, Illinois. Our Conference Chairs, Laura Hanson and Tracy Saxe, are hard at work planning another incredible program. Presenting at the Conference is a great way to get more actively involved in the very important educational work of the College. The next Insurance Law Symposium will take place some time in early 2022 in conjunction with Vanderbilt Law School in Nashville. Steve Pate, Brad Box, and Brandon McWherter are co-chairing the event. We are looking at all available options to hold this symposium in person. Stay tuned for more details. The College rose up during the pandemic to utilize available technologies to sponsor numerous Pop-Up webinars. To that end, we have an upcoming program that will be held virtually on January 13, 2022, with “The Use of Extrinsic Evidence to Grant and Deny Defenses,” presented by Fellows Doug Richmond, Jim Bryan, and Nancy Kornegay. I urge all of you to register for this informative program. Keep checking the College’s website for more Pop-Up webinars that will be added to the calendar. It is my sincere hope that more of you will get actively involved in the important educational work of the College. If you are not sure how to get more involved, contact any of the College’s officers or Board of Regents members. We have many great programs planned, and I hope you will take advantage of these great opportunities to get involved. I look forward to seeing all of you in February at the Insurance Law Symposium and May at the Annual Conference. All my best, Wayne Fellows Gather in Chicago for 2021 Annual ConferenceAfter what seemed like an eternity, ACCC Fellows came together in Chicago in September for the College’s 9th Annual Conference. Held at the InterContinental Chicago, the conference was a vaccination/negative test and mask required event, attended by about 110 Fellows and sponsors.

The conference planning committee was led by co-chairs John Bonnie, Weinberg Wheeler Hudgins Gunn & Dial, and Spence Taylor, Barze Taylor Noles Lowther LLC, and co-vice chairs, Laura Hanson, Meagher & Geer, PLLP, and Tracy Saxe, Saxe Doernberger & Vita, P.C. The committee met regularly throughout the year, reviewing speaker proposals, securing sponsors, and carefully considering the format in which the conference would take place.

The second day of the conference included a dinner where new Fellows and award recipients were recognized. Since we did not meet in person is 2020, the new class of Fellows from both 2020 and 2021 were recognized.

2020 class of new Fellows

2021 class of new Fellows The 2021 law student essay competition winners attended the conference and were recognized at the dinner. In this year’s competition, students were challenged to prepare a memo analyzing available coverage (defense and indemnity) for a camp facing negligent hiring, training, and supervision claims when a counsellor engaged in a physical relationship with a camper and was at a party where campers allegedly sustained bodily injury. First place was awarded to Jory Berg of Chicago-Kent College of Law and second place was awarded to Chase Babineaux of Georgia State University College of Law.

Jory Berg & Sheri Pastor

Chase Babineaux & Sheri Pastor Our conference committee, along with members of the Communications committee, have summarized the panel discussions from the conference. Conference attendees can view the papers and presentations behind the members only log in. Still want more content? Mark your calendar to join us for our 10th Annual Conference, May 11-13, 2022. We will be returning to the InterContinental Chicago.

Angela Elbert, Laura Foggan, & John Bonnie

Andy Downs clowned around with Michael Kiernam

KT Talieh and Michael Levine

Chris Mosley, Adam Fleischer & Monica Sullivan Coverage Issues from HAL: Risk Management and Insurance for AI Systems & Robotics Summarized by Tracy Saxe, Saxe Doernberger & Vita, P.C. This panel, including Laura Foggan, Partner, Crowell & Moring LLP, John Buchanan, Senior Counsel, Covington & Burling LLP, and Lorelie Masters, Hunton Andrews Kurth LLP, discussed how Artificial Intelligence (AI) and robotics are increasingly present in our daily lives (e.g., autonomous vehicles, drones, manufacturing robots, proactive healthcare management, disease mapping, automated financial investing, virtual travel booking agent, etc.). There are a wide variety of potential losses associated with the use of AI and robotics (e.g., bodily injury, death, tangible property damage, privacy violations, economic/financial loss, business interruption, etc.). Potential causes of liability associated with AI and robotics include AI coding or data input errors, failure of artificial intelligence processing, failure of robotics mechanical/electrical components, intentional interference, and cyber-attacks. There are insurance products, such as Technology Errors & Omissions or Product Liability & Property, that can be utilized to protect against AI and robotics related losses. Many current policy forms, however, contain terms ill-fitted for AI and robotics. Additionally, the use of connected/automated vehicles creates fortuity/“expected or intended” issues. Coverage attorneys should be used to fill potential coverage gaps by assisting with exposure analysis and insurance policy wording customization. To maximize protection, the following risk management practices should be followed: (1) Identify AI & robotic assets, (2) assess/quantify exposures, (3) align commercial insurance with potential losses, (4) consider vendor/supply chain, (5) consider contractual allocation of liability, and (6) consider alternative insurance structure. In addition to the increasing presence in everyday life, AI is also being used to enhance the operations of the insurance industry by prompting efficiency, uniformity and eliminating human bias. For example, Insurtech streamlines insurance transactions (e.g., claims, claim adjustments, claim payments, reinsurance claims, etc.) resulting in lower costs and faster payments. Despite the potential benefits associated with the use of AI and Insurtech in the insurance industry, there are also several pitfalls, including: data inaccuracy, insufficiently supervised machine learning, model inaccuracy/malfunction, lack of paper trail, etc. The pitfalls mentioned above have given rise to a number of lawsuits against insurers, which focus on the insurers’ improper reliance on AI systems.

Strategic Issues in Insurance Arbitration Clauses Summarized by Christine Haskett, Covington & Burling LLP This panel (Dan Bailey, Bailey Cavalieri LLC, Steven Gilford, JAMS, Christine Haskett, Covington & Burling LLP, Paul R. Koepff, Clyde & Co., Sherilyn Pastor, McCarter & English) discussed issues relating to arbitration clauses, including those that arise in connection with the London arbitration clause that appears in many Bermuda form policies. First, the panel discussed the extent to which coverage lawyers may be involved in the negotiation of arbitration clauses generally and the limits on the policyholder’s ability to negotiate around the London arbitration clause. The panel also discussed the impact of the situs of the arbitration and what it means in terms of choice of law, as well as issues that are presented in the new world of virtual arbitrations. The panel then moved to the issue of consolidation and agreed that the question of whether arbitrations against multiple insurers can or should be consolidated is an important issue that involves many strategic considerations, both on the insurer and the policyholder side. Finally, the panel discussed issues around arbitrator selection and the importance of ensuring the credibility of party arbitrators.

Litigating the Duty to Indemnify Summarized by Laura Hanson, Meagher & Geer, P.L.L.P. Chris Mosley, Sherman & Howard LLC, and Ellen Van Meir, Nicolaides Fink Thorpe Michaelides Sullivan, LLP discussed the split in case law around the country on whether a finding that there is no duty to defend automatically means that there is no duty to indemnify. The presentation also discussed the trigger of the duty to indemnify (verdict/judgment or arbitration award or settlement) and the burden to prove the duty to indemnify under the policy. The presentation addressed what evidence is necessary to prove the duty to indemnify and how to present it. They commented on allocation of covered and uncovered claims and how the burden can shift under those circumstances. The presentation concluded with practical tips on strategy in proving the duty to indemnify and defenses to it.

Can You Climb the Excess Tower and Enjoy the View From Up There? This session engaged the audience with questions posed by panelists Beth Bradley, Tollefson Bradley Mitchell & Melendi LLP, Margo Brownell, Maslon LLP, Gary Gassman, Cozen O'Connor, and Marilyn Fagelson, Murtha Cullina LLP. Using their phones, attendees texted the answers to questions about a hypothetical case involving Critical Products, Inc., a company faced numerous asbestos bodily injury claims. As they shared the summary of responses from attendees, the panelists addressed the challenges of proving exhaustion of underlying insurance, establishing proper exhaustion, and establishing exhaustion when entering into a below-limits settlement with the underlying carrier. They also discussed the effects of Qualcomm on securing below-limits settlements.

The Illusory Coverage Doctrine: Going Beyond the "Plain Language" of the Policy Summarized by Andrew Downs, Bullivant Houser Mike Hamilton, Goldberg Segalla, Vince Morgan, Bracewell LLP, and Monica Sullivan, Nicolaides Fink Thorpe Michaelides Sullivan LLP, and moderator Marion Adler, Adler Law Practice, LLC, presented a panel on the growing use and acceptance of the illusory coverage doctrine. The panel focused on exclusions because that’s where these issues most commonly arise. The focus of both the program and the accompanying paper was on liability coverages, although there was some discussion of the largely unsuccessful efforts of policyholders to persuade trial courts to apply it to COVID Business Income claims. The main lessons conveyed are ones that apply to many commercial claims where what happened, or what the policyholder’s operations were, were not what one or both parties to the contract expected:

There is an excellent paper available on the ACCC website: click here.

Six Cases in 45 Minutes Summarized by John Bonnie, Weinberg Wheeler Hudgins Gunn & Dial, Robert Chesler, Anderson Kill, P.C, Anthony Leuin, Shartsis Friese LLP, and Suzanne Midlige, Coughlin Midlige & Garland LLP identified six key decisions considered essential reading for insurance lawyers.] The cases included G&G Oil Co. of Ind., Inc. V. Continental W. Ins. Co., 165 N.E.3d 82 (Ind. 2021), which addressed commercial crime coverage for a ransomware attack, and Landry’s, Inc. v. Ins. Co. of the State of Pa., 4 F.4th 366 (5th Cir. 2021), which addressed personal injury coverage under a CGL policy for a credit card fraud. Also highlighted were Verto Med. Sols., LLC v. Allied World Specialty Ins., 996 F.3d 912 (8th Cir. 2021) which addressed ambiguity created by competing provisions in a D&O policy, and Certain Underwriters at Lloyd’s v. NL Indus. Inc., 2020 N.Y. Slip Op 34331 (Dec. 29, 2020), which addressed competing and inconsistent decisions from two jurisdictions on the same “expected or intended” provision in a single policy. Finally, the panel discussed Target Corp. v. ACE Am. Ins. Co., 2021 U.S. Dist. LEXIS 23490 (D. Minn. Feb. 8, 2021), addressing “property damage”/loss of use coverage under various CGL policies for the settlement of claims for a data breach involving a credit card data breach, and Arch Ins. C. v. Murdoc/RSUI Indem. Co. v. Murdock, 248 A.3d 887 (Del. 2021), addressing coverage under a D&O policy with respect to non-covered parties, claims and damages.

Recent Developments in Excess Judgment Liability Is a demand within limits necessary? This question was answered by William Barker, Dentons, Jim Cooper, ReedSmith, and Rebecca Weinreich, Lewis Brisbois Bisgaard & Smith LLP. The answer is a qualified “yes,” in about half of the jurisdiction that address the issue. Typically, the impetus for a settlement comes from the plaintiff and pro-policyholder rules prevail in many jurisdictions, and this might continue to be the case in jurisdictions that have not yet ruled on the issues. and the problems those rules create; as well as opportunities that such rules may create for policyholders. The panel discussed the impact of cases like Puritan Ins. Co. v. Canadian Univ. Ins. Co., American Physicians Insurance Exchange v. Garcia, Boicourt v. Amex Assurance Co., and Harvey v. GEICO Gen. Ins. Co., on settlement demands.

Reinfection: Examining Judicial Traits and Estimating Outcomes as Covid-19 Cases Gain Appellate Review Summarized by Robert Allen, The Allen Law Group This topic was discussed by a robust panel consisting of Honorary Fellows Jeff Stempel, William S. Boyd School of Law, University of Nevada Las Vegas, and Leo Martinez, UC-Hastings/Andersen, from academia, and Rick Hammond, Insurance Claims and Litigation Consultants, LLC, from the insurer side and John Shugrue, ReedSmith, from the policyholder side. The discussion first focused on the surprising one-sidedness of how these cases are being decided in favor of insurers. Politically, policyholders fare slightly better in front of Democratic Judges, which is not lost on litigation finance companies trying to profit from the situation. A debate ensued as to whether a conspiracy existed in which the success of the insurers is explained by their cherry-picking cases with the strongest and most clear-cut coverage defenses against the most inexperienced attorneys and pushing those cases to the forefront. Also, the differences between the pro-insurer Couch and the pro-policyholder Windt treatises were explored. At the end of the day, there are many cases on appeal and so, the possibility exists for some significant change. In this regard, look for some certifications from the federal courts to the state’s supreme courts on COVID coverage issues. Technology for Coverage Geeks: Effective Use of Technology in Coverage and Bad Faith Litigation Luddites beware! Edward “Ned” Currie, Jr., Currie, Johnson & Myers, P.A. and Gregory P. Varga, Robinson & Cole LLP, have an arsenal of apps that can improve your presentations and make you a more efficient attorney. They gave a real-time demonstration of apps that can be used for dictation, presentations, and more. Some examples include Notability, which allows you to annotate anything, and Timeline 3D (available in app stores), which allows you to create and present timelines.

Insurance Issues in Bankruptcy Summarized by Christine Haskett, Covington & Burling LLP This panel (Mary Borja, Wiley Rein LLP and Seth Lamden, Blank Rome LLP) covered a number of insurance-related issues that can arise in bankruptcy proceedings. The panel discussed the fact that burning limits policies present particular issues due to the desire to preserve the estate’s assets for distribution to claimants and creditors. The panel also discussed issues arising in the context of D&O policies, which include several different types of coverage and so may give rise to the question of whether the policy is an asset of the bankruptcy estate and whether the insurer can advance costs to the insureds without violating the bankruptcy freeze on assets. There are also complicated issues around which parties should attend mediations, how to reach a global settlement, and when mediations should be conducted in light of the bankruptcy stay. Finally, the panel discussed how self-insured retentions may be addressed in the bankruptcy context.

Multiple Insureds with Insufficient Limits - The Law, Considerations and Recommendations This panel outlined a situation where a personal injury claim was made against an individual who had obtained coverage and named a company as an additional insured. The claim was made against both parties and the damages were significantly more than the individual’s coverage. The insurer offered to pay the limit in exchange for the release of the individual and company, but the claimant refused to release the company and demanded that the individual be released. Patrick J. Kenny, Armstrong Teasdale LLP, Garth Gersten, Shapiro Bieging Barber Otteson, Sara Thorpe, Nicolaides Fink Thorpe Michaelides Sullivan LLP, and Meghan Moore, Flaster Greenberg PC, discussed the insurer’s options and several approaches to the settlements, noting some jurisdictional anomalies and limitations, with advice on how to handle such cases in jurisdictions where case law has not yet been established.

Insurer Bad Faith 2021 and Beyond: A Survey of Extra Contractual Law and Where Things Stand Summarized by Robert Allen, The Allen Law Group Jennifer Mathis, Troutman Pepper Hamilton Sanders LLP, and Bob Allen, The Allen Law Group, addressed the current status of bad faith/extracontractual litigation. Armed with interesting statistics compiled by Doug McIntosh, Segal McCambridge Singer & Mahoney, Ltd., the panel analyzed the vast size of the U.S. tort system and particular litigation hot spots across the country. A few trends appear to be developing. First, state legislatures are getting involved in passing laws that impact insurer’s bad faith/extracontractual exposure. Also, the majority of bad faith/extracontractual cases emanate from automobile accidents. Finally, some creative ways to fairly resolve claims with questionable coverage while eliminating bad faith exposure on the insurer are gaining traction.

Coverage Counsel as Witness: The fine line between “claims handling” and “legal advice” Summarized by Michael Aylward, Morrison Mahoney LLP The conference concluded with a spirited discussion by Neil Posner, Much Shelist, P.C., Rikke Dierssen-Morice, Maslon, and Debra Varner, Varner & Van Volkenburg, PLLC concerning the ethical issues arising out of insurance coverage engagements. As Neil Posner stated at the outset, the purpose of the presentation was not to pit insurers and insureds against each other but rather to provide the ACCC with the information we need to know so that you can avoid or reduce the risk of incurring a bar complaint, a court sanction, a motion to disqualify or even being sued for malpractice. The panel concluded with the following useful checklist to avoid trouble:

Thank you to our 2021 Annual Meeting Sponsors:

ACCC New Member Spotlight: Erika BrightACCC New Member Spotlight: Erika Bright Erika L. Bright, Partner, Wick Phillips, was nominated to the College by Beth Bradley, and joined in May 2021. Erika represents corporate policyholders in disputes with insurance carriers and advises clients on all insurance-related topics, including how to minimize risk, draft indemnity agreements and obtain optimum insurance coverage. Erika has extensive experience in the courtroom and has litigated insurance disputes involving virtually all types of coverage, including Directors and Officers, Errors and Omissions, Fiduciary Liability, Commercial General Liability, Property, Builder’s Risk, Employer’s Liability, Environmental and Energy policies. Additionally, Erika is an accomplished lecturer and author on insurance issues and frequently speaks at industry conferences, events, and law schools nationwide. She serves as Faculty Member and lecturer for the Texas Bar CLE’s Advanced Insurance Law Course and UT Law CLE’s Annual Insurance Law Institute. She has authored and contributed to many leading publications, such as the ABA’s Handbook on Additional Insureds and Law 360. Prior to joining Wick Phillips, Erika was a partner at Haynes and Boone, LLP in the firm’s insurance coverage and business litigation practice groups.

Where are you from; where did you grow up? I was born and raised in the college (football) town of Norman, Oklahoma. What steered you to a career in the law? First, my propensities to question, listen, and develop my own opinion from a very young age (sorry, Mom and Dad). Second, my lack of propensity for anything scientific. Where did you go to college and law school? University of Oklahoma What did you do after law school; what was your first job as a lawyer? I joined Haynes and Boone straight out of law school and remained there for almost 18 years. Truth be told, I had no idea I would be assigned to work with the insurance coverage group and was not particularly excited when I first heard that news. Whether it was foresight on the firm’s part or simple luck, the insurance coverage practice turned out to be the perfect fit. I am grateful to have been steered (shoved) in the right direction all those years ago. Tell us about your first big insurance coverage case. We represented the Canadian Olympic Association. It was a fascinating and complex case involving novel issues, high profile figures, and a long slate of great lawyers on both sides. The dispute spawned proceedings in Texas and Canada, so we spent a good deal of time in Toronto. I learned what a terrific city Toronto is, except that I could not find any decent spicy food. At the beginning of the case, I was carrying bags, organizing (hard copy) documents and taking notes all day. By the end, I was taking depositions, writing the briefs and participating in key strategy decisions. I feel like I “grew up” during that case and will always remember it fondly. What is the biggest change you've seen over your career with respect to coverage litigation? Over the years, I have seen liability coverage disputes gradually decrease and property coverage disputes materially increase. D&O and CGL claims dominated my time in the early 2000’s. However, for the past five years or so, I have seen less liability coverage denials and many more property claim denials (or partial denials). How many jurisdictions have you handled coverage or bad faith litigation? Do any of them stand out for one reason or another? I have handled coverage disputes in about 10 different states. I have enjoyed working in all of them, though sometimes I need a special dictionary for cases pending in Louisiana. For example, “liberative prescription” means “statute of limitations,” which, like quite a few other Louisiana common law phrases, is not intuitive to me. What do you like to do in your spare time? Travel, travel, and more travel. Getting To Know the ACCC’s Rick Hammond

ACCC Past President Mary Craig Calkins sat down with ACCC Fellow and First Party Committee Co-Chair, Rick Hammond – continuing the tradition, remotely of course–and talked about Rick’s background, his background and journey in the field of insurance, and what he has been doing during the pandemic. MCC: Tell us what led you to the field of insurance coverage law. Did you start out anticipating that you would be a lawyer? RH: Looking back on my life, it is a bit like a jigsaw puzzle that while you don’t see the full picture in the beginning, over time, all of the pieces came together and fit perfectly. To tell you a little about myself, I was born and raised in Chicago on the South Side in a predominantly Black neighborhood and one of four siblings. My Dad was a Skycap at United Airlines and my Mom was a part-time kindergarten teacher. I remember being a kid watching my father come home from work wearing a back brace and a having a pile of coins that he would throw on a dresser. They were the tips he received from schlepping bags all day. I also remember after a number of years, the IRS started taxing those coins! By the way, I always use a Skycap when I travel and over tip as a tribute to my dad. For the first 12 years, I went to Catholic schools, and graduated from Hales Franciscan High School. I was not the best student, played in the band, studied Spanish. I spent summers working in various blue collar jobs, for instance as a bus boy, McDonalds, grocery store bagger, etc. My last year of high school, I worked for UPS loading boxes into the back of semi-trailers. It was that job that made me decide that I wanted to get an education and do something better with my life. But I am so grateful for those blue collar jobs because they taught me the importance of “a day’s pay for a day’s work.” In fact, now, when I’m looking at hiring someone, I’m always interested in their blue collar experience, because it speaks volumes about a person when they’ve had to get their hands dirty to make a living. I was one of the first in my family to go to college and I attended Southern Illinois University. When I went to college, I had no real guidance or direction, just a goal of getting a degree. I first majored in Spanish and then switched to Graphic Art and Design. During the summer, I worked as a part-time translator and bill collector for Spanish speaking customers. In college, something strange happened. I learned that if you put your mind to something, you can accomplish it. So, when I necessarily took the tough courses in math and science, I actually got the best grades of my life. Astonished, I started testing myself more and more: “if you can do that, what else can you do?” When I graduated with my degree, I thought about going into graphic arts as a career, but they were offering less money than I had been making at my job at McDonalds. One of my college classmates gave me a reference for a job with Allstate, and they hired me as a property adjuster. One of the puzzle pieces fell into place… I ultimately became a claims supervisor, but I wanted to do something different. I went to Equitable Life Insurance Company and became a full lines agent. Because I largely sold life and health insurance, I studied and obtained a Chartered Life Underwriter’s Certificate (CLU), again testing myself. I had always dreamed of going to the Department of Insurance. I applied with the Department and they hired me as an administrative assistant, which was a supervisory position in their Consumer Section, the group that handled consumer complaints and other regulatory issues. Ultimately, I became head of the Department’s Chicago office. Another puzzle piece fell into place. I left the Department of Insurance and became the executive director of a national insurance trade association, The Insurance Committee for Arson Control (ICAC), which represented over 2,000 insurers on insurance fraud and anti-arson issues. Insurance was now fully in my blood and I wanted to boost my insurance career. As a way of achieving that, I went to law school at night while working at the Department and ICAC. I was determined not to practice law but just wanted to advance my insurance career. But as the saying goes, “If you want to make God laugh, tell him what your plans are.” During my last year of law school, I attended a job fair and a major insurance defense firm offered me a job. MCC: You are involved in a number of bar associations. Tell us how that came about. RH: As a first-year lawyer, one of the partners at my firm was Jill Berkeley. By that time, she was already an icon as a coverage lawyer. Another of the partners at that firm discouraged me from joining a bar association, but Jill said something different. She encouraged me to join and become active in bar associations, and said that soon I will start to see a return. Best advice I have ever been given. I took Jill’s advice and ran like Forrest Gump with it. I became active and held leadership positions in the Chicago Bar, Illinois State Bar, ABA, DRI, the Illinois Defense Counsel (where I ultimately became President), FDCC, and the ACCC, where I currently hold a leadership position. I also stayed active with insurance industry groups and I’m just finishing up a 30-year term as columnist in the International Association of Special Investigations Unit publication. All of these were puzzle pieces coming into place that I didn’t see at the time. Through my involvement in bar associations, I’ve had had an opportunity to develop relationships and become friends with some of the most well-known, respected, and esteemed coverage lawyers in the country and internationally. The pieces of the puzzle came together and everything that I’ve done in the past has prepared me for what I’m doing today. Through all of the interactions and things I have done, it is the relationships that I point to and cherish. I will always remember that in law school, one of the professors said, “Chicago is a big city but a small legal community, so be mindful and careful of your reputation.” That advice was so on point because our reputations are everything. People have to feel you are trustworthy and a person of your word and not just window dressing. MCC: What are some of the cases that you most enjoyed over your years as a coverage lawyer? RH: Cases do not stand out as much as the client relationships that I have been blessed with, especially those that turned to friendships. Looking back on how many lives have touched mine, it is all for the better. My clients stick out more than the cases. My viewpoint about client relationships is that, as attorneys, our job is to make the client’s problems our problems. In other words, they should be able to sleep at night while we stay up to try and solve their problems, and give them the sense that we care more about their case than its profitability. Relationships are what are important—working together as a team to resolve their problem, those with whom you are in the proverbial trenches and fox holes. MCC: What led you to the ACCC? RH: Janet Brown, our member from Florida. We were on stage together for a presentation and she talked a lot about the ACCC in the cab ride to the airport. She had very high opinions of the organization and nominated me. After joining, I now find myself amongst a lot of the friends and esteemed colleagues with whom I developed relationships in other organizations. MCC: Other than spending time with your 3 ½ year old black lab Bruno Mars, what have you been doing during the COVID quarantine? RH: The pandemic is and was a tragic event that has brought a lot of hurt and pain globally, but with all due respect, there was some good that came out of this situation. For me, it allowed me to make the transition into being a full-time expert. My first (unsolicited) case as an expert was about 15 years ago from former FDCC President, Jean Lawler. Afterwards, and largely because of my insurance background, I began to get other calls. At the onset of the pandemic, I had a fairly large book of business and about eight lawyers working for me, but while being sheltered in place and having time to reflect, I decided to step out on faith and leave my entire practice to the people who helped me build my business. I haven’t looked back. Ironically, most of my clients are directly the result of relationships that developed from my involvement with bar associations—and continue here at the ACCC. Ned Currie, Hope Nightingale, Dan Litchfield, Wayne Taylor, to name a few, are ACCC members that have been instrumental in my success. Again, it was serendipitous. You go back to the very beginning and Jill’s advice, “join and become active in bar organizations.” It also goes back to my law professor’s comment about the legal community being small and the importance of being mindful about your reputation. Because once you get to a certain level, we all tend to know each other, i.e., it suddenly becomes a small community of your peers. COVID-19 has also made a difference—a positive impact--with my family. Because, I work a lot from home, I am closer with my family because we spend more time together. I used to get up at 5:00 am and be out the door by 5:45 am to drive downtown to work. This change allows me to have more time and more quality time with my family. My wife, Donna, is a former insurance claims manager who handled liability claims and hired and fired lawyers. She helps me think through coverage and client issues and has always been supportive of my entrepreneurial spirit. My daughter Taeler[CM1] and her husband Joseph are also insurance professionals. We often talk insurance when we get together (and put everyone else to sleep). As you can see, if you cut me, I bleed policy language. MCC: What extracurricular activities do you enjoy? RH: We love to travel. Donna and I have visited about 25 of the Caribbean islands, and have traveled across U.S., Canada and Europe. I have been to places I never would have visited but for my being active in our bar associations. In addition to travel, I like to pretend that I’m a jazz pianist. I call myself a “pro se jazz pianist” – “pro se” because I play piano pretty much like a pro se plaintiff practices law. In addition to the keyboard, tennis is one of my passions. Also, Donna is a long distance runner and I am a bicyclist. We live in an area that is surrounded by a lot of forest preserves where we can go biking and running together, and take Bruno Mars for a walk. MCC: What else should I be asking you about? RH: I have two fundamental mottos. First, everyone is born with a certain amount of potential, and our job is to try and exhaust that potential before we die. Second, that we should try to leave the earth a better place than before we got here. I am active on the Board of Trustees of Loyola University Chicago and I am an adjunct insurance law professor at Loyola’s law school. I am also the incoming chairman of the board of Arrupe College, which is a two-year degree program at Loyola for the “Rick Hammond” type students of the world, i.e., students like I used to be, looking for guidance and a path to some level of success. Arrupe provides a virtually debt-free higher education for students from a limited financial background, and those who are just below the cut of getting into major universities. The college is built on mentoring and counseling, and has a graduation rate that is significantly higher than most city colleges. Donna and I have funded scholarships for many of its students, and it is a way of us paying it forward and giving back. In addition, I have chaired my high school’s Board of Trustees as another way of giving back. One thing that I’ve learned is that every time you are giving, you are also receiving. MCC: Best advice to your colleagues in the ACCC? RH: Who am I to be giving the ACCC advice? I am a strong proponent of “collective wisdom.” In my view, the ACCC as a collective is “the best of the best.” So, just imagine the potential in the collective wisdom we can employ and what we can accomplish as an organization. Therefore, my advice is for us to just “keep on keeping on” and keep getting our ACCC name out there. Thanks to the ACCC for allowing me to talk about my journey. I’m a perfect example of the saying that “God likes to use very ordinary people to do very extraordinary things.” Last, I’ll leave you with a humorous saying that I recently read on line which totally describes me, and with apologies for the language: “Life’s journey is not to arrive at the grave safely in a well preserved body, but rather to skid in sideways, totally worn out, shouting: “Holy Sh**… What a ride!” Using Extrinsic Evidence to Excuse a Liability Insurer’s Duty to DefendBy Douglas R. Richmond, Aon Commercial Risk Solutions

This article first appeared in the SMU Law Review, Volume 74, Issue 1. Reprinted with permission. Most Americans and American businesses purchase liability insurance to protect against financial loss should they ever be sued. In furnishing this protection, liability insurers contractually promise policyholders that they will defend them against lawsuits seeking covered damages and indemnify them for such damages up to the policy limits. As important as the insurer’s promise of indemnification is to an insured, the insurer’s agreement to defend the insured in litigation is an equally essential aspect of the liability insurance bargain. An insurer must decide whether it has a duty to defend its insured at the outset of a case. There are two approaches to determining an insurer’s duty to defend. First, there is the eight corners rule, under which the factual allegations in the plaintiff’s complaint or petition are compared with the policy, and the insurer owes a defense only if those allegations potentially implicate the insurer’s duty to indemnify the insured. Second, there is the extrinsic evidence approach. Courts employing an extrinsic evidence approach hold that an insurer must look beyond the pleadings and consider any facts brought to its attention or any facts that it reasonably could discover at the time suit was filed in deciding whether it has a duty to defend. Liability insurance policies typically provide that the insurer will pay the cost of the insured’s defense in addition to the policy’s liability limits. This is a potentially significant expense for the insurer because defense costs may, and often do, exceed any settlement or judgment ultimately paid. Given the expense associated with providing a defense, it is not surprising that an insurer may want to disclaim its duty to defend based on extrinsic evidence that establishes that it will have no duty to indemnify the insured. Of course, an insurer generally cannot decline to defend its insured if, in making that determination, it is limited to the facts alleged in the plaintiff’s petition or complaint; after all, even in extrinsic evidence states, it usually is the allegations in that pleading that triggered the insurer’s duty to defend in the first place. Thus, insurers frequently test their ability to rely on extrinsic evidence to disclaim their duty to defend when the plaintiff’s complaint or petition alleges facts that trigger the duty. In other words, if an insurer must, in many states, consider extrinsic evidence in accepting its duty to defend, can it also rely on extrinsic evidence to deny or exit a defense? The answer, generally, is no; the use of extrinsic evidence is rarely a two-way street. As a result, even an insurance company with a solid factual defense to coverage generally must defend the insured under a reservation of rights and file a separate declaratory judgment action to establish that it will have no duty to indemnify the insured and can therefore terminate its duty to defend. From an insurer’s perspective, however, that approach is of limited value unless the declaratory judgment action can be decided before the tort action against the insured concludes. In fact, such an outcome is rare. Consequently, an insurer may be forced to bear the cost of defending a lawsuit alleging uncovered claims or causes of action well after it has discovered that it will never have to indemnify the insured. Those costs get passed on to insureds through premiums. Although the general rule holds that an insurer may not rely on extrinsic evidence to refuse to defend an insured, some courts that adhere to the general rule occasionally recognize exceptions. Plus, there is a contrary minority rule. It is therefore fair to ask whether an insurer should be allowed to rely on extrinsic evidence to disclaim or extinguish its duty to defend when the plaintiff’s complaint or petition alleges facts that implicate coverage, and, if so, under what circumstances? This question is timely first because of two 2020 Texas Supreme Court decisions addressing it and offering different answers based on the facts presented: Richards v. State Farm Lloyds and Loya Insurance Co. v. Avalos.Second, as Richards and Loya demonstrate, insurers’ use of extrinsic evidence to excuse their defense obligations is an ongoing litigation strategy. That is not to say that the strategy is good or bad, but it is to say that the extrinsic evidence issue will continue to surface in key cases in various jurisdictions. Third, while insurers’ use of extrinsic evidence to defeat the duty to defend is hotly contested by policyholders, courts that have considered the issue over the years have rarely discussed it in meaningful fashion in their opinions. The resulting lack of guidance hampers courts either confronting the issue for the first time or entertaining reconsideration of prior holdings. This Article provides that guidance. Click here to read the full article. It’s The Law! The Growing Role of “Statutory” ExclusionsBy Michael F. Aylward, Morrison Mahoney LLP (Boston)

An improbable endorsement has emerged in recent months as a potent weapon for insurers in “advertising and personal injury” coverages disputes. Even as courts have continued to broaden their interpretation of the meaning of “publication” and the scope of coverage for the “invasion of privacy” offense, insurance underwriters have expanded the scope of exclusions geared towards the statutes giving rise to many of these claims. Statutory exclusions are a relatively novel feature of insurance policy drafting. Until the last few years, liability insurance exclusions focused almost exclusively on particular types of injury (e.g., environmental contamination or faulty workmanship) or conduct (e.g., sexual assault). In the few cases where CGL exclusions have referred to statutes, they tended to do so generically (e.g., liquor liability or worker’s compensation laws). In recent decades, however, a few statutes have generated enormous amounts of litigation. Beginning in the 1980s, statutes such as CERCLA and AHERA created strict and retroactive liability for losses that would likely have been viewed as involving property damage but which would not otherwise have resulted in mass litigation or enforcement activity. In the 1990s, the Telephone Consumer Protection Act (followed by the Controlling the Assault of Non-Solicited Pornography and Marketing Act in 2003) took this a step further, creating statutory penalties that have made these statutes a favored vehicle for class action suits. Most recently, states such as Illinois have enacted a similar liability regime permitting suits against companies that improperly traffic in private biometric information. Although many courts declined to find CGL coverage for TCPA, enough found that the transmission of junk faxes concerned the publication of material that invades the recipient’s right of privacy to make these claims a significant concern to insurers in the early years of the new millennium. Faced with this uncertainty, the Insurance Services Office (ISO) promulgated a new endorsement (Form CG 00 67 03 05) in 2004 excluding coverage for claims arising out of the “Violation of Statutes that Govern Emails, Fax, Phone Calls or Other Methods of Sending Material or Information.” Two years later, this exclusion was folded into the 2007 edition of the standard CGL form. This new exclusion amended Coverages A and B to make clear that there is no coverage for “bodily injury” or “property damage” or “advertising or personal injury:” Arising directly or indirectly out of any action or omission that violates or is alleged to violate: a. The Telephone Consumer Protection Act (TCPA), including any amendment of or addition to such law; or b. The CAN-SPAM Act of 2003, including any amendment of or addition to such law; or c. Any statute, ordinance or regulation, other than the TCPA or CAN-SPAM Act of 2003, that prohibits or limits the sending, transmitting,communicating or distribution of material or information. In 2008, ISO promulgated a new endorsement (CG 00 68 05 09) that amended Exclusion Q to also include violations of the Fair Credit Reporting Act and the Fair and Accurate Credit Transaction Act. ISO ultimately withdrew this endorsement, however, when these changes were folded in Exclusion Q with the adoption of the current CGL form in 2013. Finally, various insurers have adopted a “Violation of Communications or Information Law” exclusion endorsement, which stated that there was no coverage for injury resulting from or arising out of any actual or alleged violation of: a. The TCPA, Drivers Information Protection Act or CAN-SPAM Act; b. Any other federal state or local statute, regulation or ordinance that imposes liability for the:

By and large, these variants have withstood numerous court challenges. In particular, policyholders have argued that these are only “statutory” exclusions and do not apply to common law claims for the offense that is at the heart of these statutes. There has also been significant controversy with respect to the “catch-all” clause at the conclusion of the exclusions and what sort of statutes other than TCPA, CAN-SPAM, FCRA and FACTA are subject to these exclusions. In one of the earliest cases to construe these exclusions, the U.S. Court of Appeals for the Eleventh Circuit ruled that a “violation of statutes” exclusion unambiguously defeated coverage for junk fax claims. In Interline Brands, Inc. v. Chartis Specialty Insurance Company, 311-731 (M.D. Fla. Nov. 21, 2012), aff’d No. 13-10025 (11th Cir. April 15, 2014), a federal district court in Tampa had ruled that any duty to defend that Chartis might otherwise would have had was negated by operation of an exclusion in its policy for “personal and advertising injury arising out of or resulting from…any accident violates any statute, ordinance or regulation of any federal, state or local government, including any amendment of or addition to such laws, that includes, addresses or applies to the sending, transmitting or communicating of any material or information, by any means whatsoever.” The trial court rejected the insured’s contention that the exclusion was ambiguous because it failed to define “violation” and didn’t specifically refer to the TCPA. Judge Adams ruled that Florida precedents made clear that an exclusion does not require a specific list of the affected statutes, ordinances or regulations in order for it to be enforceable. However, the court declined to give effect to the prior publications and knowing violation exclusions in the Chartis policy holding that a duty to defend would nonetheless otherwise have existed given the fact that TCPA is a strict liability statute. On appeal, the Eleventh Circuit refused to find that this exclusion was ambiguous because it did not specifically reference any particular statutes or was otherwise overbroad. Nor was the court willing to find that the exclusion should be void as being against public policy. The court observed that “coverage for violations of law creates a moral hazard that could substantially increase insurance costs” and concluded that the exclusion was not only not void for being against public policy but it appeared to be quite “sensible.” The year after the Eleventh Circuit’s affirmance in Interline Brands, the Tenth Circuit ruled in EMCASCO Ins. Co. v. C.E. Design Ltd., 784 F.2d 1371 (10th Cir. 2015) that an Oklahoma District Court did not err in holding that a CGL insurer had no obligation to afford coverage for a consent judgment arising out of an insured’s transmission of unsolicited faxes in light of a policy exclusion for “distribution of material in violation of statutes.” Despite the insured’s argument that this exclusion did not apply to allegations that the insured had “converted” the recipients’ paper toner and fax machines and had violated the Illinois Consumer Fraud and Deceptive Business Practices Act, the Tenth Circuit agreed with the Oklahoma District Court that these claims failed to alleged an “occurrence” for purposes of Coverage A and were subject to the policy’s exclusion for Coverage B. At the end of 2015, the Ninth Circuit ruled in Big 5 Sporting Goods Corp. v. Zurich American Ins. Co., 2015 U.S. App. LEXIS 21185 (9th Cir. Dec. 7, 2015)(unpublished) that this exclusion precluded any duty to defend Song-Beverly Act suits in which the plaintiffs alleged that the insured illegally transmitted or retained consumers’ Zip Codes. The court rejected the insured’s contention that the underlying complaint set forth common law claims that were separate and apart from the “Song-Beverly” statutory claims. The Ninth Circuit declared that there was no common law basis for suing for “Zip Code” violations absent this statute. Further, the court ruled that California does not recognize a common law or constitutional right or cause of action for communicating or distributing Zip codes. In 2018, the Eighth Circuit ruled in American Family Mutual Ins. Co. v. Vein Centers for Excellence, Inc., 2019 U.S. App. 98 (8th Cir. Jan. 3, 2019) that a liability insurer was not obligated to provide coverage for a class action brought against the insured for sending unsolicited advertisements to various hospitals. In light of an exclusion in the policy for “distribution of material in violation of statutes” the Eighth Circuit agreed with the Missouri District Court that the underlying TCPA claims were excluded from coverage. The court rejected the insured’s argument that the exclusion constituted a constructive nonrenewal of its policy for which it had not received written notice as required by Mo. Rev. Stat. Section 379.883(2) declaring that American Family was entitled to the presumption under Missouri law of receipt of mailed materials. It was therefore a presumption that the insured had received the Coverage Summary letter that American Family had mailed out more than 60 days prior to the renewal of this policy that referenced this new exclusion. In 2020, the Fourth Circuit ruled in Hartford Cas. Ins. Co. v. Davis & Gelshenen Co. LLP, No. 19-1578 (4th Cir. Feb. 13, 2020) that allegations that a law firm violated the federal Driver’s Data Privacy Protection Act by mailing advertisements to accident victims whose names and addresses they had legally collected from official accident reports submitted to the state Department of Motor Vehicles are excluded from CGL coverage by the policy’s exclusion for claims arising out of the distribution of material or information. Allegations that a debt collection agency harassed a debtor and made 53 abusive phone calls that ultimately caused her to miscarry have been held subject to a Recording and Distribution of Material or Information in Violation of Law” exclusion in Zurich’s CGL policies, as well as a Violation of Communications or Information Law exclusion. Despite the insured’s argument that these exclusions were limited to the statutory claims against it and that Zurich’s duty to defend was still triggered by the plaintiff’s common law privacy claims, the Seventh Circuit ruled in Zurich American Ins. Co. v. Ocwen Financial Corp. 990 F.3d 1073 (7th Cir. 2021) that these exclusions applied not only to statutory claims but to all common law claims based upon conduct that violated the statutes. The court declared that if the plaintiff would not have been injured but for the conduct that violated an enumerated law, then the exclusion applies to all claims flowing from that underlying conduct regardless of the legal theory. A few weeks later, the Seventh Circuit ruled in Mesa Laboratories, Inc. v. Federal Ins. Co., 2021 U.S. App. LEXIS 11365(7th Cir. April 20, 2021) that an Illinois District Court did not err in ruling that an “Information Laws Exclusion” in a CGL policy applied to common law as well as statutory claims. The exclusion in question precluded coverage for “damages, loss, cost or expense arising out of any actual or alleged or threatened violation of … the United States of America Telephone Consumer Protection Act (TCPA) of 1991 … or any similar regulatory or statutory law in any other jurisdiction.” The Seventh Circuit ruled that this exclusion applied both to the federal TCPA claim and Illinois Consumer Fraud and Consumer Deceptive Business Practices Act statutory claims as well as the suit’s common law claims for invasion of privacy resulting from the insured’s unauthorized transmission of junk faxes. The court ruled that “the common‐law claims of conversion, nuisance, and trespass to chattels arise out of the same underlying conduct as the statutory claims—the sending of unsolicited faxes.” As none of the plaintiff’s injuries “would have occurred but for Mesa’s sending unsolicited fax advertisements,” the Seventh Circuit ruled that the Information Laws Exclusion was not limited to the statutory claims against the insured. Most recently, the Eighth Circuit ruled in Rodenburg LLP v. Certain Underwriters at Lloyd’s of London, No. 20–2521 (8thCir. Aug. 21, 2021) that a “Distribution of Material in Violation of Statutes” exclusion precluded coverage for claims under the Fair Debt Collection Practices Act and various common law theories that a consumer brought against a law firm that had aggressively pursued her to recover a debt that was actually owed by someone else In holding that any duty to defend was negated by the Distribution of Material exclusion, the Eighth Circuit ruled that the FDCPA was clearly a statute “that prohibits or limits the sending, transmitting, communicating or distribution of material or information…” and that the conduct underlying the invasion of privacy claim was the same conduct underlying the FDCPA claim and therefore clearly “arose out of” acts excluded by this endorsement. At least one court has recently ruled that an exclusion for common law claims, including “invasion of privacy,” also extend to statutory causes of action. In Horn v. Liberty Insurance Underwriters, Inc., 2021 U.S. App. LEXIS 16279 (11thCir. June 1, 2021), the Eleventh Circuit ruled that a Florida District Court was correct in ruling that a policy exclusion for “claims…arising out of…an invasion of privacy” precluded any obligation to provide coverage for a lawsuit alleging the transmission of junk faxes in violation of the Telephone Consumer Protection Act of 1991. In upholding a Florida District Court’s declaration that the exclusion precluded coverage for class action claims involving the insured’s robo-dialing operations, the Court of Appeals ruled that the class action specifically alleged that insured had intentionally invaded the class members’ privacy and sought recovery for those invasions. Writing in dissent, Judge Newsom argued that “invasion of privacy” connotes only the common law tort and does not extend to violations of statutes such as the TCPA and is, at a minimum, ambiguous. On the other hand, at least one court has recently ruled that these exclusions do not apply to statutory claims that are not based on the means by which private information is communicated. In West Bend Mutual Ins. Co. v. Krishna Schaumburg Tan, Inc., 2021 IL 125978 (Ill. May 20, 2021), the Illinois Supreme Court recently ruled that a “violation of statutes” exclusion did not apply to claim that a tanning salon sold confidential biometric information in violation of the Illinois Biometric Information Privacy Act. Not only were such claims held to involve a “publication” of private information triggering Coverage B but the Violation of Statutes exclusion was held not to apply because the statutes referenced in this exclusion all regulate communications methods, whereas the BIPA only regulates “the collection, use, safeguarding, handling, storage, retention, and destruction of biometric identifiers and information.” Most recent, however, a North Carolina court distinguished Krishna Schaumberg and ruled in Massachusetts Bay Ins. Co. v. Impact Fulfillment Services, Inc., No. 20-026 (M.D.N.C. Sept. 24, 2021) that liability insurers had no duty to cover a law suit in which the plaintiff alleged that the insured violated the Illinois Biometric Information Privacy Act by using their fingerprints as part of its payroll time-keeping procedures. In granting the insurers' Motion for Judgment on the Pleadings, Judge Osteen ruled that the "Recording and Distribution of Material or Information" applied to BIPA, in light of the similarities between BIPA and the Fair Credit Reporting Act, one of the statutes identified in the exclusion. The court also took note of Hartford Cas. Co. v. Greve, 2017 WL 5557669 (W.D.N.C. Nov. 17, 2017), in which another North Carolina court had applied this exclusion to alleged violations of the state’s Driver's Privacy Protection Act. In this case, Judge Osteen found that the language of the exclusion in barring losses arising out of the collection and dissemination of information is consonant with BIPA's prohibition against “collection and disclosure of biometric identifiers and biometric information." The court distinguished Krishna Schaumburg as involving a version of the exclusion that lacked any reference to the Federal Credit Reporting Act and declared that it was not obliged to follow Illinois law in light of North Carolina authority as exemplified by Greve. In conclusion, courts have been notably unsympathetic to policyholder arguments that these exclusions are limited to statutory claims. At the same time, the Illinois Supreme Court’s recent ruling in Krishna Schaumburg also make clear that not all privacy claims are subject to such exclusions and that courts may well differentiate between exclusions that focus on the “communication” of private information and those that seek to impose liability based on the management of such information. It’s A Tie! ACCC’s Rock Star Competition Concludes InconclusivelyBy Michael F. Aylward, Morrison Mahoney LLP (Boston) In the end it came down to two great rock and roll records. After a wine-fueled foray into his record collection during the start of the pandemic, past president Mike Aylward created a list of his personal favorites, including 130 great records from 1962 to 1995. On Memorial Day, he announced the start of a competition that did not involve the recovery of any assets or the interpretation of a single clause, but required ACCC Fellows to remember and cherish the music of their (ever-distant) youth. Between June 1, 2020, and August 8, 2021, dozens of ACCC Fellows voted every week to pick the best records of individual years, which were then matched against each other in ever-diminishing rounds until it finally came to four quarterfinalists (Born to Run, Highway 61 Revisited, Sgt. Pepper’s Lonely Hearts Club Band, and Surfin’ USA). Despite the clear propensity of ACCC Fellows to vote for great ‘60s records, Bruce Springsteen’s anthemic Born to Run eked out a win over Bob Dylan’s Highway 61 Revisited, but ended in a flat-footed tie in the final round with The Beatles’ Sgt. Pepper’s.

The top scoring participant was Brian Weiss, newly of Selman Breitman, who set aside his propensity for all things involving the Grateful Dead long enough to navigate his way through the Scylla and Charybdis of folk rock, acid rock and disco to the Promised Land week after week. The other top scoring finalists were Walter Andrews, Mary McCutcheon, Mike Hamilton, John Vishneski, Neil Selman, John Buchanan, Andy Downs, Alex Henlin and Jean Lawler. Before we move on other things, ACCC asked the contest participants to record their own thoughts and reactions about the competition: ACCC: Out of 130 great records, why these two? Mary McCutcheon: Although there are many terrific songs on other Beatles albums, Sgt Pepper’s was something different. A country bumpkin from Fresno, I was visiting San Francisco during the “Summer of Love”. I was only 11, so I didn’t partake in the festivities, but my sophisticated city cousins drove me by the corner of Haight-Ashbury to look at the hippies. We played the album continuously and obsessively. We couldn’t explain it, but we knew music would never be the same.

Brian Weiss: Sgt. Pepper’s was a game-changer. It broke new ground as to what a “rock album” was supposed to be, from the album cover artwork to the length of the songs, the use of advanced studio technology, and the introduction of a “concept album” – all from the greatest rock band in history. Born to Run put Springsteen on the map. Every song, top to bottom, is a masterpiece. Born to Run itself may be the greatest rock single of all time. Alex Henlin: Born to Run is a classic appeal to American wanderlust, complete with the emotional response of teens/early 20’s to the reality of life and needing to strike out on one’s own – and the uncertainty that comes with it. Sgt. Pepper’s was the first concept album, completely different from everything that came before – bold, experimental. They speak the same language of trying something new, of daring, of hoping. And that’s why they won out, as far as I’m concerned. John Buchanan: Sgt. Pepper’s was, and remains, ground-breaking. Born to Run wasn’t so much ground-breaking as a record that distilled past American rock n’ roll into its best essence and combined that music with some all-American storytelling lyrics. John Vishneski: Sgt. Pepper’s encapsulated The Beatles at (one of) the peaks of their career, including a lot of positive uplifting hits (Lucy in the Sky With Diamonds, When I’m Sixty-Four), making it fun to listen to as an album. A Day in the Life does not fit that mold, but it is also one of the most emotionally powerful and sonically creative songs The Beatles ever did. Mike Hamilton: I think, in addition to being great albums [though not my top choices] it is the iconic nature of the artists, their place in rock history, that helped these two albums win in the end. Rebecca Weinreich: Just the album names, let alone seeing the record jacket, transports me not only to a different time, but to a different Rebecca (or, and only between us, back to “Becky”). It’s like visiting an atmosphere, an energy which was deeply special and personal and where I haven’t been in decades. Andy Lundberg: Both records are major milestones, vividly marking the end of one era and the beginning of another – the critics thought so, the musical peers thought so, and the listening public thought so. Jon Landau was famously quoted after he saw Bruce play at the Harvard Square theater in May 1974 that he was the future of rock and roll. My question for Landau today would be: “Was The Boss really “the future” of rock – or was he actually the messiah who signaled a return to its earlier, purer self?”

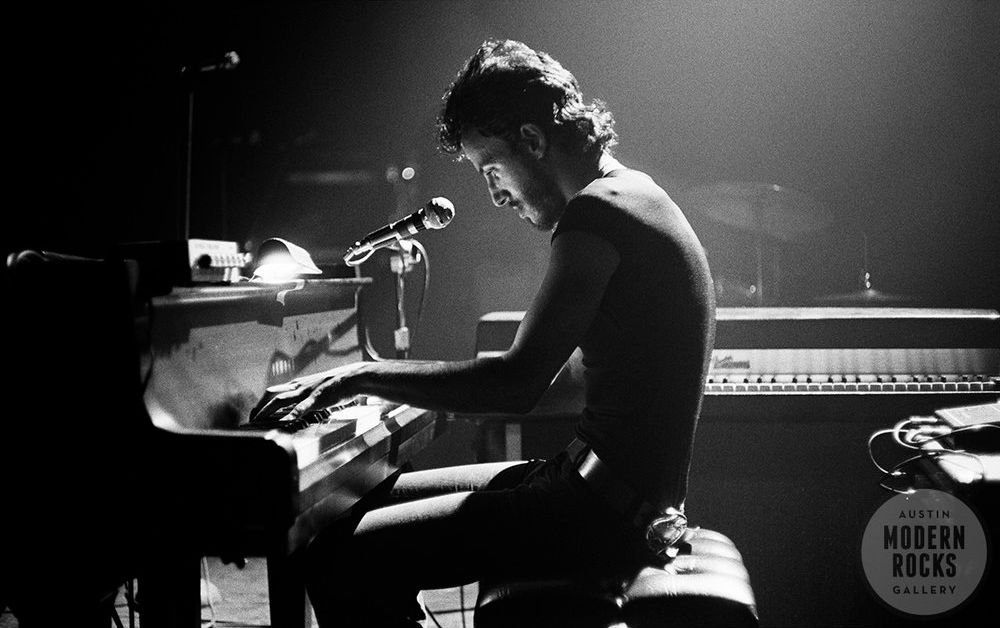

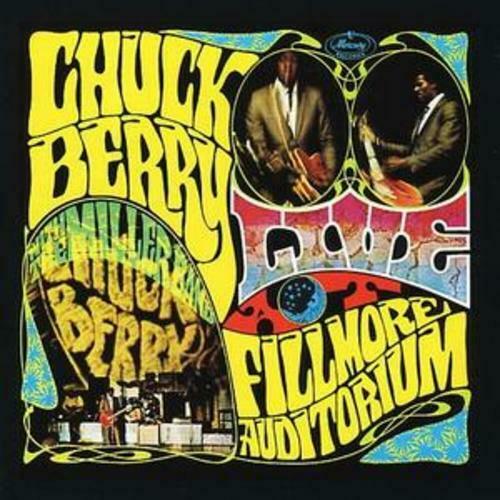

Walter Andrews: Those albums are the “gold standard” for the music we have listened to for the past four decades. It is like listening to Mike Aylward’s top cases of the year or reading Lorie Masters’ insurance treatise. ACCC: Were there other records that should have made it to the Finals? John Buchanan: It’s hard to argue with the four finalists, but I personally regret that Paul Simon’s Graceland. It was a great record that broke new ground; and from a low-brow listener’s perspective it was more graceful. Reviewing the list, I’m now recalling so many other great albums, the old LPs or CDs of which are still lying around the house somewhere: Smokey & the Miracles’ Going to A Go-Go (1965), Chuck Berry Live at the Fillmore (1967) (with young Steve Miller Band backing up), the eponymous albums Dire Straits (1978) and The Roches (1979), the McGarrigle Sisters’ Matapedia (1996), etc., etc. None of those made it high on the charts, probably, but they still resonate with me, for random reasons.

Mike Hamilton: When I think of a flawless album, my mind always goes to Fleetwood Mac: Rumors should have been in the Final Four. Brian Weiss: I’ve always believed Dark Side of the Moon was a monumental album for many of the same reasons as Sgt. Pepper’s but for the progressive wing of music. I would have also expected Led Zeppelin IV to be up there. Mary McCutcheon: I would say Dylan’s Highway 61 Revisited or—an incredible album that hangs together so well—Joni Mitchell’s confessional Court and Spark. I used to have it memorized, and “I have wandered down the Champs-Elysees” humming the tune to myself: pure joy! Andy Lundberg: It’s hard to believe that Dark Side of the Moon did not make it to the Final Four. Did anyone not buy and listen to that record, over and over? Was it not the late-night soundtrack to many meaningful hours of teenage, dorm, and first-apartment living? Rebecca Weinreich: I’m torn about Tapestry which I think was as moving and nuanced and complex and wonderful as the finalists. Arguably it was more groundbreaking and impressive because it was in the voice of a fierce, strong, brave woman. On a process point, I confess I never really got my arms around the factors which I should be considering in determining the greatest rock album of all time, but I was carried along on the wave of enthusiasm which infused every aspect of this tournament. Walter Andrews: B.B. King’s Some Help I Don’t Need ”Tell that slick insurance salesman/he’d better write some on himself.” ACCC: What is it about these records that still resonated so loudly through the pandemic? Mary McCutcheon: In writing the answers to the other questions, I realize that music brings you back to a time and place- of hope (Sgt Pepper’s) excitement (Bruce) or introspection (Dylan, Joni). We need that during the pandemic: need to get out of our closed-in, anxious world and remember marvelous times from the past-and anticipate marvelous times to come.

This photo of Mary McCutcheon at Disneyland doesn’t really fit with this piece, but it’s too cute to leave out Walter Andrews: Both Born to Run and Sgt. Pepper’s are so retrospective: “20 years ago today,” “But there is nowhere left to hide.” Baby, we were born to run away from this pandemic. Mike Hamilton: These records take me back to a time when I remember listening to the songs on the radio. And I think the overwhelming feeling during the pandemic is “we want to go back to the way it was before the pandemic.” So, talking about classic rock albums takes one back to a simpler time, way, way before the pandemic life! John Buchanan: Heck, any distraction resonated through this pandemic.

Ditto for this photo of John Buchanan and his trail-running companion, Angus (“Dog Wild”) Buchanan Brian Weiss: They provided us with solace during dark times, a reminder that there is still good out there in the world. The Texas Supreme Court Hears Oral Argument on Two 8-Corner/Extrinsic Evidence CasesOn September 14, 2021, the Texas Supreme Court heard arguments in Texas Political Subdivisions Prop./Cas. Self-Insurance Fund v. Pharr-San Juan-Alamo ISD, 2019 WL 4678433 (Tex. App.—Corpus Christi-Edinburgh 2019, pet. granted) and Bitco Gen. Ins. Co. v. Monroe Guar. Ins. Co., 846 Fed. Appx. 248 (5th Cir 2021, certified questions accepted) in which the Texas Supreme Court is being asked to permit the use of extrinsic evidence to defeat a duty to defend. They are the first two arguments on the Texas Supreme Court’s YouTube page for September 14, 2021. The Pharr-San Juan-Alamo ISD oral argument is from 05:00 – 050:00 and the Bitco oral argument is from 1:02:00 to 1:44:00. Click here to access the Texas Supreme Court’s YouTube page for September 14, 2021. Member News Charles Browning Among 2021 ‘Leaders in the Law’

Charles Browning, a partner at Plunkett Cooney (Bloomfield Hills, MI) has been selected a 2021 “Leader in the Law” by Michigan Lawyers Weekly (MiLW), an industry publication serving the state’s legal community. This is the second time that he has been selected for this honor, having also been named a Leader in the Law in 2015. Honorees were selected for, among other things, their significant contributions to the practice of law in Michigan, their expertise and leadership, as well as for setting an example for other lawyers. Ned Currie: One to Watch

ACCC past president Ned Currie, a shareholder of Currie Johnson & Myers, P.A. (Jackson, MS) has been reappointed to serve on the Mississippi Supreme Court Advisory Committee on Rules. He was renominated to serve by the Mississippi Defense Attorneys Association. Ned was also recently admitted to the American Board of Trial Advocates, an invitation-only organization dedicated to the preservation and promotion of the civil jury trial right provided by the Seventh Amendment to the U.S. Constitution. Members must have at least five years of active experience as trial lawyers, have tried at least 10 civil jury trials to conclusion and possess additional litigation experience. Members must also exhibit the virtues of civility, integrity, and professionalism. Rhonda Tobin Among Benchmark Litigation’s Top 250 Women in Litigation

Rhonda Tobin, Managing Partner of Robinson+Cole (Hartford, CT) has been named one of Benchmark Litigation’s Top 250 Women in Litigation for 2021.The guide focuses on the leading Top 250 female litigators from across the U.S. who have earned their place by participating in some of the most impactful litigation matters in recent history, as well as by earning the hard-won respect of their peers and clients as top players in their respective fields. Rhonda is the only female litigator chosen in the state of Connecticut, and this is the eighth consecutive year she has received the distinction. Do you have news to share? We’ll publish news of achievements, firm changes, awards, wins, etc. If you are quoted or published, send that as well. We are looking for content about our members to include in Member News, Article of the Month, and social media posts. Send your information to [email protected]. Call for ACCC Historical Images

In New Orleans, at a luncheon after forming the College: Lewis Collins, Bruce Celebrezze, Dan Kohane & Ned Currie The American College of Coverage Counsel will celebrate its 10th anniversary in 2022. In preparation for this exciting event, one of ACCC's founding members, Steve Pate, has been tasked with collecting historical photos. The images will be included in a commemorative album that will be printed and made available for distribution at the 2022 ACCC Annual meeting. If you have photos from past ACCC meetings, symposiums or other events, or any other images relating to the American College of Coverage Counsel that you would like to share for inclusion, please send them to Steve Pate at [email protected]. For any questions, please contact Steve by email or phone at 832-214-3957. Thank you in advance for taking part in the ACCC anniversary celebration! Call For VolunteersWant to become more involved in the ACCC? Join a committee! We are actively seeking volunteers to join our committees: ADR CGL/Excess Liability Insurance Communications Cyber Insurance and Computer Crime D&O and Management Liability Emerging Risks Extracontractual and Bad-Faith Claims Litigation First-Party Insurance Outreach Professional Liability Professionalism and Ethics Regional Meetings Click here to volunteer. Nominate a FellowThe Membership Committee routinely vets prospective Fellows of the College. In order to maintain the prestige of membership, the only entry to the College is through a referral from a current member (someone who is NOT at the same firm as the nominee). We are seeking nominations of qualified candidates who practice law in the U.S. and Canada. The Board of Regents recently approved the consideration of candidates from Bermuda as well. Qualified candidates are lawyers engaged in the private practice of law, with a concentration primarily in the fields of insurance coverage, bad faith and/or extracontractual claims, licensed to practice law in the highest court of their respective states, and who have engaged substantially in the practice of insurance law for at least 15 consecutive years. Time spent as a judge or law clerk may be considered in determining whether the 15-year requirement has been satisfied. Nominations can be sent to [email protected]. Please include the nominees name, basic contact information, and link to their firm bio. The Membership Committee will conduct an initial vetting, including contacting other Fellows for references, and will then send an application to the candidate as a next step. If a candidate is nominated and does not progress to the application stage, the nominator will be informed. Welcome New Fellows!Chris Bator Barry Buchman Rina Carmel Matt Darrough Amber S. Finch Ezra S. Gollogly David B. Goodman Gregory Gotwald Robert P. Jacobs Nathan R. Lander William (Bill) Lewis Jennifer E. Michel Jason Rosenthal James A. Skarzynski Timothy Sullivan Timothy M Thornton Heidi L. Vogt |